Strong Fundamentals Fuel the Natural Gas Industry

In the following commentary, the Portfolio Managers of the Hennessy Gas Utility Fund discuss record levels of production and consumption of natural gas, the increase in demand for natural gas for both exportation and power generation, and the Hennessy Gas Utility Fund.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What has been driving the robust growth of the U.S. natural gas market?

U.S. natural gas production and consumption reached record levels in 2018, and 2019 is on pace to surpass those records. The strong growth in demand for natural gas has been originating from two primary sources:

- The U.S. electric power generation industry continues to switch from coal to natural gas to fire its plants; and

- Exportation, including pipeline volumes to Mexico and liquefied natural gas to overseas destinations.

How is natural gas becoming an increasingly important input with respect to power generation?

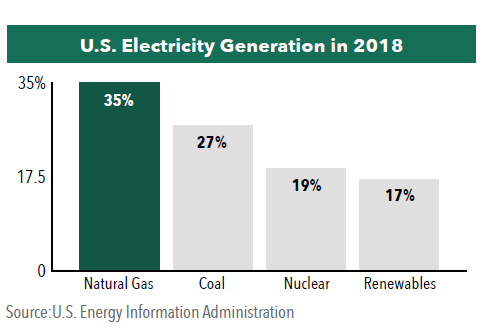

Natural gas is becoming a larger fuel source for U.S. power generation due to its low and competitive pricing and environmental advantages vs. coal. In fact, in 2018, natural gas was the leading source of electric power generation, surpassing coal, nuclear, and renewables.

The EIA expects the share of U.S. total electricity generation from natural gas-fired power plants will rise to 37% in 2019.

As aging coal plants are retired, they are increasingly replaced by or converted to natural gas fired plants. In 2018, more than 60% of electric generating capacity installed was fueled by natural gas. Over the next several years, we expect natural gas to continue to be the fuel of choice for electricity power producers.

Would you please discuss the growth of liquefied natural gas (LNG) exports?

The U.S. is currently among the largest exporters of natural gas in the world and expected to be the largest global exporter of LNG by 2023. Currently the U.S. has liquefaction capacity of about 7 billion cubic feet per day. By the end of 2021, capacity may grow approximately 50% to 10 billion cubic feet per day and new build projects could increase the capacity higher by 2023 and 2024.

How might the growth in renewable energy sources including solar, wind, and hydropower energy affect the natural gas industry?

Energy supplied from renewable sources in the U.S., albeit small from a relative perspective, continues to grow. Many of the companies in the Fund offer a diverse portfolio of energy solutions, providing not only natural gas but also renewable energy sources including solar, wind, and hydropower. We believe that renewable energy sources will become an increasingly larger proportion of the energy supply landscape in the U.S. and that the Fund will participate in this expansion through its holdings of diversified utilities.

Why should investors allocate a portion of their portfolio to the Hennessy Gas Utility Fund?

Natural gas is abundant, affordable, and has environmental advantages over other fossil fuels. In many ways, it has become the fuel of choice for power generation, industrial usage, and for many homes and businesses. The Fund invests in the distribution side of the natural gas industry, providing exposure to the growing demand for natural gas. Many of the Fund’s holdings have strong and improving fundamentals that are supportive of long-term growth prospects. There are also a number of positive tailwinds for these companies, including a supportive regulatory environment and a growing customer base, which should continue for many years to come.

What are the Hennessy Gas Utility Fund’s different portfolio buckets?

The Fund’s portfolio is generally divided into three distinct buckets consisting of the following:

- Diversified multi- and electric utility companies

- Regulated natural gas distribution companies

- Midstream pipeline and LNG exporting companies

As of 6/30/19, the buckets were approximately 55%, 20%, and 25%, respectively, although weightings are subject to change.

Historically the Fund has offered an attractive dividend stream. Can you discuss the current level of dividends for the Fund’s holdings?

As of 6/30/19, 45 of the 49 portfolio holdings paid a dividend, and the Fund’s 30-day SEC yield was 2.81% (HGASX). Since the Fund’s inception over 30 years ago, approximately 25% of the total return has come from income distributions, while 75% has come from capital appreciation.

How might lower interest rates impact the Fund?

Utilities are generally capital-intensive businesses that can benefit from a lower cost of capital as interest rates remain low. During periods of economic uncertainty, or in low rate environments, investors have historically favored the Utilities sector. The performance of the Hennessy Gas Utility Fund has, however, shown no statistically significant correlation— either positive or negative—to the movement of interest rates. We believe investors should focus on the many factors that drive the Fund’s performance, including the industry’s strong fundamentals and the growing importance of natural gas both domestically and worldwide.

- In this article:

- Energy

- Gas Utility Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.