Robust Growth in the Natural Gas Market

In the following commentary, Portfolio Manager Ryan Kelley discusses the drivers behind the strong growth in the natural gas market in 2018, how tight inventories might cause more volatility in the gas price and the outlook for continued growth in natural gas exports.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

U.S. production and consumption of natural gas posted robust growth in 2018. What has been driving this growth and how is it benefiting Fund holdings?

Strong growth in demand for natural gas in 2018 originated from two main sources: the U.S. electric power industry and overseas customers. The electrical power generation industry continues to switch from using coal to cheaper, cleaner-burning natural gas to fire its plants. Consumption of natural gas by electric utilities was up 17% in the first nine months of 2018, while coal consumption was down 5% through August.

Meanwhile, export demand continues to grow. Liquefied natural gas (LNG) exports were up 50% year over year in November, driven by strong demand from China and Europe, and pipeline exports to Mexico were up 12%. A colder start to the winter also bolstered residential demand for natural gas.

The pipeline and gas distribution companies in the Fund have benefited from volume growth in the natural gas market, as revenues and earnings for these companies are predominantly tied to volume throughput. Historically, earnings per share (EPS) growth for utilities has averaged 3-5% annually. However, EPS for the Utility sector is forecast to grow at closer to 5-7% per year over the next five years thanks to strong demand for natural gas as well as the effects of infrastructure replacement and modernization.

Natural gas prices spiked in November as a result of strong domestic and export demand, leading to a decline in inventories. Could the low inventory position last through the winter? What is your outlook for the price of natural gas?

The price of natural gas spiked to over $4.50/million British thermal unit (MMBtu) in November in reaction to reports that inventories were 20% below their five-year average. Inventories have been low in 2018 as a result of high usage, and the cold start to this winter heating season tipped the market into a condition of very tight supply. The market for natural gas today is finely balanced. Consumption together with net exports roughly equal production, so it is difficult for the industry to build inventory. We expect the price of natural gas to remain above $3/MMBtu for the current heating season. And because the market has a lower inventory cushion, investors should expect more volatility in natural gas prices this winter, as the market reacts more sharply than usual to weather events.

Would you please discuss the growth of natural gas exports over the last few years and your outlook for natural gas exports going forward?

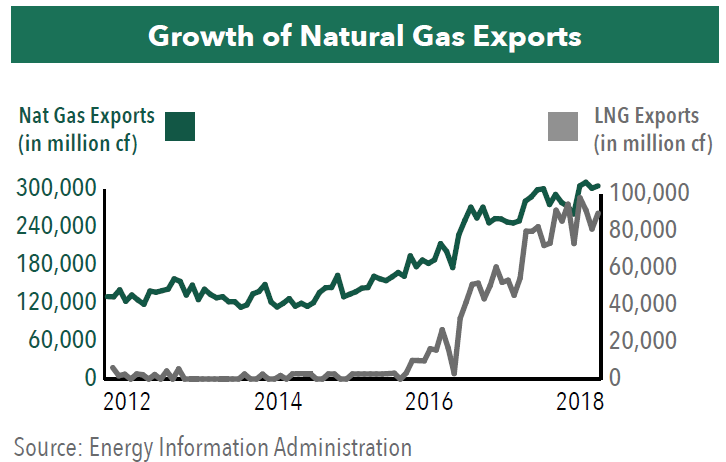

Growth in exports of natural gas has accelerated significantly since 2016 when the U.S. first began to export LNG. In the last two years, exports of natural gas have jumped over 60%, with almost three quarters of the growth coming from increased exports of LNG and the rest coming from growth in pipeline exports to Mexico. We anticipate the growth to continue in 2019 with LNG exports and pipeline exports to Mexico expected to rise almost 80% and 16%, respectively.

Industry commentators forecast tremendous growth in LNG exports from the U.S. in the years ahead, with terminal export capacity set to increase 8-fold over the next decade, just in time to meet growing demand from China, India and Japan. The U.S. is expected to be the largest exporter of LNG in the world by 2023.

Would you please discuss your outlook for growth in the natural gas market?

We believe the fundamentals of the natural gas market remain compelling. Growth in production and consumption is expected to drive above-average growth in EPS for many of the stocks in the Fund over the next few years. Meanwhile, average valuations have come down with the market; the stocks in the Fund are trading on 17x trailing earnings (December 31, 2018) vs. 23x twelve months ago. Should economic growth slow, investors are likely to look favorably on utility-type investments given their more predictable, less economically sensitive earnings streams. High dividend yields relative to the general market should also contribute to good returns; 45 out of the 50 holdings in the Fund currently pay a dividend.

- In this article:

- Energy

- Gas Utility Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.