Quality Growth Advantages in Japanese Companies

Portfolio Manager Masa Takeda discusses Japanese energy imports, inflation, interest rates and valuations. He also talks about the effects on Japanese companies with regard to Russia and ongoing supply chain issues.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

How have Japanese energy imports been affected by the Russian war in Ukraine and subsequent sanctions placed on Russia?

Trade between Russia and Japan is negligible on a macroeconomic scale. In 2020, exports represented 0.9% of total exports, whereas imports represented 1.6% of total imports. Although the energy import directly from Russia is small, the impact of higher liquefied natural gas (LNG) and oil prices is a major issue for Japan.

We do not think that to replace thermal power with renewable energy is an immediate solution. The resumption of nuclear power generation is economically required, but it is a politically difficult issue. The reopening of nuclear power plants and expansion of renewable energy sources will be issues over the long term.

With U.S. inflation rising at the fastest pace in 40 years, would you please discuss the inflation rate in Japan?

In the midst of global inflation, Japan is also facing a major transition to an inflationary trend. The current core inflation index as of February 2022 was 0.6% in Japan. The key issue is where inflation trends lie in the long-term inflationary trend, and whether the current events are reinforcing that trend. In this regard, it is important that the normal inflationary trend built up in the nearly 10 years since Abenomics continues. The fact that the trend of base-pay increases is continuing and that the Kishida administration is considering tax incentives for companies that raise their base-pay rates will provide the Japanese economy with an opportunity to strengthen the normal inflationary trend.

As we continue to see central banks around the world raise rates, has the Bank of Japan’s near-zero rate policy changed?

BOJ Governor Haruhiko Kuroda continues to be committed to the current monetary easing centered on yield curve control. The aim is to support Japan’s economic activity, which is on its way to recover from the COVID-19 pandemic, and thereby achieve the price stability target of 2% in a sustainable and stable manner.

Major companies around the world have been pulling out of Russia. What have been the actions of Japanese companies?

None of the Fund’s holdings have direct meaningful exposure to Russia or Ukraine as a revenue source. However, we are seeing some repercussions from the Russian invasion such as higher commodity prices. The manufacturing names in the Fund should experience a negative impact in the form of higher raw material costs but we believe that the issue should be manageable.

On the other hand, Mitsubishi Corp would be a beneficiary as it owns natural resources assets around the world. However, Mitsubishi Corp may be forced to take some losses on its Sakhalin-2 plant project (Gazprom 50%, Shell 27.5%, Mitsui 12.5%, Mitsubishi 10%) in Russia should the company decide to exit. Although the exact scale of the impairment is unknown at this stage, I believe it will be insignificant to the company’s financial health and profitability. For example, Shell, the second biggest stakeholder in the project with 27.5% ownership, is estimated to write down $3 billion upon exiting this project. Mitsubishi’s ownership is 10% so using Shell’s case as an indicator, it will be roughly $1 billion in impairment charges. This compares to its shareholder equity of $60 billion and total assets of $180 billion (and the current year’s consolidated net income estimated to be around $7.5 billion). The project’s profit contribution to Mitsubishi’s bottom line is also insignificant as its total annual LNG output stands at 12 million tons across different gas fields globally, of which Sakhalin accounts for only 0.96 million tons (the LNG segment profit in FY2020 as a % of total net income was around 10%).

Elsewhere, Hitachi’s information technology services business may experience some operational disruption as the company employs a few thousand people in Ukraine through GlobalLogic (Hitachi’s recent acquisition). We are taking a wait-and-see stance currently. The stock is trading quite cheaply at 10x price to earnings without much hype around the potential for GlobalLogic. Also, the subsidiary has engineering centers in 11 geographies with Ukraine being only one of them. Thus, Hitachi should be able to re-route the outsourcing work to other locations if needed.

How have the ongoing supply chain issues affected the Fund’s manufacturing-driven holdings and how are those companies responding?

The Fund has moved away from manufacturing businesses over the last several years in favor of more asset-light, intangible-asset-based companies. Nevertheless, we still own select manufacturers of physical goods, and they have been addressing supply chain disruptions, raw material cost increases, and chip shortages through multi-pronged approaches.

For example, NIDEC is addressing these challenges through a rapid expansion of a new business line (electric vehicle traction motors business). Thanks to its existing economies of scale (as an industry leader, NIDEC produces some 3 billion units of motors every year), management is confident in capturing the structural long-term growth of the electric vehicle industry, where NIDEC aims to become a dominant supplier in the ecosystem.

This should help offset the above-mentioned headwinds over time. NIDEC has been also aggressively scouting outside talents to strengthen its internal manufacturing capabilities. The hiring of ex-Renesas high profile semiconductor expert is one such example indicating NIDEC’s long-term strategy of internalizing chip manufacturing. Management has an excellent track record of cost savings in times of crisis throughout its history owing to strong cost discipline and productivity enhancement.

Shimano’s production schedules have been largely unaffected as their production bases are in Asia. Management has also announced 5% price increases on its products to absorb higher raw material prices. The company is confident in pushing through the hikes as the end-market demand for sports bicycles continues to stay strong.

Daikin minimized the negative impact to it profits through price hikes, production process rationalization, and sales increases during the most recent quarter. As such, the company reported only a slight year-over-year decline in operating profit but maintained profitability higher than pre-COVID levels.

Sony Group managed to improve profitability through premiumization of its product offerings, which helped them absorb the adverse impact through higher margin. Also, to address chip shortages, Sony Group has decided to invest in a joint venture with Taiwan’s TSMC for their first-ever chip manufacturing facility in Japan. This should help alleviate concerns around its ability to source logic chip wafers in the future. Furthermore, for the full year, its entertainment businesses such as music and movies are expected to help offset / ease pressure on the hardware business. We believe that there are benefits to being a conglomerate for Sony Group.

Would you please discuss the Fund’s current valuation?

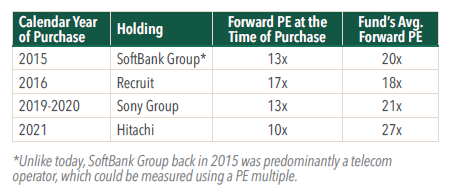

In recent years, the Fund’s aggregate exposure to high growth and high price to earnings (PE) multiple names have been reduced in favor of other equally compelling growth stocks with more attractive valuations. Some of the major investments made after 2015 include:

With these new investments, continued earnings growth of the Fund’s old holdings, and the recent share price correction, the Fund’s valuation premium over the market average has recently narrowed. In November 2021, the Fund’s average PE was hovering around 55% above that of the Tokyo Stock Price Index (TOPIX). As of April 2022, it is about 39% higher. Considering the quality growth advantages of our holdings, we believe the Fund’s valuation is attractive.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.