Recent Volatility Provides Attractive Opportunities

Portfolio Manager Masa Takeda provides his outlook for 2019 and shares his thoughts on recent market volatility, the impact of trade tariffs, the Bank of Japan’s monetary policy, and the case for active management.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Would you please comment on the recent market volatility?

We believe the volatility in Japanese equity prices in the fourth quarter of 2018 was largely in response to external factors, primarily worries over the trade conflict between the U.S. and China, signs of slower growth in China, and weakness in the U.S. market. We believe the recent stock market retreat presents investors with an attractive buying opportunity for three main reasons:

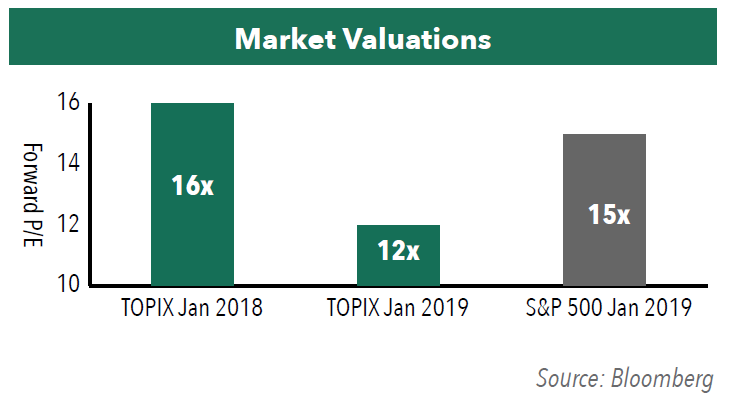

- Current market valuations are at the lowest level we have seen in many years, at just 12x forward earnings estimates as of January 2019, down from 16x a year ago. The S&P 500 was trading at 15x in January 2019.

- Japan’s companies are much more profitable than they were a decade ago. Japan’s return on equity reached 10% last fiscal year, the highest level in 30 years, as a result of corporate restructuring, better governance, and a more competitive currency.

- We feel confident that our portfolio holdings can successfully weather unsettled economic conditions, should they arise. In particular, our consumer-oriented stocks sell high-quality, differentiated products, and we believe their revenue growth is relatively immune to global economic conditions.

Since the trade disputes began a few months ago, what impact, if any, have tariffs had on portfolio holdings?

The Hennessy Japan Fund has no direct exposure to industries that are affected by the tariffs already put in place. However, for many of our holdings, China is an important market. Slower growth in China is having a mild impact on the consumer-oriented companies in the Fund, such as Unicharm and Kao. However, our consumer product companies enjoy considerable brand loyalty in China and operate in markets that tend to experience stable growth in demand. We also expect revenue growth from other regions of the world to offset any short-term weakness from China.

The Bank of Japan (BOJ) has maintained an accommodative monetary policy for many years. Do you believe this stance will continue or will the BOJ start to think about tightening measures?

Loose monetary policy, low-interest rates, and quantitative easing over the last five years have led to abundant liquidity in Japan’s financial system and a depreciation of the yen. Nonetheless, Japan has still not escaped from its deflationary mindset, nor has it reached its inflation goal of 2%. As a result, although the BOJ has been scaling back bond purchases since the fall of 2018, paving the way for the eventual normalization of the balance sheet, we are confident that the BOJ will continue to keep monetary policy easy and interest rates low.

What is your outlook for the Japanese markets heading into 2019?

We are optimistic about the outlook for Japanese equities in 2019. We believe the economy will continue to grow steadily and that inflation should remain comfortably above zero. Trade war risk aside, we expect to see continued growth in earnings from Japanese global businesses and the favorable level of the yen vs. the U.S. dollar should provide support for export growth. We also expect further structural reform from the Abe government to be a plus for the Japanese economy.

How should investors gain exposure to the Japanese market?

We believe investors should use active management to access to Japanese equities. Japan offers investors some of the most globally competitive companies in the world. However, it is difficult to gain exposure to these companies through an index fund, since major Japanese equity market indexes are dominated by the largest corporations— traditional, slow-growing Japanese behemoths. In contrast, the Hennessy Japan Fund focuses on what we believe are some of the best investment opportunities the Japanese market has to offer— globally competitive companies that operate great businesses with exceptional management teams and trade on attractive valuations.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.