The Midstream Energy Sector: Opportunities for Both Income and Price Appreciation

Midstream energy companies have long been attractive to yield-seeking investors. With historically low valuations and the potential for stock buybacks and rising payouts, now may be an extremely opportune time to consider adding exposure to the sector.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

Midstream energy companies – those involved in processing, transportation, and storage – have long been attractive to yield-seeking investors. But there are additional reasons for investors to consider the sector right now. Midstream companies are undervalued compared to their historical averages, and buybacks are increasing. COVID-19 vaccines should lead to an economic rebound and a sharp increase in energy demand, which should benefit midstream companies. Taken together, for these reasons and others, we believe it is an extremely opportune time to consider adding exposure to midstream energy.

High Yields and Low Valuations

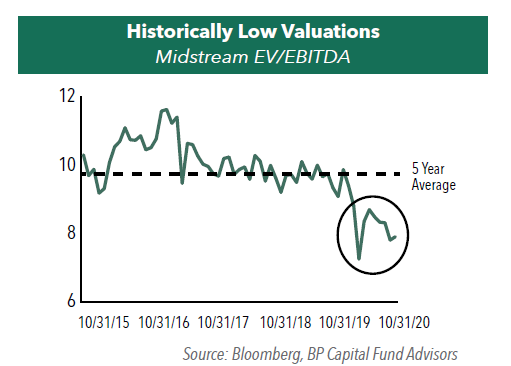

In a low to no-yield world, the double-digit yields currently found in the midstream energy sector stand out for investors starved for income. But the midstream energy industry is more than just an income play; it also offers a strong potential for capital appreciation. Companies are steeply discounted compared to their historical valuations, suggesting the possibility for substantial upside for price appreciation. The sector is therefore of interest to value investors, and there are a number of catalysts that could drive stock prices higher.

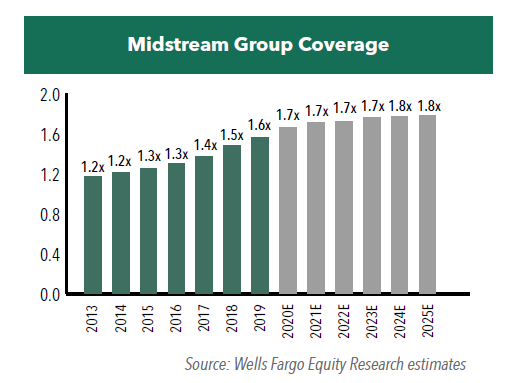

Midstream companies have been shifting their business models to focus on generating free cash flow and reducing debt. With distribution coverage ratios high and rising, this means companies should be well-positioned to be able to maintain today’s payouts and afford increases in the future. In other words, yields are not just high, they are generally more sustainable than in the past. These metrics also point to the potential for increases in payouts in the future, which could drive midstream stock prices higher.

Additionally, buybacks are gaining traction in the midstream energy sector. Five repurchase authorizations were announced at the beginning of November 2020 alone. Buyback programs generally support equity prices, and fewer shares outstanding can make dividends to remaining shareholders more sustainable and/or allow midstream companies the flexibility to lower leverage and self-fund CapEx projects. Widespread buybacks among midstream companies could be a significant catalyst for a surge in stock prices going forward.

Headwinds Turn Tail

The midstream energy sector has faced headwinds that are finally abating, and they are even turning into tailwinds. The sector had already priced in a Biden victory, but the election has provided more certainty.

The widely forecast “energy transition” toward cleaner or low carbon energy sources such as renewables has been underway for some time, but a Biden presidency could accelerate the transition. Though this could potentially have negative consequences for some energy producers over the coming decades, midstream companies may actually stand to benefit and have begun to study how existing infrastructure can be used for this transition. For example, natural gas, which is itself a clean form of energy, is transported through pipelines, and natural gas infrastructure is compatible with certain renewables. Hydrogen - what some believe is an equally attractive longer-term solution - can already be blended/transported over midstream companies’ existing pipelines or through new pipes constructed along the same right of way. For this and a variety of other applications, such as storage, midstream companies are well-positioned with the infrastructure requirements for the “energy transition.”

By far the largest headwind impacting midstream companies has been the demand destruction caused by the global pandemic, and despite some recovery, demand for oil (and certain products, namely jet fuel) has remained persistently weak. But with the economy opening back up and recent news of successful vaccine trials, there is finally light at the end of the tunnel. The economy and demand for energy should quickly return to something closer to “normal,” pre-pandemic levels once vaccines start to be distributed broadly. Also, the huge, ongoing fiscal and monetary stimulus could lead to an economic boom once this normalization takes place, a boom that should benefit the entire Energy sector.

Midstream Energy – A Recovery Play?

As we grow more optimistic that a COVID-19 vaccine will lead to a turnaround in the economy, we encourage investors to look very closely at the opportunities developing in the midstream energy sector. High yields and low valuations already in place make the sector attractive today, and catalysts for payout and stock price growth appear to be on the horizon. With investors fleeing companies that benefited because of the pandemic lockdowns, the midstream energy sector presents an interesting alternative. It could prove to be a very compelling recovery play.

- In this article:

- Energy

- Midstream Fund

You might also like

-

Investment Idea

Investment IdeaDefining the Energy "Value Chain"

Ben Cook, CFAPortfolio ManagerRead the Investment Idea

Ben Cook, CFAPortfolio ManagerRead the Investment IdeaEnergy is a large and complex sector. The sector’s broad sub-industries can be divided into a “value chain,” each segment of which has different characteristics and offers different investment opportunities.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundEnergy - Attractively Valued Sector with Higher Free Cash Flow Yields

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager Ben Cook, CFAPortfolio ManagerRead the Commentary

Ben Cook, CFAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein discuss the Fund’s disciplined process throughout the volatility driven by tariff uncertainty and geopolitical developments.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas: Essential to Reliable Power

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryUtilities have delivered strong returns in 2025, fueled by demand trends, earnings growth and their defensive nature, positioning natural gas utilities as a compelling opportunity amid market uncertainty.