Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

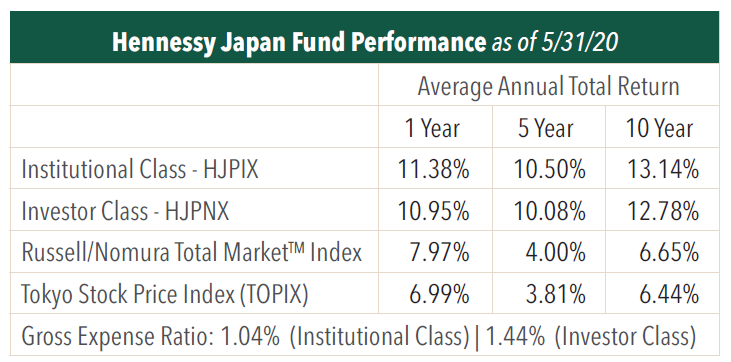

In May 2020, the Fund rose 11.39% (HJPIX) while the Tokyo Stock Price Index climbed 6.03%. The Russell/Nomura Total Market™ Index, the benchmark for the Fund, advanced 6.30% over the same period.

Among the best performers were our investments in Shimano Inc, a global leader in bicycle parts manufacturing, Terumo Corporation, Japan’s largest medical device manufacturer, and Anicom Holdings, Inc., a supplier of factory automation related sensors.

As for the laggards, Sony Corporation, a diversified consumer and professional electronics, gaming, entertainment, and financial services conglomerate, negatively affected the Fund’s performance.

Even though our investment style calls for long-term ownership of high-quality companies, we do not blindly subscribe to the buy-and-hold camp. Every time a new piece of information about a particular portfolio name or its industry emerges, we evaluate the potential consequences, and if the impact on the long-term health of the business is deemed negligible, we take no action on the position. When the outlook of the business becomes suddenly challenging due to rapid changes in external environment (such as this year’s coronavirus pandemic), our tendency is to hold steady insofar as we are convinced that the company has the wherewithal to survive the headwind subject to various stress-testing and scenario analysis. In other words, the inactivity in the portfolio is the result of very active mental analysis and judgement about the future course of the businesses in the portfolio on an ongoing basis.

Based on our research experience, most information that comes across can be dismissed as “noise.” For example, a temporary blip in same-store sales numbers for a retailer due to unfavorable weather is a noise. Given the exponential increase in information in the internet era, the key for investment professionals like us is to distinguish between “noise” and “signal.” We consider the “signal” as an event that could alter the fate of the business to a point that its intrinsic value, defined as the present value of future aggregate cash flows, would be significantly impaired. Developments such as structural shifts of consumer behavior or advances in technology also come to mind as examples.

Sometimes a “signal” can prove to be false. As the coronavirus pandemic wreaked havoc on the global economy, it was obvious at first instance that demand for consumer discretionary items as well as economically sensitive industrial goods would be decimated. Rather than emotionally rushing to exit our positions in such names, we took time to review all of the Fund’s holdings as the panic selling set in to reassess if there was any reason we could no longer hold a particular holding. As the dust from the March market chaos settled, we began to notice that a few of the portfolio holdings could thrive as a result of the pandemic profoundly changing the way people go about their lives.

A good example is Shimano, the global parts maker for high-end sports bicycles. Sports bicycles are no small ticket item for consumers so it was clear back in March that demand would take a huge hit. However, investors have recently started taking note of the possibility of an acceleration in industry sales driven by consumers looking to take up cycling as a way of exercising in the post-COVID19 social distancing world. Demand from commuters looking for safer alternatives to crowded morning buses and trains is seen rising as well. As a matter of fact, we have read recent European governments’ announcements about the construction of new bike paths to encourage social distancing in many big cities. Driven by rising expectations for higher sales globally, Shimano’s share price surged to an all-time high this month.

Other likely post-pandemic portfolio beneficiaries include:

»Keyence: its factory automation sensors will beincreasingly used to help reduce the need forhumans at manufacturing sites

»Daikin: its ductless type AC system is expectedto take market share from the duct type in the USas the former can better prevent the spread ofvirus indoors

»UniCharm: the diaper and sanitary napkin makeralso makes high-quality face masks as the mask-wearing culture is becoming the new norm

All of these companies have been holdings of the Fund since before the health crisis. Despite the difficult conditions in the broader markets, share prices of these companies have registered positive returns this year, contributing to the Fund’s outperformance relative to the benchmark so far.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.