Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

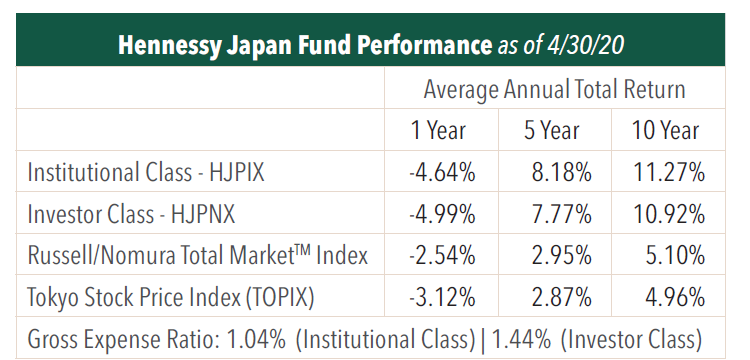

Fund Performance Review

Among the best performers were our investments in SoftBank Group Corp., a telecom and Internet conglomerate, Takeda Pharmaceutical Company Limited, a multinational pharmaceutical company, and Recruit Holdings Co., Ltd., Japan’s unique print and online media giant specializing in classified ads and provider of human resource services.

As for the laggards, Kao Corporation, Japan’s largest manufacturer of home care and personal care goods, Terumo Corporation, Japan’s largest medical device manufacturer, and Ariake Japan Co., Ltd., a producer of natural seasonings and flavorings from meat products, negatively affected the Fund’s performance.

This month, SoftBank Group Corp. provided the best return to the Fund. Contrary to public perception invoked by the negative publicity around the Vision Fund, SoftBank boasts an extremely asset-rich balance sheet whose investment securities amount to roughly $180 Billion net of debt, conservatively estimated. These assets are not marked-to-market under International Financial Reporting Standards rules: The Alibaba stake is calculated using equity method; the SoftBank (domestic telco) is consolidated; and Sprint had been consolidated before it was merged with T-Mobile, which reclassified the investment into the equity method category. However, the attributable market value of these assets can easily absorb the firm’s temporary operating losses related to the souring investments in the Vision Fund. With SoftBank Group’s current market cap at roughly JPY 9.6 Trillion (USD $89 Billion), we believe there is a “margin of safety.” The stock market seems to be well aware of this too. On a year-to-date (YTD) basis, the stock has comfortably outperformed the index so far albeit with significant volatility. This follows a 30% stock price rally in 2019.

On March 23rd, after a few consecutive days of precipitous share price drop amid the coronavirus driven market sell-off, SoftBank Group announced a large-scale asset disposal program amounting to JPY 4.5 Trillion (USD $42 Billion). According to the press release, the proceeds will be used towards share buybacks and debt repayment. This should further limit the downside risk of the stock in our view. Below are our views on the announcement.

Asset Sale Execution Risk

We consider this risk manageable. While there are a few notable investment holdings held by SoftBank, no official decision has been communicated to the market thus far as to which asset will be put up for sale. Considering that SoftBank is a critical source of cash flow (SoftBank receives JPY 270-280 Billion [USD $2.5–2.6 Billion] in dividends per annum) and shares in the newly merged T-Mobile have a four-year lock up clause as part of the merger agreement, we would surmise that Alibaba is the natural choice as a partial sale candidate. Reducing the Alibaba exposure should also move SoftBank’s investment portfolio away from being overly dependent on one investment, as it makes up over half of the portfolio.

SoftBank is currently sitting on a paper profit of nearly JPY 14.4 Trillion (USD $ 133.6 Billion) on this single investment (on a pre-capital gains tax basis). As the company’s plan calls for a 12-month timeframe to complete the disposal program, we consider the liquidity hurdle to be minimal. Furthermore, Alibaba’s businesses continue to chug along. It enjoys a dominant position in its core e-commerce segment, with promising new areas like the cloud business gaining traction. It also contains a crown jewel, Ant Financial, China’s dominant payments and financial services arm.

The fact that China has quickly contained the coronavirus outbreak and has been seeing steady recovery in economic activity is also reassuring that the positive business environment can be a tailwind for Alibaba’s share price.

Share Buyback

A share buyback should only be carried out when the share price is deemed undervalued relative to its intrinsic value. Needless to say, the lower the share price at which SoftBank buys in, the better. With the share price up more than 70% from the recent low on March 19th due to the program announcement, the economic rationale of the buyback has become less clear. We will keep an eye on how management is proceeding (or lack thereof) with the buyback program.

Debt Repayment

The progress of the share buyback should be monitored in conjunction with SoftBank’s reduction of interest-bearing debt, which stands at JPY 6.2 Trillion (USD $57.5 Billion) as at the end of 2019 (consolidated net debt of JPY 15.7 Trillion [USD $145.67 Billion]). The program was aimed at arresting the share price fall at the height of the market panic-selling and narrowing the conglomerate discount, which widened to as much as 70% at the peak. A share buyback is an effective tool to achieve this, but without a corresponding reduction in debt, SoftBank’s financial standing will be weakened. The company has been known for its insatiable appetite for making investments in start-ups with unproven business models. As such, whether they can demonstrate restraint in favor of debt reduction this time should be closely scrutinized.

Outlook

While SoftBank’s share price recovery was nothing short of dramatic, the March panic-selling and ensuing announcement by management revealed that the company was in a position of forced seller of assets in a down market. This was something we had underestimated as a risk. As the saying goes, an intelligent investor must buy low and sell high, not the other way around. Now that management has officially decided to retrench its venture capital business, the long-term prospects for the stock needs to be toned down, at least for the foreseeable future.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.