A Clear Play as Energy Demand Rises

The Portfolio Managers share their insights on the effect of intense summer temperatures, potentially rising rates, and global energy demand on midstream companies. They also discuss current valuations, payouts, and buybacks in the sector.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

How have the intense summer temperatures throughout the U.S. impacted midstream companies?

Impacts can include increased power demand with utilities that drive higher natural gas pipeline and storage terminal volumes. For those natural gas companies that have “interruptible” (vs. “firm”) contracts, this can translate to meaningfully higher profits.

Additionally, some G&P (gathering and processing) businesses have commodity linked contracts and benefit from higher commodity prices. With natural gas prices spiking to the $4/million British thermal unit (MMBtu) range in part due to higher summer temperatures, this has had a positive impact on those companies with exposure to natural gas.

The Fed is planning on raising interest rates sooner than expected. How have midstream equities historically performed during a rising rate environment?

Generally speaking, over the past couple of decades, midstream equities have performed well in rising rate environments. Rate shocks were the exception, like with most equities, leading to short-term weakness. As a key example, when the Fed Funds rate was significantly increased from 1.00% in mid-2004 to 5.25% by mid-2006 (and well telegraphed), the AMZ index increased 56% on a total return basis (12/31/2003-12/31/2006). This performance was much greater than the S&P 500 return (34%). Assuming interest rate increases are being driven by strength in the economy, this typically corresponds to favorable energy demand, which should benefit midstream fundamentals.

With global energy demand on an uptick, would you please comment upon the impact to U.S. midstream companies?

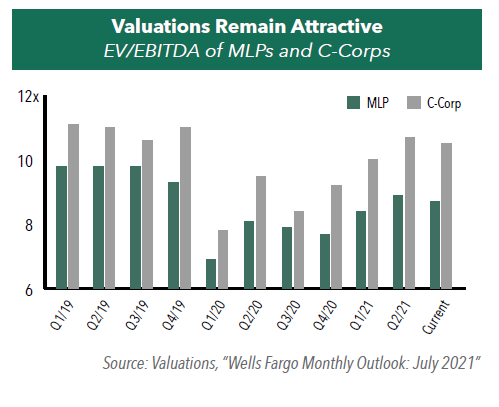

We believe there is still attractive total return potential for the midstream group. With the possibility of strong and sustainable yields in the current low-rate environment, we believe there is room to run for Midstream equities as absolute prices and multiples are still below pre-COVID levels while at the same time the debt market has already fully recovered. And while valuation alone isn’t a catalyst, given the global economic recovery and favorable Energy-specific tailwinds, most of our companies have generated Free Cash Flow (FCF) after dividends in 2021, and many should be able to buy back stock given progress with deleveraging.

With capex spending down 30%-40% in each of ‘20 and ‘21, and assets in many basins underutilized, we should see operating leverage kick in as well.

We believe it is reasonable to assume EV/EBITDA multiples could expand further (with some of our favorite names much more discounted), particularly among MLP-structured equities.

Would you please discuss current payouts as well as the pace of buybacks among midstream companies?

The average yield of midstream companies (represented by the AMUS: Alerian US Midstream Energy Index) is approximately 7-9% with ample dividend coverage of roughly 2x. As FCF is generally increasing, management teams are faced with a capital allocation decision including some or all the following: further debt paydown, small-scale/accretive growth projects, modest dividend growth, and/or share buybacks. We expect midstream companies to favor a combination approach. Thus far, as it relates to buybacks, most companies have stressed “opportunistic” vs. “programmatic” plans. While buybacks have been relatively modest in the first half of 2021 given the early stage of the recovery, some estimates suggest a potential ~$2 billion in buybacks in 2021 and increasing in 2022.1

- In this article:

- Energy

- Midstream Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.