Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the Japanese market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

For the month of November, the Hennessy Japan Fund (HJPIX) declined 1.76% while the Russell Nomura Total Market™ Index lost 3.07% and the Tokyo Stock Price Index (TOPIX) decreased 3.20%.

Among the best performers were our investments in Mercari, Inc., the operator of Japan’s largest online flea market app “Mercari,” Sony Corporation, a diversified consumer and professional electronics, gaming, entertainment and financial services conglomerate, and Unicharm Corporation, Japan’s baby and feminine care products maker.

Click here for full, standardized Fund performance.

As for the laggards, Recruit Holdings Co., Ltd., Japan’s unique print & online media giant specializing in classified ads as well as providing human resources (HR) services, Terumo Corporation, Japan’s largest medical device manufacturer, and Nitori Holdings Co., Ltd., the top manufacturing and retail chain of furniture and interior goods were the largest detractors to Fund performance.

It has been almost two full years since the outbreak of the COVID-19. As we approach the end of 2021, we would like to offer some insights on current market valuations for Japanese equities as well as how we view the Portfolio positioning going into calendar year 2022.

In our view, there are two ways to look at the market valuations for Japan. First, in terms of stock market performance in relation to earnings growth. Since the start of Abenomics in 2013, the TOPIX benchmark (with dividends) has risen approximately 172%. Meanwhile, the TOPIX earnings per share (EPS) has grown from Japanese yen (JPY) 50 ($0.44) in FY2012 to JPY 116 ($1.02) in FY2021 (according to Nomura’s monthly Japan equity strategy report). This JPY 116 ($1.02) in EPS roughly matches the previous peak earnings in FY2017 recorded right before the onset of the U.S.-China trade war. By this coming fiscal year, the EPS is expected to grow by another 15% on the full reopening of the domestic economy to JPY 134 ($1.18) bringing the total cumulative increase to about 169%. Thus, compared against each other, the stock market is up 172% and EPS is up 169%. Based on this, one could argue that the current market has already priced in a full recovery over the coming 12-18 months.

Another way to look at market valuations is by using price to earnings (P/E) and price to book (P/B) ratios. According to Bloomberg, Japan currently trades at a P/E of 14.2x and a P/B of 1.24x, significantly trailing behind both the U.S. and Europe. The cheapness can be explained by the country’s perennial low ROE (return on equity) compared to other countries. Here, we believe that a continued focus on corporate governance reforms and a rising awareness around capital efficiency by Japanese companies can translate into further improvement. We would not be surprised to see Japan’s ROE reaching low-to-mid teens on a sustainable basis with strong balance sheets down the road. This could lead to re-rating of valuation multiples providing further upside to the Japanese stock market.

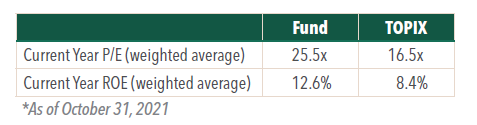

Turning to the Fund valuations, although its average P/E trades at a premium to the index, we do not think it is overvalued relative to the intrinsic value, quality, and growth prospects of the businesses the Fund owns. For example, the average ROE

of its investees is substantially higher than the broader market average (see below). Furthermore, our clients should understand that companies like Mercari require a much longer time horizon than the current year’s earnings to justify valuations as truly owner-oriented management often prioritizes strengthening the moats by making heavy front-loaded investments, which inevitably depresses earnings (sometimes for years). But the truth of the matter is, the intrinsic value of a business is determined by the future aggregate cash flow. We would advise our clients to look at the Fund valuation metrics with these caveats in mind.

In terms of the Fund’s positioning, we used to describe its Portfolio broadly consisting of two types of businesses: “economically sensitive high quality manufacturers & industrials” (e.g. Nidec, Keyence, Daikin, Misumi Group) and “stable growing consumer products/ healthcare businesses” (Terumo, Kao, Unicharm, Rohto). Together, they were meant to cover for each other through good and bad times in the hope of providing consistent market-beating returns.

More recently, however, we have come to realize that this perspective may have become less relevant in today’s economic environment. Now, we would broadly divide the Portfolio between “high quality seasoned holdings whose competitive strengths are rooted in manufacturing excellence” (be it industrial, medical device, apparel, consumer products) and

“businesses whose compelling economics reside in intangible assets such as proprietary software, algorithms, user data, network effects and intellectual properties.” The former group is asset heavy and can be generalized as businesses that sell ‘stuff’ (physical goods) while the latter tends to be asset-light in nature. It’s worth noting that over the last several years, we have found more compelling opportunities latter than the former.

Businesses that manufacture & sell ‘stuff’:

Nidec: the world’s largest manufacturer of precision motors. First purchased in 2013.

Terumo: medical device maker. First purchased in 2007.

Shimano: the world’s dominant supplier of high-end sports bicycle parts. First purchased in 2007.

Misumi Group: manufacturer/distributor of precision machinery components. Already in the Fund after we took over, we first repurchased in 2007.

Daikin: the world’s largest air conditioner maker. First purchased in 2008.

Rohto: maker of over-the-counter eye drops and skincare cosmetics. First purchased in 2007.

Uni Charm: maker of baby/adult diapers and sanitary napkins. First purchased in 2007.

Kao: maker of personal care products. First purchased in 2007.

Fast Retailing: purveyor of casual clothing. First purchased in 2017.

Businesses with large intangible assets:

Recruit: Online HR ads & classified advertisement media platform operator. First purchased in 2016.

Sony: Entertainment company with a focus on gaming, movies and music with rich content library. First purchased in 2019/2020.

Mercari: Online consumer marketplace operator for used items. First purchased in 2020.

Hitachi: Manufacturing company in transition towards asset-light, software-driven business model. First purchased in 2021.

SoftBank Group: Investment company focused on artificial intelligence innovation. First purchased

in 2015

Keyence: developer of customized factory automation sensors. First purchased in 2007.

While these classifications are arbitrary and some investors may disagree with our views, the reason we prefer to frame our Portfolio this way is because of lingering concerns over prolonged inflation.

In the face of rising prices of everything from raw materials, semiconductors, shipping, and labor, companies that make physical goods are feeling the pressure. Meanwhile, companies that provide software and online services are feeling a minimal impact, if any, in this regard.

For the former group, we continue to consider one of the reliable competitive advantages for Japanese publicly traded companies to be manufacturing excellence. The country’s craftsmanship and its studious ethos helped many manufacturing companies to become global leaders in their respective fields with ample addressable markets still ahead of them. Particularly, the Fund’s investees have excellent track records of masterfully navigating through past recessions thanks to the strong management leadership, be it during the Asian currency crisis in the late 90s, the burst of the dotcom bubble in the early 2000s or the 2008 global financial crisis. Hence, we believe they have the ability to weather the inflationary headwind of late.

The latter type of company generally requires very little capital to grow and as such can possess characteristics of high returns on capital and high operating leverage, making them potential candidates for “exponential grower” or “non-linear grower” even under the current inflationary environment. This holds true even if Japan may not have produced too many world-class “asset light tech companies” to date. Despite the dearth of choices, over the past few years we have been able to identify names like Recruit, Sony, Keyence, and SoftBank Group whose share prices have done very well for the Fund since my initial purchases, and remain core holdings. Similarly, we would expect our newly added names like Mercari and Hitachi to follow suit in the not-too-distant future. To summarize, we feel good about the current Portfolio going into 2022.

Click here for a full listing of Holdings.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.