Market Commentary and Fund Performance

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., sub-advisor to the Hennessy Japan Fund, shares his insights on the Japanese market and Fund performance.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

Fund Performance Review

For the month of February, the Hennessy Japan Fund (HJPIX) declined 4.93% while the Russell Nomura Total Market™ Index lost 0.51% and the Tokyo Stock Price Index (TOPIX) decreased 0.39%.

Among the best performers were our investments in Rohto Pharmaceutical Co., Ltd., a leading skincare cosmetics and over-the-counter ophthalmic medicines producer, Shimano Inc., global top market share bicycle parts manufacturer, and Nitori Holdings Co., Ltd., the top manufacturing and retail chain of furniture and interior goods.

Click here for full, standardized Fund performance.

As for the laggards, Recruit Holdings Co., Ltd., Japan’s unique print and online media giant specializing in classified ads as well as providing human resources services, Kubota Corporation, Japan’s largest and the world’s leading manufacturer of farming equipment, and Daikin Industries, Ltd., the leading global manufacturer of commercial-use air conditioners detracted from the Fund’s performance.

In last month’s commentary, we explained that the Fund had been well-positioned to withstand rising inflation and interest rates from a business fundamentals perspective. That is to say, the Fund’s portfolio holdings have been carefully balanced between “high quality holdings whose competitive strengths are rooted in manufacturing excellence” (be it industrial, medical device, apparel, consumer products) and “businesses whose compelling economics reside in intangible assets such as proprietary software, algorithms, user data, network effects and intellectual properties.” The former group is asset heavy and can be generalized as businesses that sell “stuff” (physical goods) while the latter tends to be asset light in nature. It’s worth noting that over the last several years, we have been making more new investments in the latter type than the former.

In the face of rising prices, the Fund’s intangible asset driven businesses that provide software and online services are feeling minimal impact as these asset light/less labor intensive companies continue to report record high profits. Meanwhile, the Fund’s investees in manufacturing businesses are currently under pressure citing higher raw material costs, chip shortages, supply chain disruptions, and lack of available labor. But they have excellent track records of masterfully navigating through past recessions/crises be it during the Asian currency crisis in the late 90s, the burst of dotcom bubble in the early 2000s or the 2008 global financial crisis thanks to competent management teams, strong pricing power, and cost competitiveness. Hence, we believe they have the ability to weather the current inflationary headwind. Better yet, should the inflation turn out to be short-lived, these manufacturing stocks will likely come back strongly.

On the contrary, our portfolio was not so well-prepared to stay insulated from valuation multiple contraction caused by rising interest rates. The reason for this is partly by design as we have said in the November 2020 letter that we are generally averse to investing in value stocks (as defined by low price to earnings (PE) or low price to book (PB)) due to their inherent subpar business nature.

This is why our portfolio remains exposed to de-rating risk in the current market environment even though we have been mindful of the risk and taken some corrective actions ahead of time. For example, in the last 24 months, we made large new investments in Sony Group (newly purchased at 13x price to earnings in 2019/2020) and Hitachi (newly purchased at 10x PE in 2021), both of which were trading at below market average PEs at the time of purchase, and added meaningfully to Mitsubishi Corp (added at 7.5x PE during 2021/2022). This effectively has helped to bring down the overall valuation of the portfolio, albeit insufficiently.

While we may have underestimated the impact of the recent rise in interest rates globally and an ensuing shift in market trends, we do believe the long-term gains from being patient will eventually outweigh the short-term pain. In other words, over time the businesses’ strong fundamentals will likely drive the Fund’s performance again. The Fund’s investees are all promising global businesses that have grown their earnings 250% to 350% on average (compound average growth rates (CAGR) 6.3%-8.7%) over the last 15 years from their pre-2008 crisis peak profits. This compares to a meager 40% cumulative growth to no growth (CAGR 0.0%-2.1%) for other large index constituents (financials, telecoms, utilities, traditional manufacturers) that the Fund doesn’t own.

We should also point out that the Fund-level PE ratio has declined as a result of the recent share price correction with the premium over the market average narrowing sharply. As shown in the November letter last year, the Fund’s PE was hovering around 50% above that of the TOPIX. Today it is only about 20% higher. Considering the quality advantages of our investees, the Fund’s valuation is becoming increasingly attractive.

Below, we would like to further offer our thoughts on the difficult absolute as well as relative year to date (YTD) Fund performance.

Thoughts On the Difficult YTD Absolute Performance and Our Expectations Moving Forward

In last month’s commentary, we had warned that some of high growth/high PE stocks in the portfolio were admittedly at risk of de-rating, should domestic long-term rates rise. For instance, if we were to change the discount rate by 2% from 8% to 10%, the intrinsic value estimates would fall by as much as 30-40% keeping all the other growth rate assumptions constant. Our long-term holdings such as Keyence and Nidec could be the biggest victims of this.

Why are we still holding these names? Below is an excerpt from last commentary to address this question.

“Over the 14 years the Fund has invested in Keyence, the company has increased its market cap tenfold (from Japanese yen 1.5 trillion→15 trillion, ($13bn→$127.9bn)), making it one of the most successful investment cases to date. This value appreciation can be broken down into the profit growth and multiple expansion. During our ownership, Keyence’s net income grew five-fold (forward looking Net Profit JPY 60bn ($518.9mn) at the time of the initial purchase to fiscal year (FY) 2022 ending March 2023 estimated JPY 300bn ($2.6bn)) while the forward price-to-earnings (PE) went from 25x to 50x. Nidec has been held since 2013 in the Fund, during which time the market cap nearly quintupled (Japanese yen 1.4tn→6.8tn, ($12.1bn→$58.7bn)), which can be divided into profit growth of 2.9x (forward looking NP JPY 60bn ($518.9mn) at the time of the initial purchase to FY2022 ending March 2023 estimated NP JPY 175bn ($1.5bn)) with the forward PE advancing from 23 to 40x (1.7x).

Of these two contributing factors, the profit growth factor should be relied upon more when thinking about the intrinsic value estimate moving forward. The reason being, the moats for Keyence and Nidec continue to stay intact and robust in our assessment, and their earnings growth prospects will likely remain bright with abundant addressable markets. As such, the accumulation in intrinsic value due to profit growth from the past is unlikely to be lost, which in turn implies that the part of market cap appreciation brought about by this factor will likely stick around although the multiple contraction (de-rating) on the back of rising interest rates may continue to take a toll. We would also like to emphasize that as price conscious stock pickers, we pay great attention to valuations upon entry. Keyence and Nidec were both first invested at near historical trough valuations.

It is extremely difficult (frankly we think it is impossible) to forecast how much the bond yields will rise over what timeframe and how long the phenomenon will persist. While the argument for the current inflationary trend being transitory has been largely dropped by the Fed, and some of today’s inflationary trend could be structural in nature such as due to demographic changes and environmental factors, there are always counter-arguments that assert technologically enabled innovations can be a deflationary factor. Putting all of these things together, we’ve come to the conclusion that long-term inflation and interest rates are too complex to predict ahead of time, hence we just leave this topic in the “too difficult pile” (as Warren Buffett often likes to stash away things that are too difficult for him to comprehend).

What we continue to focus solely on is the companies’ businesses and their progress. When we invest in promising long-term capital compounders at historically attractive valuations, our approach is almost like “buy-and hold” (unless the business’s moat suffers significant deterioration or the valuation becomes “irrationally” expensive). This mindset unfortunately hurt the Fund returns during the latest month but it is also true that such determination served well during the past interest hikes (by not selling too hastily). Even when we recognize that some of its holdings are disproportionately benefitting from multiple re-rating on top of rising profit levels, our de facto action is to just “let the winners run” with only occasional profit-taking (e.g. to meet Fund redemptions) but rarely exit the position completely.”

So what is the outlook for these beaten-down stocks? Well, if the share price corrects by 30-40% from the peak (as of this writing, some of the holdings have already corrected by 20-30% YTD) due to de-rating, theoretically earnings would have to increase by 40-60% to fully offset the lost ground. Based on the historical 12-15% earnings compounding rate of Keyence and Nidec, it would require 3-5 years to bring us back to the peak share price levels. Valuation multiple contraction can occur in a very short period of time as happened recently, but earnings growth can only materialize over several years. Hence, patience is required.

Of course, Nidec and Keyence could overcome the de-rating headwind quicker if the earnings growth accelerates thanks to their own business efforts. One such potential scenario is Nidec’s traction motors business for electric vehicles. Though the company has yet to score a big win (such as winning a Tesla order etc.), Nidec has been consistently revising their FY2025 order projections upwardly from 2.5mn to 3.5mn units over the past year. It is important to remember that Nidec is the world’s largest direct current brushless motors of all types with over 3bn units in total annual production, giving them formidable scale advantage. As the electric vehicle traction motor production volume ramps up, management expects this business to breakeven in FY2023, which could potentially add JPY 30bn ($254mn) to their existing consolidated profit base of JPY 190bn ($1.6bn). Once in the black, its profit contribution will accelerate thereafter, and combined with the continuous growth of other motor segments, their earnings momentum is poised to pick up significantly.

Keyence, the factory automation sensor developer, has masterfully navigated the turbulence so far. The company’s unique direct sales channel strategy allowed management to respond quickly to secure enough parts supply, while most of its competitors rely on a sales agency model and hence were unable to effectively deal with the problem.

As a result, Keyence posted a 50% operating profit increase YoY in the last quarter, surpassing the previous record high in 2017 by 25%. The company’s overseas revenue roughly accounts for half of the total. If the revenue breakdown was to mirror the global GDP distribution, we would not be surprised to see five years from now Keyence’s foreign sales making up a far bigger portion than its domestic sales, which are still growing at a decent clip. As an aside, our export-oriented holdings are expected to benefit from JPY depreciation as well.

Meanwhile, we are excited about our recently purchased names. For instance, Hitachi should have limited de-rating risk as we entered at value stock-like valuation (10x PE, low-teen return on equity (ROE), healthy balance sheet), and we believe the firm has the potential to transform into a growth company from a manufacturing-driven hardware sales model to a scalable solution-based model built around their proprietary industrial IoT (Internet of Things) platform called Lumada. As the business portfolio shift progresses, their ROE should improve further accompanied by above average earnings growth, increases in free cash flow and continued strengthening of the balance sheet. We suspect the stock remains considerably undervalued due to the market’s “anchoring bias” from the times when the company was a lethargic, low margin, troubled hardware manufacturer. If our investment view is correct, we expect both earnings growth and multiple expansion to drive up the share price. On the other hand, if we are proven wrong, Hitachi will just remain as a cheap manufacturing stock with not much downside risk. Hitachi is still in the early stages of the transition, however restructuring efforts over the past 10 years has helped the company already achieve mid-teen ROEs on a reasonably healthy balance sheet. As such, there remains downside risk to the current year’s profit guidance but given a far bigger future upside potential, the odds are in our favor.

It is probably debatable, but we would classify SoftBank Group under the “value” bucket with a good margin of safety due to its heavily discounted valuation. The firm’s net asset value (NAV), which consists of attributable market values of its publicly traded investees as well as fair value assigned to pre-IPO investees. We can see some of the Fund’s investors frowning upon such “value” designation. But it is worth mentioning that over 70% of its investment securities are publicly traded, which allows any outside people to objectively measure the aggregate value of its investment portfolio based on quoted security prices. True, these investees are concentrated in loss-making tech start-ups but when SoftBank Group’s shares are trading 50% below the objectively measured aggregate NAV, we cannot help but think of it as an undervalued security. Management is also on our side as they are acting on yet another big share buyback program (worth JPY 1tn ($8.5bn) this time or equivalent to over 10% of its current market cap).

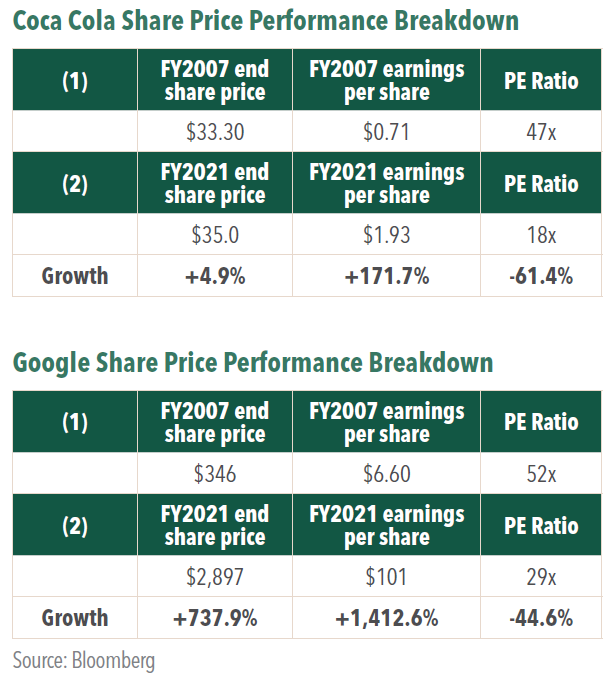

Then, there are investment cases, where, even with contracting multiples, it is entirely possible that long-term profit growth can outweigh the valuation de-rating factor. As a historical case study, the U.S. Internet giant Google is a case in point. As shown in the table below, Google shares experienced a multiple contraction from 52x in 2007 to 29x at the end of last year. During this period, however, its earnings per share (EPS) increased from $6.6 to $100.5, giving the stock an 8-fold increase ($346 at the end of 2007 to $2,897 at the end of 2021). It is also noteworthy that Google’s stock price tumbled during 2008 by 60% amid the Great Financial Crisis but still achieved this great performance. Conversely, Coca Cola also went through a similar phase where its PE ratio contracted from 47x in 1997 to 18x in 2011, during which time the EPS growth only managed to bring the share price back up to where it was 14 years earlier. What these case studies tell us is that it’s the business performance that matters and our belief is that, in this modern digital age, proven intangible asset-based businesses (internet, software, platform businesses), which we often term in our letters as “non-linear” businesses is the best way to achieve this. We would like to highlight Mercari and Recruit, two of our Internet stocks with successful business track records. We are very much looking forward to them driving the Fund’s performance over the mid-to-long term.

YTD Relative Performance vs. the Benchmark

We should also be forthcoming with the Fund’s poor relative performance. The Fund has not only suffered in absolute terms but also significantly underperformed the index thus far this year. While the Fund holdings remained under selling pressure as the growth-to-value market rotation took a toll, the value stocks marched higher despite their lack of growth appeal. In theory, higher interest rates should result in price correction of all equities regardless of whether they are long-duration stocks (growth names) or short-duration stocks (value names). But in reality it is completely reasonable that some stocks get re-rated, perhaps driven by mean-reversion effect. After many years of anemic growth, the PE ratios of these companies were depressed, so for their valuation levels to moderately recover is not surprising. So far, we have seen this take place with Japanese’s banks’ price to book ratios rising to 0.5x from 0.3x recently. For Toyota, the largest index constituent, its PE ratio has climbed to 11x from 9x. When such polarization of the market occurs, the difference between the Fund return and the market return becomes quite vivid especially when the last few months is looked at in isolation. With the Fund’s active share of 80% as of 12/31/21, it is inevitable that the Fund behaves very differently from the broader market. We cherish this as an active manager.

In Conclusion

Lastly, while the equity markets continue to be spooked by the prospect of rising inflation and the resulting higher interest rates, we attempt to look beyond and focus on when the inflation is brought under control. No matter how steep the pace of inflation may be, things will eventually settle down. We are mindful that the majority of market participants today have lived in a disinflationary world all their lives and are navigating uncharted waters at present. We have no clue whether the world will witness the return of a Volcker era but we will seek to make certain that our investees maintain their competitive moats to survive and thrive during this challenging period, which we believe should eventually lead to superior Fund’s performance in the future.

Click here for a full listing of Holdings.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Portfolio Perspective

Portfolio Perspective

Japan FundA Differentiated Portfolio Focused on Margin of Safety and Upside Potential

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.