Inflection Point for Midstream Companies

Over the last five years, a difficult operating environment and misalignments between midstream MLP (master limited partnership) investors and industry management teams have contributed to declines in distributions and stock prices. However, we believe that today midstream companies are at an important inflection point, poised to resume distribution growth that should attract favorable investor attention.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

Key Takeaways

- Positive fundamentals are driving growth in cash flows

- Companies are embracing capital discipline and improving governance

- Stock valuations are at historically low levels

- Payouts are projected to rise, which should drive stock prices higher

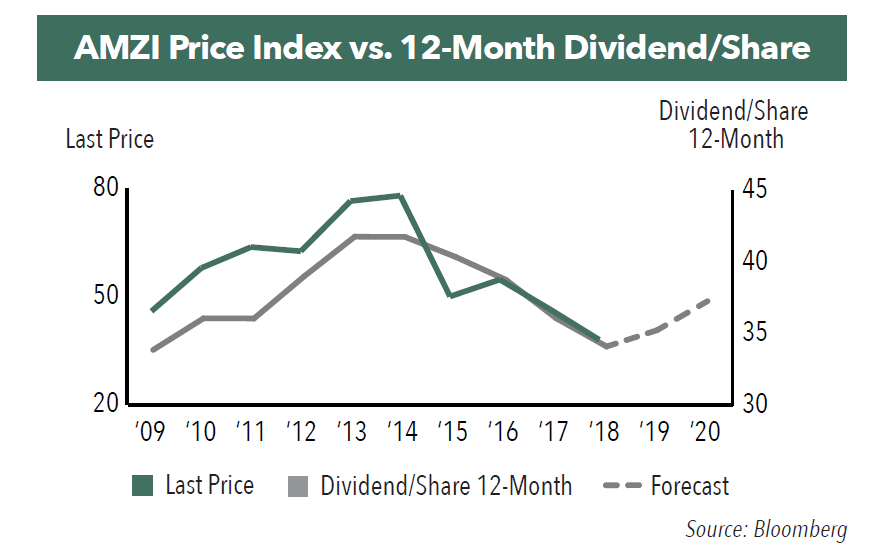

Background

The decline in the price of oil from 2014 to 2016 hurt midstream companies’ cash flow growth, and as a result, many cut their capital spending budgets and their distributions. The Alerian MLP Infrastructure Index (AMZI) saw its trailing twelve-month distribution per share fall from a high of $43 in October 2014 to $33 in June 2019. The stock prices of midstream companies retreated also, following the decline in distributions.

Today - Improved Fundamentals, But Low Valuations

There have been many significant, positive changes for midstream energy companies over the last few years:

Return to Growth in Cash Flow. Midstream companies are benefiting from the rapid growth in production of crude oil and natural gas in the U.S., with higher volumes flowing through their gathering, processing, pipeline, and storage assets. This has, in turn, led to higher revenue and cash flows. Cash flows have been rising steadily since the beginning of 2017, and the first quarter of 2019 marked the eighth consecutive quarterly increase in cash flow generation for midstream companies.1

Improved Capital Discipline and Stronger Balance Sheets. Management teams have shifted away from “growth at all costs” towards a more disciplined approach to growth focused on stronger balance sheets and more self-funded capital spending. Through a combination of moderated spending programs and higher cash flows, midstream companies have successfully increased the portion of capital spending funded with company cash flow from 7% in 2015 to 29% in 2018, with a further increase to 42% projected for 2019.1 Lower capital spending has meant less reliance on equity issuance to fund growth and the potential for more cash to be paid out in distributions. Balance sheets have also become stronger, with midstream company-level debt to earnings before interest, tax, depreciation, and amortization (EBITDA), moving steadily lower over the last few years as management teams have used cash to pay down debt.

Elimination of IDRs. A majority of midstream MLPs have addressed a major investor concern by eliminating Incentive Distribution Rights (IDRs). IDRs had diverted distributable cash flow away from limited partnership unit holders in favor of the GP, or general partner. In March of 2014, 70% of the AMZI was comprised of companies with IDRs, and by March of 2019, this figure had fallen to just 16%.2 As a result, we believe midstream companies are now better positioned to increase cash payouts to investors as company cash flow generation has continued to rise.

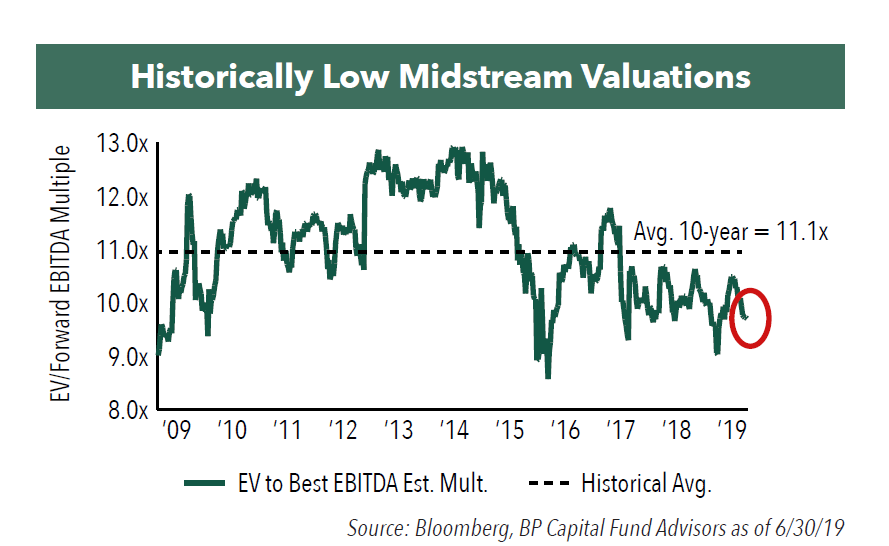

Historically Low Valuations. Despite a meaningful improvement in midstream MLP financial strength, MLP valuations stubbornly remain at near historic lows. Over the last ten years, the AMZI has traded at an average multiple of approximately 11.1x on an Enterprise Value (EV) to forward 12-month EBITDA basis. Currently, the AMZI trades at roughly 9.7x EV to forward 12-month EBITDA (as of 6/30/19).

Catalyst to Drive Midstream Stocks Higher?

We believe midstream companies today are in a strong position to begin increasing their distributions, powered by steady cash flow growth, moderated capital spending budgets, and better governance practices, and that stock price increases should follow.

Payouts Projected to Rise. The financial strength and ability to pay out more cash to investors has improved dramatically for midstream companies. Based on analysts’ consensus estimates, dividends appear to have troughed at the end of the first quarter of 2019 and are projected to rise in the second half of 2019 and into 2020 and 2021. On a compound annual growth rate basis, distributions are projected to grow at 3.3% between year-end 2019 and 2021.

Stock Prices Have Followed Distributions. The projected increase in cash payouts is important because historically stock prices for midstream companies have closely followed distributions.

Strong Distribution Coverage. Midstream management teams have been cautious about raising distributions over the last two years, even though cash flows have been growing. As a result, coverage ratios (defined as distributable cash flow divided by distributions paid) have risen on average from 1.30x in 2016 to nearly 1.47x in 2018.2 We believe rising coverage levels are an indicator of distribution and dividend stability and point to the potential for future payout increases.

Conclusion

We believe 2019 will be a pivotal year for midstream companies, presenting a tremendous opportunity for investors. Supported by a combination of improved corporate governance and positive industry fundamentals, midstream companies are expected to begin increasing payouts in the second half of the year, and we expect stock prices to again closely follow distributions as they have historically.

- In this article:

- Energy

- Midstream Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.