Attractive Attributes of Midstream Companies

Many midstream companies offer a higher-quality balance sheet, consistent distribution growth, and a higher distribution coverage. Read our investment case for midstream equities.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

The following highlight several attractive attributes about midstream companies:

1. Attractive yield. We believe Midstream companies offer attractive yields to income-seeking investors. As of 5/31/23, midstream C-Corps’ current average yield was 6.9%, while the average yield of midstream master limited partnerships (MLPs) was 8.3%.1 In addition, these yields are often higher compared to other sectors.

2. Favorable dividend/distribution growth. Distributions continue to represent a meaningful component of total shareholder/unitholder return. Since the year 2000, the historical midstream sector annual cash payout growth has averaged 5%. During 2023, we anticipate this trend to continue with a cash payout growth projection of 5%.

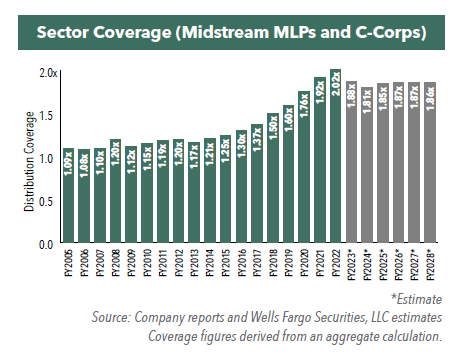

3. Well-funded cash payouts could lead to further increases in the future. These distributions have been well covered in terms of the amount of cash generated by companies. For example, in 2019, the average distribution coverage in the midstream sector was 1.6x, so every $1 in payout per share/unit was covered by $1.60 distributable cash per share/unit. In 2022, the coverage was 2x, meaning that companies on average covered their distribution by 100%, which generated $2 in distributable cash for every $1 paid to investors. Over the next 5 years, the average distribution coverage is forecasted to be between 1.8 and 1.9x.1

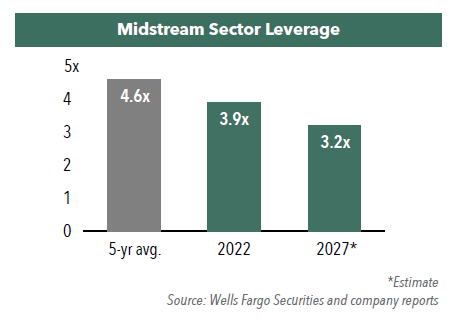

4. Lower leverage over time. We believe midstream companies have responded to the investment community’s call for improved financial flexibility. Midstream sector leverage (debt to EBITDA) was approximately 3.9x at year end 2022, while the 5-year average (2017-2021) has been about 4.6x. This figure is anticipated to decline to 3.2x by 2027.1

5. Attractive valuation. As of 5/31/23, C-Corps were trading at 9.0x EBITDA, below their 5-year historical average of 10.1x. Midstream MLPs were trading at 7.6x EBITDA, lower than the 5-year average of 8.5x as of the same period.1

An Opportunity to Potentially Benefit

As an actively managed Fund, the Hennessy Midstream Fund offers a concentrated portfolio of midstream companies we believe have stronger balance sheets and lower leverage, advantaged geographic/asset footprint, cash flows supported by a more diversified customer base, and meaningful long-term volume contracts that aims to preserve capital.

- In this article:

- Energy

- Midstream Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.