Guide to Investing in Natural Gas

6 key reasons why investing in natural gas in our view is a smart move. Get our current outlook and advice on how to invest in natural gas.

A Fuel of Choice for the Nation

Natural gas is abundant, affordable, and has environmental advantages over other fossil fuels. Plus, advances in drilling technologies have steadily lowered extraction costs and increased production. As a result, natural gas is a critical source of energy for many homes and businesses and has grown over the past decade to account for nearly 40% of electricity production in the United States.

The key reasons to consider investing in natural gas are as follows:

- Growing demand for cleaner fossil fuels

- Vast domestic supply

- Low and competitive relative price

- Increase in U.S. exportation

In this guide, we look in more detail at 5 reasons to invest in natural gas right now along with other considerations to minimize risk.

Explore Our Guide to Investing in Natural Gas:

“With a 100+ year supply and competitive pricing, clean-burning natural gas represents a compelling investment for decades to come.”

- RYAN KELLEY, Hennessy Funds

5 Reasons to Consider Investing in Natural Gas

Natural gas is a clear winner. Here are the key factors behind the sector’s long-term growth potential.

1. The imminent “energy transition”

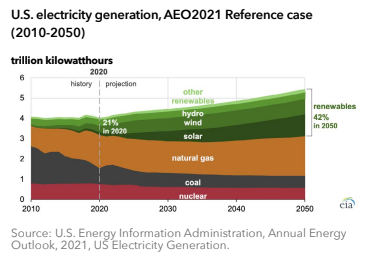

The U.S. Energy Information Administration forecasts that electricity will increasingly be generated by renewables and natural gas while coal use falls. In response to concerns about climate change, policy action is driving this “energy transition”. Natural gas’ rise is due to the fact that it is an intrinsically efficient source of energy and is the ideal complement to renewables.

Indeed, a primary driver of the current strong growth in demand for natural gas is that U.S. electric power generation plants continue to switch from coal to natural gas. This is due to gas’ low and competitive pricing and the fact that gas burns cleaner and produces fewer carbon emissions than coal or oil. And, as a reliable and flexible source of energy, natural gas is well positioned to be used in combination with renewable energy sources such as wind and solar.

Learn more about the role of natural gas in the energy transition.

2. Plentiful domestic supply and production capabilities

According to the U.S. Energy Information Administration (EIA), as of February 2020, the United States has enough natural gas to last about 92 years, assuming the same production rate as in 2018. While only 15% of this estimated volume is “proved reserves” (produced with reasonable certainty under current economic and operating conditions) the remaining “unproved resources” are still recoverable using current technology but don’t take into consideration the economics or operating conditions.

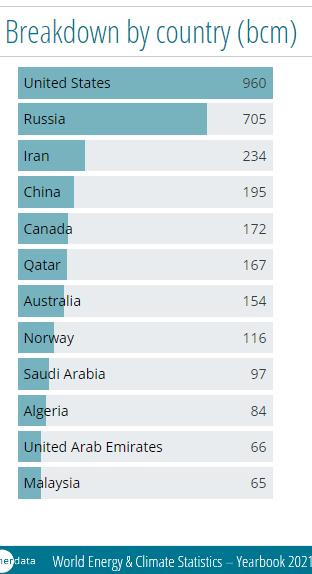

In addition to having plentiful reserves, the US has the infrastructure to take advantage of these resources. Since 2012, the United States has surpassed Russia as the largest producer of natural gas.

3. Low cost of energy and high efficiency

Not only does natural gas have a lower fuel cost than other fossil fuels, it has a lower levelized cost of electricity (LCOE)1. LCOE represents all costs for a generating plant over its lifetime, such as operations and maintenance, in addition to the cost of the fuel. Plus, natural gas is extremely efficient. Moving natural gas from the wellhead to the burner tip retains 92% efficiency, compared to the electrical grid where a huge amount of energy is lost during transmission.

4. Increased exportation

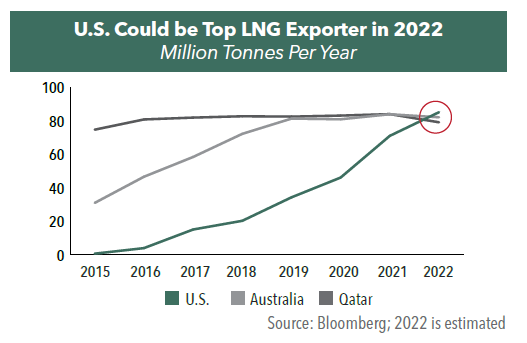

Developments such as liquefied natural gas (LNG) and compressed natural gas (CNG) have made trade in natural gas more practical and have made investing in natural gas more attractive. As a result, another primary driver of the growth in demand for natural gas is exportation, including pipeline volumes to Mexico and LNG/CNG to overseas destinations. The US is one the largest exporters of natural gas in the world and is expected to be the largest global exporter of LNG by 2023.

5. Relative stability during volatile market cycles

The Covid-19 pandemic of 2020 presented an excellent case study of natural gas’ price stability relative to crude oil. Natural gas prices held fairly steady while oil prices fell to historic lows. This was due to natural gas being the energy of choice for utilities and as industrial and commercial use fell, residential usage increased. Margins on residential gas are higher than on industrial and commercial. Because of this phenomenon, gas utility funds in particular may provide a more stable commodity for investors seeking true asset class diversification.

Risks of Investing in Natural Gas

Any investment comes with risks. Here are the primary risks associated with investing in natural gas:

- Lower supply: If shale oil producers decrease production in response to the sharp decline in oil prices, some of the “associated gas” produced as a byproduct will disappear. This should cause natural gas prices to rise, but likely remain at relatively low and competitive levels.

- Lower-priced substitutes: If prices from other sources decrease dramatically (or if natural gas prices increase) for a prolonged period, utilities may consider converting their plants.

- Global economic or political turmoil: Turmoil elsewhere would likely strengthen the US dollar and weaken demand for commodities.

Current Outlook for Investing in Natural Gas

“Over the last decade, strong growth in production has allowed the U.S. to become a net exporter of natural gas.”

- RYAN KELLEY, Hennessy Funds

The Portfolio Managers of the Hennessy Gas Utility Fund discuss America’s role as a global supplier of natural gas, the Fund’s alternative energy exposure, earnings growth expectations, and how Utilities perform in a rising rate environment.

- U.S. - Top LNG Exporter for the First Time in 2021

Natural gas utilities’ average EPS growth is expected to remain strong at 6-8% per year due to the growing importance of natural gas and its usage, an accommodative regulatory environment, and a continued large undertaking in pipeline replacement and modernization.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

Read our latest portfolio manager commentary: Natural Gas Remains a Fuel of Choice

How to Invest in Natural Gas

We believe the best way for the average investor to take advantage of natural gas’ future growth potential is by investing in natural gas stocks and/or mutual funds. Other approaches, such as natural gas futures, options on futures, and contract for difference (CFD) derivative instruments can be quite risky and require a high degree of sophistication.

Individual Natural Gas Stocks

Buying shares in publicly held natural gas companies – natural gas producers or production infrastructure companies – has advantages and disadvantages. The investor has complete control of which companies to invest in and the stocks they buy are highly liquid. However, building a diversified portfolio requires extensive research given that the energy sector comes with risks beyond typical management issues and competitive dynamics. Geopolitics can upset markets overnight and natural gas prices are based on many complex factors and can be volatile (see the Natural Gas Value Chain section below for a more in-depth look at the categories of companies in the sector). Further, many natural gas companies are involved in other energy products such as crude oil and will be significantly impacted by those sectors.

Natural Gas Mutual Funds

To mitigate the risk associated with picking individual stocks, many investors choose natural gas mutual funds. These funds represent a portfolio of investments in stocks of natural gas companies and can cover a wide range of market caps and styles. They can also focus on a particular aspect of the industry. For example, funds that focus on natural gas distribution provide investors the opportunity to benefit from the growing demand for natural gas while limiting exposure to negative trends affecting other energy companies (such as companies that operate in crude oil drilling in addition to natural gas).

Selecting Natural Gas Mutual Funds

We encourage investors considering how to invest in natural gas to look at all available natural gas mutual funds to find the best funds that match their portfolio objectives. Hennessy offers the Hennessy Gas Utility Fund, a natural gas mutual fund. Here are a few highlights:

- Focus on Distribution: The fund invests in the distribution side of the natural gas industry. This provides exposure to the growing demand for natural gas while limiting exposure to negative trends affecting other energy companies.

- Index-based Investment Methodology: The fund holds shares of publicly traded members of the American Gas Association (AGA) in approximately the same proportion as their weighting in the AGA Stock Index.

- Historically Steady Dividend Payouts: Due to their relatively stable revenue streams, we expect dividend payouts to remain steady for the vast majority of our portfolio companies. Further, companies in the fund have grown their dividend at about a 5% annual rate over the last five years.

- Participation in Expansion of Renewable Energy: Many of the companies in the fund offer a diverse portfolio of energy solutions, providing not only natural gas but also renewable energy sources including solar, wind, and hydropower.

Natural Gas Overview

To aid in your decision on whether and how to invest in natural gas, this section provides more background on the sector overall.

What Is Natural Gas?

Natural gas is a mixture of gases created deep underground as pressure and heat transformed carbon and hydrogen-rich plant and animal remains millions of years ago. Natural gas consists of many compounds, including methane (which accounts for over 90%), natural gas liquids, and non hydrocarbon gases, such as water vapor and carbon dioxide.

Sources of Natural Gas

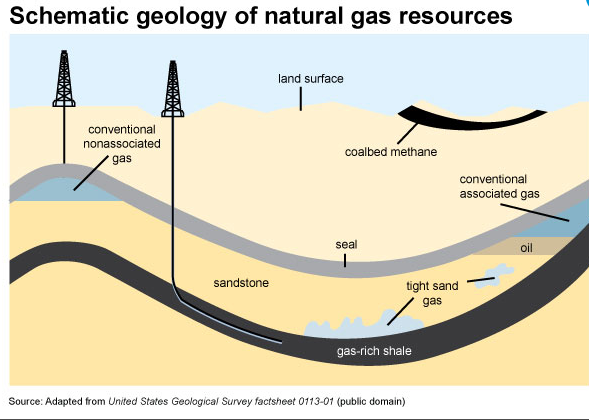

Natural gas is found in four main places as follows:

- Conventional natural gas occurs in spaces between layers of overlying rock formations.

- Unconventional natural gas, also known as shale gas or tight gas, is found in small spaces within sedimentary rock such as sandstone or shale formations.

- Associated natural gas occurs with crude oil deposits.

- Coal bed methane is found in coal deposits.

Horizontal drilling and hydraulic fracturing in sedimentary rock account for the majority of the increase in natural gas production since 2005 and shale gas currently accounts for roughly two-thirds of the total natural gas produced.

Natural Gas Value Chain

The Natural Gas sector can be separated into a “value chain” of segments based on the activities needed to bring gas out of the ground and to the end-user. Each of these segments has unique characteristics and unique investment opportunities and risks. Below we provide a summary of the main segments.

In general, in the Natural Gas value chain, the closer you are to the end-user, the potentially more stability you have in your investments.

- RYAN KELLEY, Hennessy Funds

Main Segments:

- Upstream companies focus on pulling natural gas out of the ground. This includes exploration, processing and field equipment and services companies. Profits for these companies are usually highly correlated with natural gas (and oil) prices.

- Midstream/storage companies store and transport natural gas and natural gas liquids through pipelines and as liquefied natural gas (LNG) exportation. Midstream companies can often pass through fluctuations in natural gas prices to their customers and therefore their profits are not as correlated with natural gas (and oil) prices.

The infrastructure and processing required to convey natural gas from wells to residential consumers, commercial manufacturing or electric power plants can be simplified into 3 main steps as follows:

- Storage. During periods of low demand, natural gas is stored in depleted natural gas or oil fields, salt caverns and aquifers.

- Transportation. Natural gas is delivered from processing plants to customers or storage areas via three types of transmission pipelines: interstate, intrastate and local distribution pipelines called Hinshaw pipelines.

- Liquefied natural gas (LNG). Cooling natural gas to about -260° Fahrenheit turns it into a liquid and decreases the volume of the fuel by 600 times. This allows special tanker trucks or ships to economically deliver natural gas to places pipelines cannot reach.

- Downstream companies refine crude oil and market the finished products, such as gasoline and jet fuel, to customers in the U.S. and abroad. Profits from downstream business also tend to be relatively well-insulated from commodity price fluctuations.

- End-user distribution companies, primarily power plant utilities use natural gas in their operations as a fuel to produce electricity. Even more than mid-stream companies, these utilities can pass through fluctuations in natural gas prices to their customers and therefore their profits are not correlated with natural gas (and oil) prices.

Natural Gas Uses

Natural gas is primarily used for residential and commercial heating and cooling. For example, gas heats approximately half of the homes in the US. And, as of January 2020, natural gas is also the largest source of US electricity production, accounting for over 37% of the total.

In addition to being a vital energy source, natural gas has many other uses and byproducts, such as:

- Acting as a raw material in the production of chemicals and materials such as paints, medicines, synthetic fibers and plastics. Providing byproducts such as ammonia and natural-gas liquids (NGLs) like propane and ethane.

- Enabling compressed natural gas (CNG) for vehicles to use in place of gasoline or diesel fuel.

Natural Gas Price Drivers

Natural gas has seen a long trend of fairly stable pricing. Still, gas is a commodity that has limited alternatives, at least in the short-term, and as such, short-term changes in supply or demand may result in minor price changes to stabilize the market.

- Supply side. Decreased supply from reduced natural gas production, storage inventory levels or imports often raises prices. These price increases often lead to increased supply which in turn brings prices back down.

- Demand side. The weather is by far the primary driver of demand in any given season. But, the level of demand for natural gas has evened throughout the year due to the increased use of natural gas for electricity production. This is because in addition to gas heating homes in winter months, utilities rely more on gas to satisfy commercial and residential need for electricity for air conditioning in summer months. Other factors that affect demand for gas include the economy, as manufacturing or residential building ramps up or down, the market for LNG exports and the price of oil. As stated above, a rise in oil prices increases demand for natural gas, which in turn causes natural gas prices to rise.

Frequently Asked Questions About Investing in Natural Gas

These are questions we often hear about investing in natural gas:

Is natural gas a good investment?

With abundant supply and competitive pricing, clean-burning natural gas is an attractive investment for many years to come. Plus, as a commodity, investing in natural gas can help you diversify your portfolio.

How can I invest in natural gas?

A good way for individuals to invest in natural gas is to purchase shares in natural gas mutual funds. Further, mutual funds which focus on natural gas distribution provide exposure to the growing demand for natural gas while limiting exposure to negative trends affecting other energy companies.