Guide to Utility Funds

Learn why you should include utility index funds in your portfolio. Get our current outlook on the sector and advice on how to choose the best funds.

Reliable, growing income mitigating large risk

The COVID-19 pandemic introduced volatility early on for earnings and stock prices of many companies, but the effect on the Utilities sector was muted and the long-term outlook remains positive. We believe utilities provide investors with reliable income and stock price appreciation potential with relatively lower volatility, and that the best way to gain exposure to utilities is through mutual funds.

This guide is designed to help you understand why you should consider including utilities funds in your portfolio, how to choose the right utilities funds, and key trends in the market.

What are Utility Funds?

A utility fund consists of a portfolio of stocks, bonds, or other securities in the utilities sector. Buying shares in a fund mitigates the risk associated with picking individual stocks and gives individual investors a cost-effective way to participate in a diversified, professionally managed portfolio.

Utility funds usually represent a wide range of market capitalizations and can be focused on domestic or international markets. The utilities sector represents companies which produce and deliver utility services to homes and businesses and can include the following:

- Natural gas

- Electric power

- Water

- Communications

Broadly speaking, utility funds can be broken into two types: those pursuing an index strategy, and traditional utility funds or ETFs. Utility index funds seek to match their performance to a sector index or benchmark and are typically managed passively, meaning that they do not have a management team making investment decisions. Traditional utility funds or ETFs are either passively or actively managed. Actively managed funds have managers who make investment decisions based on strategies to beat a benchmark or index.

Why Include Utilities Funds in Your Portfolio

The utilities sector is considered a “safe-haven sector” given that demand for these services typically holds fairly stable, even during a recession. A strong case for investing in utility funds in both bear and bull markets can be made based on several factors:

- Reliable dividend income: Utilities funds that focus on income (rather than capital appreciation) typically offer dividend yields of 1-3%. While not a dramatic return, these funds may beat other defensive options such as CDs or bonds, especially when interest rates fall.

- Defensive guard against inflation or recession:Demand for utilities services usually holds fairly stable, even during a recession, since consumers still need light, heat and water for their homes. Further, utility companies can usually maintain profit margins if fuel costs increase because they pass these higher costs on to the end-users.

- Good relative returns: Utility stocks fell less than the overall market in Q1 2020 and appear more attractively priced on both a relative and an absolute basis. While utility stocks have historically traded at a premium, the sector is trading approximately in-line with the S&P 500® Index.

- Above average growth in EPS EPS growth for the utilities sector has been above the S&P average since 2015. In fact, in the first half of 2020, the EPS estimate for the utilities sector only dropped 2% while the S&P EPS dropped about 30%. This is being driven by a large amount of capital expenditures, increased demand and a supportive, regulatory environment.

- Long-term earnings visibility: Utilities are able to give EPS and capital expenditure targets going out 3-5 years. This makes it easier for investors and fund managers to analyze companies and the sector overall more reliably in the long-term.

How to Choose Utilities Funds

As always, investors should first be clear on their investment objectives. Those with a long-term strategy may prefer utility funds and ETFs that focus on paying dividend income. Investors seeking returns in the near-term may prefer funds focused on growth and capital appreciation.

Below are the key factors to consider when selecting a utilities fund or ETF to invest in:

- The fund’s historical performance

- The dividend yield (trend and forecast)

- The specific companies within the fund portfolio

- The fund’s expense ratio and other fees

- The breadth of holdings in the fund

- The fund’s tenure and how it has performed in both bear and bull markets

Spotlight on Natural Gas utility Funds

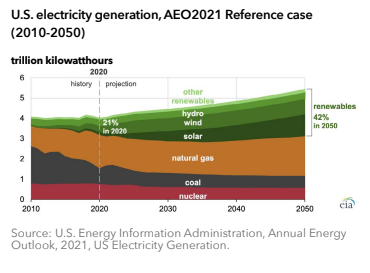

We believe natural gas utilities are the best type of utilities to invest in because they have a significantly better growth trajectory than other utilities. This superior growth potential is based on two key factors. First, natural gas utilities have exposure to the energy sector, which has greater upside appreciation. Second, demand for natural gas continues to increase. In fact, over the past ten years, natural gas has become the primary source of fuel for electricity utilities and now accounts for nearly 40% of electricity production in the United States.

Energy utilities choose natural gas because it is abundant, affordable, and has environmental advantages over other fossil fuels. Here are the primary drivers behind the long-term growth potential of natural gas:

- Growing demand for clean fossil fuels

- Vast domestic supply

- Low cost of energy

- Increase in US exports

- Stability during volatile markets

For a deeper look at the natural gas market, see our guide to Investing in Natural Gas.

Selecting Utility Mutual Funds

We encourage investors to look at all available utility funds to find the best utility mutual funds that match their portfolio objectives. As stated above, we believe natural gas utilities represent the best type of utilities to invest in. Hennessy offers the Hennessy Gas Utility Fund, a leading natural gas mutual fund.

Here are a few highlights of the Hennessy Gas Utility Fund:

- Potential for Growth: The fund has exposure to the energy sector which gives it greater potential for upside appreciation.

- Focus on Distribution: The fund invests in the distribution side of the natural gas industry. This provides exposure to the growing demand for natural gas while limiting exposure to negative trends affecting other energy companies.

- Index-based Investment Methodology: The fund holds shares of publicly traded members of the American Gas Association (AGA) in approximately the same proportion as their weighting in the AGA Stock Index.

- Historically Steady Dividend Payouts: Due to their relatively stable revenue streams, we expect dividend payouts to remain steady for the vast majority of our portfolio companies. Further, companies in the fund have grown their dividend at about a 5% annual rate over the last five years.

- Participation in Expansion of Renewable Energy: Many of the companies in the fund offer a diverse portfolio of energy solutions, providing not only natural gas but also renewable energy sources including solar, wind, and hydropower.

Frequently Asked Questions – Mutual Fund Utility

These are the questions we often hear about investing in utility funds:

What are utility funds?

Simply put, a utility fund is a mutual fund that invests primarily in utilities. These funds will often focus on a particular market such as natural gas or crude oil and focus on areas of that sector such as drilling, electric utilities, or distribution.

Are utilities a good stock investment?

Adding utility stocks can provide income and reduce volatility in a portfolio. ... Utility stocks are viewed as a safe investment to add to a portfolio since these companies are part of a regulated industry and often have fewer competitors.