Focus Fund Company Spotlight: RH

RH (formerly Restoration Hardware) has transformed into a global luxury brand focused on a sophisticated lifestyle within the home furnishings marketplace. With its bespoke design and hospitality experience, RH plans to continue expanding its brand to the global marketplace.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

RH is a leading luxury retailer in the home furnishings marketplace, offering merchandise in sophisticated and unique lifestyle settings inspired and in partnership with world-class interior designers and artisans. The company’s curated and fully integrated merchandise spans several home design categories, including furniture, lighting, textiles, bathware, decor, outdoor and garden, and child and teen furnishings.

RH currently operates 40 legacy stores, 24 design galleries, 15 bath and kitchen showrooms, and 38 outlet stores throughout the U.S., U.K., and Canada.1

In 2020, the company generated approximately $2.8 billion2 in revenue within the highly competitive $200 billion3 global home furnishings industry.

While RH experienced short-term challenges due to COVID-19 related store closings, the pandemic has provided key tailwinds. By mid-2020, RH experienced a surge in demand with a trend in home improvement, historically low interest rates, strong existing home turnover in million-dollar-plus homes, and a robust second home market.

Transforming Retail Stores into Hospitality Experiences

RH is in the early innings of a transformational change to its real estate and store design strategy. The company is replacing its legacy mall-based locations with larger design galleries, located primarily in prestigious off-mall locations. Catering to the affluent, RH has established this next generation of galleries in high-profile locations such as the company’s six-story gallery located in New York’s Meatpacking District or its Boston Gallery located in the historic landmark Boston Society of Natural History building. Products in these gallery locations are presented in fully furnished rooms, emphasizing collections over individual pieces, and encourages a higher average order value as customers are inspired to purchase the collection to replicate the design aesthetic of the gallery. The mall-based locations are typically about 8,000 square feet, versus the design gallery prototype that is about 38,000 square feet. The larger design galleries produce two times the sales volume of legacy stores on lower occupancy and expense rates, resulting in two times to three times higher four-wall profit.

A cornerstone to RH’s design gallery strategy is creating an unmatched personalized hospitality experience. These are inspiring spaces with garden courtyards, rooftop parks, restaurants, wine vaults, and barista bars. As a result, RH galleries create spaces that feel more like destination excursions than retail stores, which helps to further drive incremental sales of home furnishings. RH believes there’s the potential for 60 to 70 of these design galleries in North America, versus 24 today, servicing every major market in North America,4 translating to projected revenue of $5 to $6 billion.5

The company is beginning to offer professionally designed and completely furnished homes and condominiums under the brand RH Residences. If successful, it would represent RH’s first step beyond the home furnishings market and into the $1.7 trillion6 North America housing market.

Catalysts for Additional Success

Membership Model

Introduced in 2016, the RH Members Program has yielded attractive results. It consists of approximately 415,000 members and drove approximately 95% of sales within the core RH business in 2019.7 For an annual fee of $100, the Program provides its members with a 25% discount on full priced items across all RH brands, an additional 20% on all sale items, and early access to clearance events.8 Additionally, RH Members receive complimentary service from RH’s in-house interior design team.

The introduction of the membership model has also provided additional benefits to the company beyond building a consistent customer base. When the Membership Program was introduced, the company eliminated seasonal promotions, which has helped RH to eliminate the cost of hiring seasonal and promotional employees, as well as reducing the number of canceled orders and returns. The result has been a reduction in the volatility of the company’s sales over the course of the year, as opposed to the peaks and valleys in sales because of a promotional calendar.

Luxury In-home Delivery

To build on its superior customer experience, the company offers complimentary in-home delivery in many of its U.S. markets.9 By using its own delivery team, as well as a dedicated interior design focused “furniture ambassador,” RH can enhance customer satisfaction by reducing damage associated with furnishing delivery and significantly reduce its return rates.

Global Expansion Plans

On top of the opportunity to more than double sales in North America, the company is poised to begin opening galleries internationally, and we believe RH has the potential to become a $25 billion global brand, versus $2.8 billion in annual sales today. The company plans to open RH England in the spring of 2022, followed by RH Paris in the fall. The company has also signed leases for galleries in London, Munich and Dusseldorf, and is close to finalizing deals for galleries in Brussels and Madrid.

Our Independent Research and Key Insights

High Quality Business

- RH’s luxury brand and growing reputation gives the company pricing power and allows the company to earn stronger margins and economic returns that other home furnishings companies.

Large Growth Opportunity

- Over the next 10 years we expect greater than 10% compound annual growth in revenue and mid-teens or better earnings per share (EPS) growth.

- The company believes the North American market continues to present compelling opportunities for an additional 40-55 design galleries in addition to its existing 24 design galleries.

- CEO Gary Friedman has announced his plan to expand into the European market as early as 2022 and believes that it represents the gateway to becoming a $20 billion global luxury brand.10

- Should RH Residences prove successful, the company’s ability to capture even a 1% share of the global housing market would represent a $70-$100 billion opportunity.

Excellent Management

- CEO Gary Friedman is a visionary leader and skilled capital allocator. Over the last 20 years, he has transformed RH from a nearly bankrupt purveyor of home accessories into arguably the leading luxury home brand in the world.

- Gary has about 30% ownership of RH and is relentlessly focused on return on invested capital and capital allocation. The company has a proven reputation for delivering value to its shareholders. Total share repurchases made between 2017 and 2019 represent a total of 60% of RH shares outstanding at the end of 2016.11

Discount Valuation

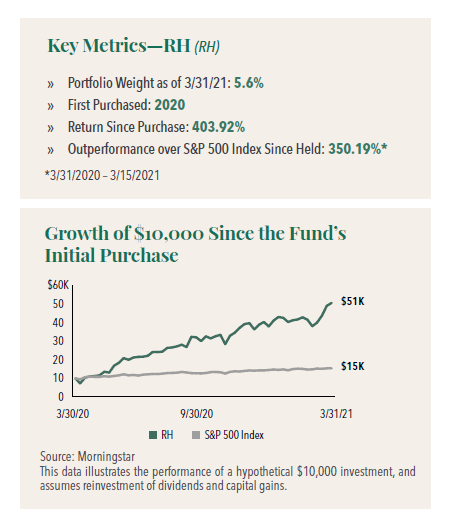

- We had been considering adding RH to the portfolio for some time and were able to take advantage of the market volatility in early 2020 by purchasing the stock at a 60% discount from its then-recent high.

- Shares trade at about 23 times our estimate of next 12 months’ EPS, a significant discount to luxury brand peers.

Summary

Overall, we think RH is a well-run, high-quality business with a large growth opportunity. Due to its revenue and earnings growth potential, we see the company as a “compounder” that should be an excellent long-term holding within the portfolio.

- In this article:

- Domestic Equity

- Focus Fund

1. RH Annual Report 2019

2. Ibid

3. RH Shareholder Letter 2020

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.