"Focused" Research Approach as the Economy Recovers

The Portfolio Managers discuss how certain holdings benefit in today’s strong housing and used and new car market, merger and acquisition activity, a new holding, and the Fund’s potential earnings growth.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

How has the strong housing market affected portfolio holdings NVR and American Woodmark?

Over the past 60 years, the U.S. has produced about 1.5 million new homes on average each year. However, in the aftermath of the great financial crisis (GFC), in 2010 the level fell to just 500,000 homes. It has since slowly recovered, adding about 75,000 per year to bring us to a level of 1.3 million homes in 2020. A surge in demand from the COVID-19 pandemic pushed housing starts to over 1.6 million in June 2021. Yet since the U.S. has so underproduced homes since the GFC, it remains millions of units short of need, and we expect housing starts to continue rising to find a longer-term equilibrium.

As a new home builder, NVR has been a direct beneficiary of this increased unit demand, and increased pricing has further benefitted its bottom line. Its current backlog in dollar value is 35% higher than in 2020, which should result in higher revenue as this buildup is delivered. This has helped NVR increase its operating margins from 12% in 2020 to 17% as of the second quarter of 2021. We predict 2022 earnings per share will roughly double from 2018 levels, with further growth remaining ahead. With this positive outlook, the stock remains attractively valued at just 13x our estimate of 2022 earnings.

American Woodmark manufactures kitchen and bath cabinets and has also benefited from the strong demand for new homes as well as remodeling projects. In the second quarter, revenue increased 18%, and we expect a mid-to-high teens rate of growth to persist for at least the next several quarters. Yet a steep rise in the price of lumber and particleboard, higher transportation costs, and a labor shortage, have squeezed the company’s operating margins. As long-time investors of American Woodmark, we have seen the company remain resilient through many inflationary periods. It has a long history of being able to restore margins by passing along higher costs through higher prices. As price increases catch up to cost increases, we expect margins to return to historical levels, driving record profitability. Despite this, the stock is trading at just 9x our 2022 earnings estimate, which appears suppressed due to today’s inflationary environment.

Supply shortages have caused prices to rise for used cars. What is your near-term outlook for portfolio holdings CarMax and O’Reilly?

As the U.S. recovers from the pandemic, there is a juxtaposition of supply chain disruption and an increased demand for both new and used vehicles. With new vehicle production suppressed primarily due to a shortage of semiconductors, demand for used cars has resulted in an unprecedented nearly 50% increase in like-for-like vehicle price year-over-year.

CarMax Inc. is in a good demand environment for used vehicles provided they can be procured. Fortunately, CarMax can access vehicles through their wholesale and trade-in channels which has adequate inventory to meet the growing demand.

We believe CarMax will continue to benefit with strong sales growth in 2021 and 2022. We project that same store sales will increase about 10% over remainder of this year, with good results in 2022. Its omni-channel and online vehicles sales capabilities have advanced over the past few quarters and should continue to improve for the foreseeable future, positioning the company for sustained market share gains. Currently CarMax trades at a reasonable valuation of about 17x our estimate of 2022 earnings.

With new cars harder to find and escalating used car prices, consumers are increasingly investing in the repair of their existing vehicles, which benefits auto parts retailer O’Reilly Automotive, Inc. In this post pandemic environment, many consumers have more time, more money, and are more willing and able to repair their vehicles. In addition, with people feeling more comfortable traveling, vehicle miles traveled have rebounded to only be down about 5% relative to the same time in 2019. In the second quarter, O’Reilly reported a 10% increase in same store sales on top of a 16% increase in 2020. We think O’Reailly has been successful gaining market share through this period because it has been able to maintain parts availability in a challenged supply environment. Historically, the company had reported same store sales increases in the 4% to 5% range. The company is trading at 20x estimated 2022 earnings per share for a business that we believe could compound earnings at a mid-teens rate for years to come.

What merger and acquisition (M&A) activity occurred in the portfolio over the quarter?

There were two significant M&A events that occurred during the quarter: 1) the termination of the Aon (a portfolio holding) and Willis Towers Watson merger, and 2) the acquisition of Marlin Business Services by a private equity firm.

When the Aon/Willis Towers Watson merger was announced approximately 18 months ago, we were proponents of the transaction. Aon has a long history of acquiring businesses and extracting value through reducing costs and enhancing services. Yet, with the concessions needed to satisfy the Department of Justice antitrust review, those anticipated synergies diminished and the transaction became less appealing. Following the termination for the transaction, and with positive quarterly results, Aon’s stock price has increased nicely as its path forward has become more clear. We continue to hold Aon and are excited about its opportunity to continue to compound earnings at a low-to-mid teens rate.

Marlin Business Services Corp. received an all-cash takeover offer from a private equity firm in April 2021. Marlin is a commercial equipment financing and leasing services company that the Fund has held for 10 years as a “special situation” purchase (one that did not meet all of our investment criteria but had a compelling risk-return profile). On the announcement, the stock increased about 70%. In 2020, the stock had traded at about 0.3x book value and now trades at a premium due to the takeout announcement. We anticipate the deal should close by the end of 2021.

Were there any new companies added to the Fund?

During the quarter we added a new 1% position in AST SpaceMobile, which is another “special situation” investment. We have held American Tower, a leading cell phone tower owner-operator, for more than two decades, and the Fund’s investment in AST is an outgrowth of our industry knowledge and ongoing research related to American Tower.

Today’s mobile wireless networks, built primarily on a backbone of cell towers, only cover about 30% of earth’s land area. Geographic coverage is sufficient in cities, but coverage becomes less reliable outside those areas. As a result, nearly all 5 billion global mobile wireless subscribers experience coverage gaps some of the time, and more than 1 billion potential subscribers have no mobile wireless coverage at all.

AST’s vision is to be able to provide mobile broadband wireless coverage via satellite to anywhere on earth, with customers using existing handheld mobile phones. This hardware compatibility would be a key breakthrough, allowing satellite-delivered mobile wireless service to expand beyond niche applications to broad consumer use. AST plans to accomplish this using proprietary software, a network of wireless carrier partners sharing their spectrum, and a constellation of 168 satellites placed in low earth orbit over the next several years.

There are numerous technical, regulatory, and business hurdles, but the company has already made substantial progress. AST is attempting to solve a huge, global need. If AST can deliver this technology, with modest assumptions, the company could be worth 15x or 30x more in five- or ten-years’ time. But space is hard, and the risks are real. If AST cannot deliver, the equity will likely be worthless. We recognize the potential for loss, and have sized our investment accordingly. But our long-industry history and network of contacts have helped us form a view that this is an investment worth making.

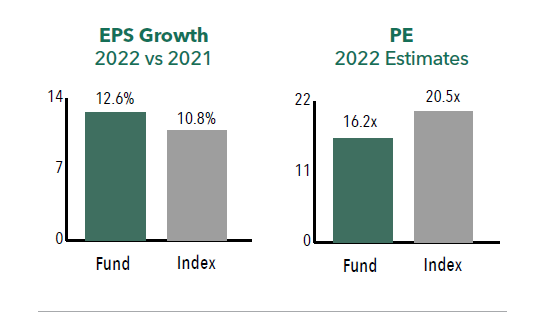

Would you please discuss the earnings growth rate and price-to-earnings ratio for the Fund versus the Russell 3000 Index?

We expect the Fund to see an earnings growth rate of 12.6% in 2022 over 2021, while the Russell 3000® Index’s earnings growth over the same period is anticipated to be 10.8%. In terms of price-to-earnings, the Fund looks attractively priced. As of June 30, 2021, the Fund traded at 16.2x our 2022 estimates, while the Russell 3000® traded at 20.5x 2022 estimates.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.