Portfolio Exposure to Tariff Impacts

In this letter we share some thoughts from the Portfolio Managers at Broad Run Investment Management, LLC, the Fund’s sub-advisor.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

April 2025

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end, and standardized performance can be obtained by viewing the fact sheet or by clicking here. Neither forward earnings nor earnings growth is a measure of a fund’s future performance.

The first quarter ushered in the second Trump administration, along with an unprecedented pace of policy changes. Most relevant to our portfolio, and the broader market, has been very aggressive posturing on international trade, punctuated by an April 2 announcement of steep and broad-based import tariffs. These trade developments have had a negative impact on the U.S. stock and bond markets, and eroded business and consumer confidence. The Hennessy Focus Fund (HFCIX) was down 4.47% for the quarter ended March 31, 2025, compared to the Russell MidCap Growth Index down 7.12% and the Russell 3000 Index down 4.72% for the same period.

While the U.S. has a large trade deficit, and faces some unfair trade practices, it also has a strong and growing economy, and benefits enormously from the dollar serving as the world’s reserve currency. Some adjustments to global trade are needed, but a wholesale reboot—as the Trump administration is proposing—seems unnecessarily risky.

As the administration embarks on high stakes trade negotiations there are a wide range of possible outcomes. In the short term, we expect some economic slowing in the U.S., and perhaps even recession. In the short-to-intermediate term, we think the most likely outcome is modest concessions from many countries without wholesale change to the world order. Trump is bombastic, but typically pragmatic, unlikely to drive the economy over a cliff in a game of tariff chicken. But miscalculations are possible, and there is potential for economic or geopolitical tensions to trigger a crisis that is difficult to contain.

Our Philosophy

As long-term, business-focused investors, we accept that macroeconomic surprises are inevitable. We cannot know what twists and turns await, so we prepare in advance by trying to own well-run, durable business that can adapt to almost any circumstance. Indeed, we have observed that the best management teams have an ability to turn adversity into opportunity, ending up in a better place than they might otherwise have been.

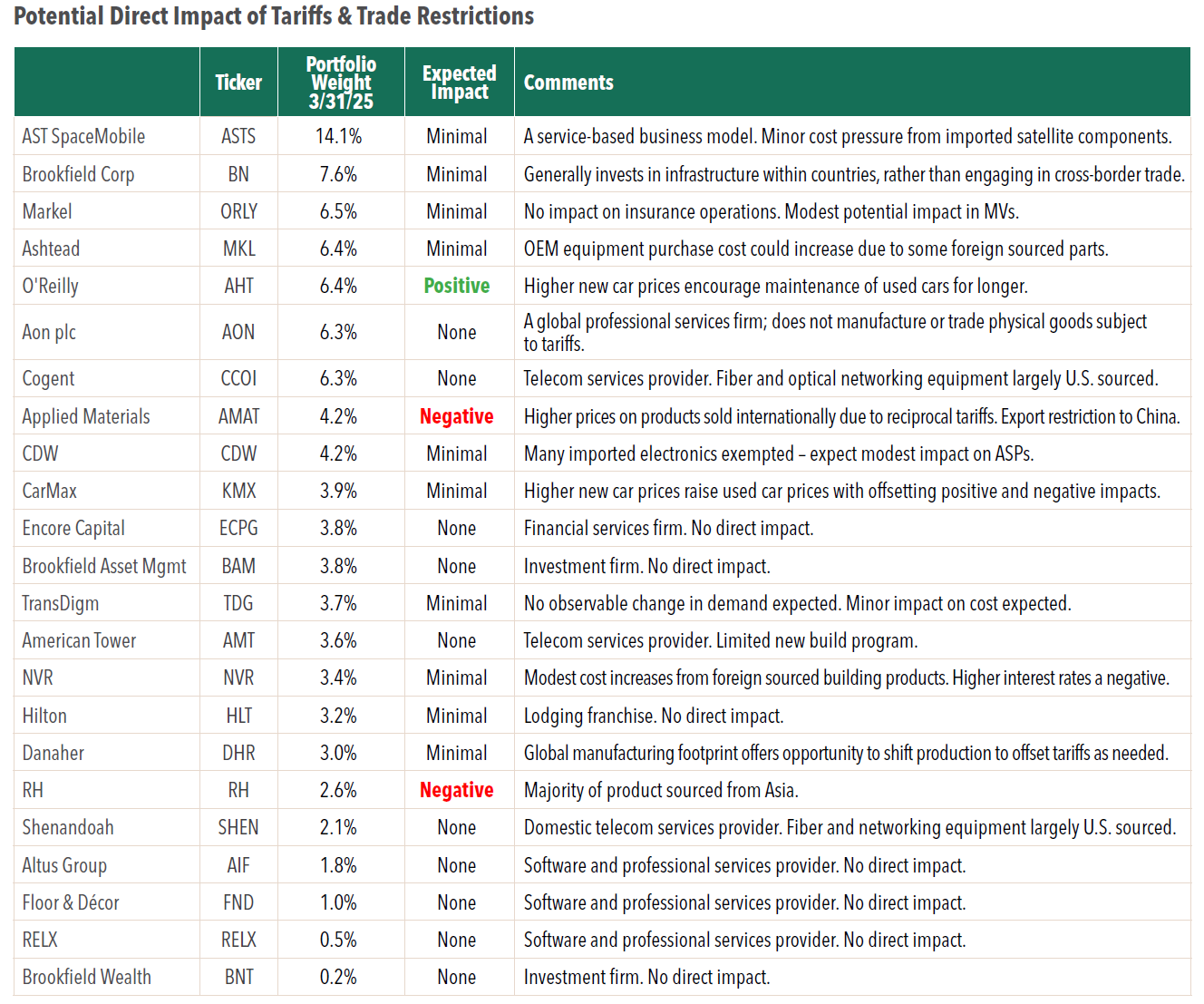

When macroeconomic surprises—such as these trade disputes—do arise, we think through how they might impact each of our businesses, and we adjust our forecasts accordingly. Fortunately, as summarized in the table below, we believe that our businesses are relatively well insulated. Of course, if the tariffs and restrictions trigger a general recession, there will be broader impact on our portfolio.

Portfolio Exposure

The following summarizes our thoughts on the direct impact of tariffs and trade restrictions on our individual holdings. Most of our businesses are domestically focused, or service oriented, and so are at minimal risk. Of course, there are second and third order effects beyond the direct impact (e.g. international travel to the U.S. is reportedly down, potentially impacting Hilton’s lodging revenue), but in this letter we simply want to give you a directional sense of our portfolio exposure.

As shown in the previous table, we expect two businesses to have a negative impact to this trade dispute:

• Applied Materials – The direct tariff impact on Applied Materials is likely modest, but the company also faces headwinds from new export restrictions to China, and some potential demand destruction due to higher prices on end market goods. The company is expected to face a $400 million revenue headwind this year due to export restrictions (1.4% of consensus revenue estimates), with about half the impact on its AGS services business and half on equipment sales.

Current estimates forecast about a 5% tariff driven price increase for electronics hardware (mobile phones, PC, servers, etc.). While this seems manageable to us, if these higher prices impact end market demand, we would see reduced demand for semiconductors, and corresponding reduced demand for Applied Material’s equipment that helps make semiconductors.

Despite these challenges, AMAT’s management expects revenue and profit growth in fiscal 2025. This growth will be fueled by its strong position in leading-edge logic, progress in high-performance DRAM, and its leading role in advanced packaging solutions that are critical for energy-efficient AI.

• RH – RH employs an import-based sourcing model, so tariffs present a notable risk. In fiscal 2024, 72%of its dollar volume of purchases originated from Asia, with Vietnam accounting for 35%, China 23%, and Indonesia and India combining for 14%. These figures reflect a significant mix shift away from China over the last several years. We expect this shift to continue given the latest trade developments.

While initial “reciprocal tariff” rates were shocking (46% on Vietnam!), they have since been stepped back via a 90-day pause and reversion to a universal 10% rate (excluding China). Trade negotiations with Vietnam and India seem to be progressing well. Our expectation is that the ultimate tariff rate for U.S.-friendly Asian countries will be at or below the current 10%.

Based upon RH’s cost structure, we estimate a 3.3% product price increase would be needed to offset this 10% tariff and hold profits flat. A 3.3% price increase seems manageable, and we expect further sourcing changes, manufacturer renegotiations, and supply chain initiatives will reduce the ultimate price increase needed to preserve profits.

Looking ahead, despite these challenges, we expect RH to achieve revenue growth and market share gains in fiscal 2025, fueled by its product transformation initiatives, platform expansion, and global market penetration. As of its last update on April 4, RH reported orders were up 17% year-to-date.

Portfolio Changes

During the first quarter we exited Warner Music Group and used those proceeds to purchase a new position in RELX Group plc. While this was only a small change—about 0.5% of assets—it reflects our waning conviction in our Warner thesis, and new appreciation for the RELX investment case (discussed in our recent Manager Q&A).

We also used mutual fund flows during the period to rebalance existing holdings, reducing our weighting in CarMax, American Tower, Markel, Aon, O’Reilly and Encore Capital Group, while increasing our weight in AST SpaceMobile, Cogent, Ashtead Group, Brookfield Corporation, NVR, Shentel, Applied Materials, and TransDigm. There is no significant change in our thinking about these holdings, this was simply a rebalancing at the margin to reflect our current best judgment.

We continue to research new businesses and to monitor those on our watch list. With the market selloff, we have focused our efforts looking in sectors most impacted by this volatility, including apparel and footwear, home electronics, and alternative asset managers, among others.

Click here for a full listing of Holdings.

Click here for full, standardized Fund performance.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.