Results Recap and Investment Outlook

In this letter, the Focus Fund Portfolio Managers review how their businesses performed in 2021, share their thoughts on inflation and discuss their investment outlook.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

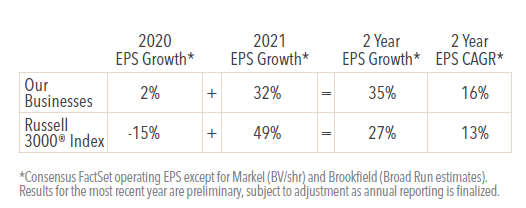

Fundamental Business Performance

Our businesses performed very well in 2021 after a COVID challenged 2020. Taking a two-year view to encompass both the pandemic-driven economic downturn, and subsequent rebound, we are quite pleased with the results. In the table in the next column, we see that for the two-year period our businesses delivered 35% EPS growth (16% compounded) compared to 27% for the Russell 3000® Index (13% compounded). We note that these results were accomplished with significantly less earnings volatility than the broader market which we think speaks to the quality and resiliency of the businesses we own.

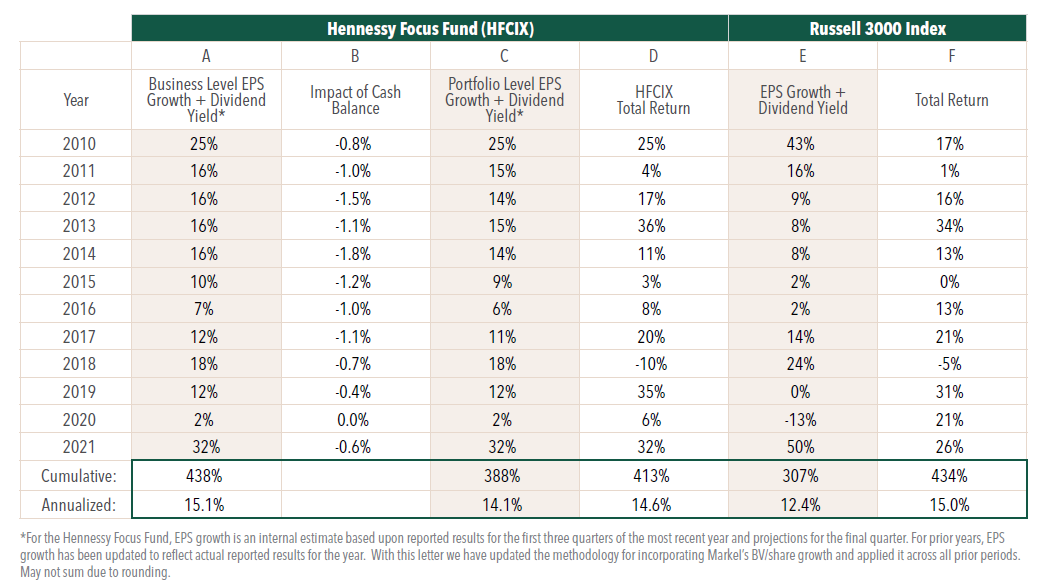

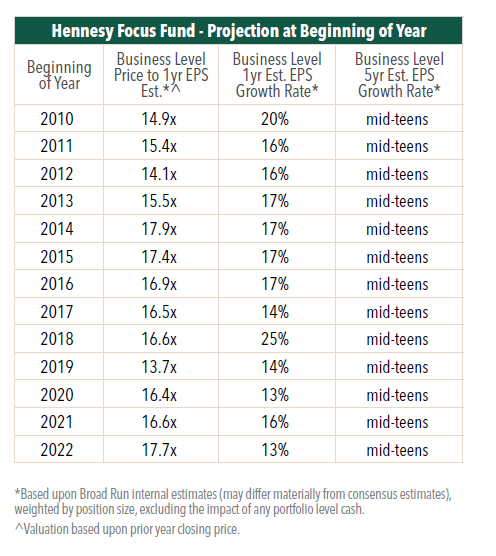

As a reminder, we underwrite our investments to target a mid-teens rate of return. We seek this return via the compounding of earnings per share over time rather than a change in valuation or clever trading in or out of a stock. As a result, our long-term portfolio performance is primarily driven by the earnings per share growth of the underlying businesses that we own.1

You can see this relationship in the table below. Over the last twelve years, our portfolio level earnings per share CAGR is 14.1%, inclusive of dividends and cash drag [column C], compared to a total return of 14.6% [column D]. Please note that there is a loose relationship between earnings per share growth and price performance in any given year, but that the relationship strengthens considerably over longer periods of time.

Inflation

Throughout 2021 we saw growing signs of inflation in the macroeconomic data, at our portfolio companies, and in our everyday lives. By December, reported inflation topped 7% for the first time in more than 40 years. Massive fiscal stimulus and a recovering economy created strong demand that collided with pandemic driven supply chain disruptions and labor shortages. Some of these pressures should abate as the pandemic recedes and supply chains catch up. But long dormant wage inflation has been awoken, and its retreat is hard to forecast. The consensus view is that inflation will return to low single-digit rates by year end, but consensus has been quite wrong about this topic so far.

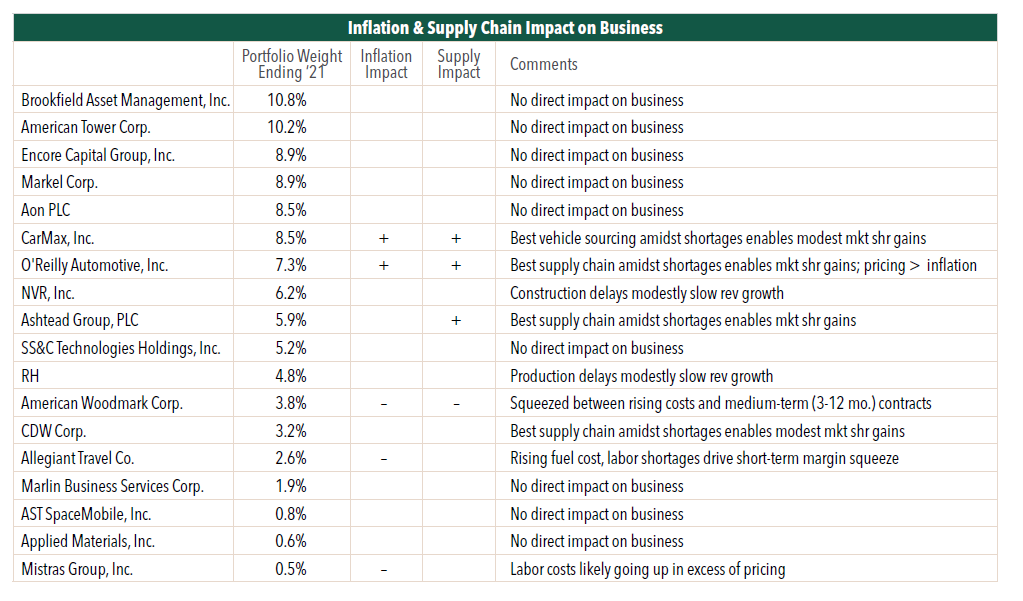

What does inflation mean for our portfolio? While we do not own energy and basic materials businesses that would be direct beneficiaries of inflation, we do seek to own businesses providing differentiated, hard to replicate products or services that are valued by their customers. As a result, these businesses tend to have pricing power allowing them to recoup cost increases, and sometimes even come out ahead.

In the table below, we provide a brief assessment of the impact of inflation and supply chain disruption on our businesses so far. We have had some pluses and minuses, but on the whole, we think the environment has probably been a modest net benefit for the nominal and real earnings power of the portfolio.

Below, we provide some more detail about three of our businesses most impacted by inflation and supply chain disruptions.

O’Reilly Automotive has significantly benefited from the current environment. First, the company is seeing auto parts cost inflation averaging 5.5%per unit. Its competitive position enables it to raise retail prices at a similar rate, and thereby achieve a 5.5% increase in gross profit on the same unit sale; a net benefit. And second, O’Reilly has the best supply chain in the industry. With industry-wide parts shortages, O’Reilly is better able to procure parts and fulfill customer orders driving customer and market share gains.

Historically, O’Reilly has been able to hold onto price increases, and new customers—once they experience the company’s superior service levels—tend to stick and become loyal repeat customers. We think that this time will be no different.

CarMax has benefited from the current environment. A shortage of semiconductor chips has reduced the production rate of new vehicles leaving used vehicles as the primary relief valve for demand. This has created a favorable environment for CarMax and other used dealers, providing tailwinds for both gross profit and financing income.

CarMax’s well-established practice of buying used vehicles from the general population has helped it maintain a solid inventory position during this time of scarcity, though a shortage of reconditioning mechanics has muted some of this benefit.

Further, in contrast to most used dealers, CarMax has not used this environment to harvest windfall profits by maximizing pricing and margins. Rather, they have adhered to an everyday-fair-pricing policy that is aligned with their brand and long-term thinking. So, profitability has benefited in this environment, but not so much so that we are concerned about a significant reset lower when new and used car supply gets back in balance.

American Woodmark has been significantly harmed by the current environment. American Woodmark has been squeezed between rapidly rising costs, and customer contracts with large home centers and home builders that have locked in pricing for between 3 and 12 months. As a result, the company is earning only about 50% of what we would ordinarily expect.

We are confident that the vast majority of American Woodmark’s normal profitability can be recouped. The company, and its industry, have a multi-decade history of being able to pass through cost increases to customers. Adding to our conviction is that the cabinet industry is currently facing capacity constraints with strong demand from both new home construction and remodeling activity; cabinet manufacturers should have market power amidst this healthy demand and tight supply.

The company has already implemented two large price increases in 2021 that were accepted by all important customers. These price increases were designed to recoup known cost increases at that point in time. So far, costs have continued to rise after new contracts were struck, leaving the company behind the curve.

American Woodmark is among the cheapest stocks that we own, trading at about 13x current earnings and about 7x normalized earnings, while continuing to grow revenue and earnings power at about 10% per annum.

Investment Outlook

The second order effects of inflation, most notably higher interest rates and a higher discount rate for risk assets, are more challenging to assess. The market appears to be struggling with this question now. As we write this letter in late January, the Federal Reserve has turned more hawkish, the equity markets have become volatile, and the major U.S. indices are down 5% to 12% year-to-date.

Our big picture view is that we are 13 years into a bull market and the risk pendulum has swung full range from fear to greed. For half a generation, risk seeking has been rewarded, and prudence penalized. While some of the air has recently come out of the hottest sectors, excesses still abound. By our math, many of the profitless growth companies, already down 25%, 50%, or more, would still require extraordinary rates of revenue and profit growth for the next decade to justify current valuations. In this environment, we think being mindful of downside risk is all the more important.

At the same time, the potential for sustained inflation poses a serious risk to purchasing power for assets held in cash and fixed income. With this backdrop we particularly like our portfolio of what we believe to be high quality, well run, growing businesses, owned at reasonable valuations based upon demonstrated earnings and cash flow.

At year end, our portfolio trades at 17.7x our 2022 earnings estimates. From this valuation level we expect portfolio returns will track the mid-teens rate of earnings growth we expect from our portfolio over the next five years, with the obvious caveat that a sustained rise in interest rates would present a headwind that could clip several points per annum off of our expected returns. We also observe that the Russell 3000 Index is trading at 21.6x 2022 earnings estimates, putting our portfolio at a larger than normal discount to the market and giving us a favorable view about relative performance over time.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.