High-Quality, Faster Growing Companies at an Attractive Price

In the following commentary, the Portfolio Managers of the Hennessy Focus Fund compare the portfolio’s earnings growth rates and valuations to its benchmark. They also provide insights into several holdings including O’Reilly Automotive, American Tower, Shenandoah Telecommunications, and AST SpaceMobile.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager

What are the earnings growth rates and valuations for the Fund compared to the Russell 3000® Index?

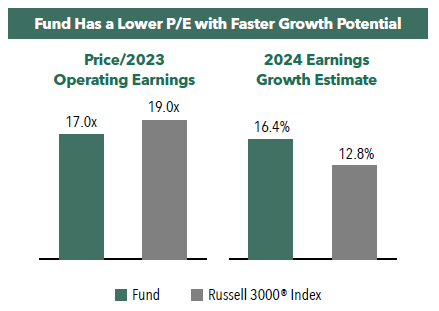

As of May 31, 2023, we believe the Fund is trading at 17.0x our estimate of 2023 operating earnings, which is a 10% discount to the Russell 3000® Index’s 19.0x estimate. With respect to 2024 estimated operating earnings, the Fund is trading at 14.9x compared to 16.8x for the Index—about 11% lower.

In terms of earnings growth, we believe the Fund will grow cash earnings by 16.4% from 2023 to 2024 whereas the Russell 3000 is estimated to grow its earnings at 12.8%.

With the Fund trading at about an 11% lower multiple than the Index and an earnings per share growth rate 28% faster than the Index, we believe the portfolio offers high-quality, faster growing companies at an attractive price.

Would you please discuss a holding best positioned for the current macroeconomic environment despite the headwinds of higher rates and heightened inflation?

O’Reilly Automotive, a retailer/distributor of aftermarket auto parts to do-it-yourselfers and repair shops, has benefited from heightened inflation and is well positioned for the current macroeconomic environment. High new and used car prices have compelled households to hold on to their existing vehicles for longer. Households have been willing to spend more on the repair of their existing vehicle as it allows them to defer the purchase of a high-priced new or used vehicle financed with a high interest rate loan. Importantly, O’Reilly’s same-store sales have also benefited from product cost inflation that it has been able to pass through to its customers because of non-discretionary demand and rational competition. Importantly, O’Reilly’s market share gains have accelerated over the last several years as it has been able to maintain superior parts availability in a challenged supply environment.

Going forward, we expect many of the environmental factors that have contributed to O’Reilly’s strong results to persist. We think used car prices will remain elevated for the next couple years as fewer new cars were produced during the pandemic (limiting supply) and those that were produced were less affordable models. Also, we believe that the ever-increasing safety and technology features on today’s new cars should keep new car prices high. We think consumers will remain reluctant to move from a car financed with a low interest rate loan to a car financed with a high-rate loan (further limiting supply).

How have American Woodmark, NVR, and RH addressed higher interest rates and the cooling housing market?

These businesses have seen, or are expecting to see, a sales slowdown of 10 to 15% as affordability challenges and reduced consumer confidence impact demand. In response, American Woodmark has focused on supply chain and manufacturing efficiencies. Combined with flow through of price increases from last year, the company is expecting to hold margins roughly flat and see only modest profit declines.

NVR, as a new home builder, is in a strong position due to the shortage of supply of existing homes for sale. NVR is holding asking prices flat but “buying down” mortgage rates making monthly payments more manageable for purchasers. While this incentive reduces margins, NVR is still very profitable relative to history and any earning declines look modest.

RH is reducing pricing on select product lines while entering new geographies and launching new products to drive consumer excitement. Operating margins are down by about half, but appear set for a significant rebound once product repositioning and launch costs are complete.

Notably, all three business are repurchasing significant amounts of their own shares.

With the U.S. cellular tower market predominantly controlled by American Tower, Crown Castle, and SBA Communications, what is American Tower’s growth plans?

First, let us not forget about potential growth from the U.S. market. At year-end 2022, there were approximately 142,000 co-locatable macro towers in the U.S. and yes, the big three tower companies owned about 71% or 100,000 of these. The preponderance of the rest is owned by smaller, private equity backed entities that will likely be sellers over time. So, we would expect American Tower to continue to evaluate every sizable tower portfolio in the U.S. that comes to market. The company has the lowest cost of capital in the industry, the best ratings, lowest leverage, and a domestic platform that allows for easy integration and cost synergies. Corralling one-third of the private towers over ten years would add about 2.5% to annual unit growth as well as several points of revenue growth. Additionally, the company purchased CoreSite Realty in 2021 to bolster its Data Center business with an eye towards developing Edge data centers at the tower site to deliver faster data speeds with lower latency to enhance developing technologies.

Outside the U.S., American Tower has completed several large platform acquisitions over the last five years: these include Telxius with concentrated tower holdings in Spain and Germany and Eaton Towers in Africa. Additional smaller acqusitions were made in India, Philippines, Canada, Chile, and Peru. Many of these locations are 3-7 years behind the U.S. in rolling out more modern, faster, and denser wireless networks and portend more than a decade of promising growth ahead.

Additionally, American Tower continues to prioritize new tower construction outside the U.S., building 4,000-5,000 towers per year with double digit to mid-teens day one cash on cash returns. These newly built towers should continue to produce growing returns as tenants co-locate over time.

How much opportunity is there for further expansion of Shenandoah Telecommunications’ (Shentel) residential fiber product Glo Fiber?

When Shentel initially set out to begin its Glo Fiber builds in 2021 the company was aiming to pass 300k homes with fiber by 2026. Fast forward to the first quarter of 2023 and the company’s goal is now to pass 480k homes with fiber by 2027. Further, Shentel has been active in applying to build fiber in regions where the government will subsidize the build cost (without government subsidies these areas would never get fiber due to the lack of density). To date, Shentel has won the right to build fiber past 30k of these rural passings for which the government will offset part of the build costs. Altogether, over the last two years Shentel has increased its targeted fiber passings from 300k to 480k. We think the company will continue to identify incremental opportunities over time and that they will come from three areas:

1. Communities adjacent to Shentel’s existing network that do not have a fiber option.

2. Distressed fiber overbuilders who were overleveraged and have become distressed.

3. The company has been on the lookout for another region in the U.S. where it could plant its flag which has similar attributes to its core markets today: tertiary markets where the incumbent cable company has a monopoly and poor service.

The combination of the above three areas should provide Shentel with plenty of opportunities to continue extending the growth runway for Glo Fiber.

The Fund’s position in AST SpaceMobile (ASTS) has grown to 1.5%. At what point would you anticipate the stock becoming a larger part of the portfolio?

Today ASTS is sized as a small (starter) position in the Fund. Normally a company like ASTS would still be private, backed by venture capital and private equity investors intent on nurturing it to profitability over many years. But the special purpose acquisition company (SPAC) mania over the last few years allowed the founder to take the firm public much earlier than normal. Today at 1.5% of Fund assets, we believe it is appropriately sized given its novel and unscaled technology and nascent business model. That said, the company has recently announced an important milestone in U.S. communications. After successfully launching, unfurling, and powering up its Blue Walker 3 test satellite, the company was able to complete the first-ever space-based voice call using everyday unmodified smartphones.

In the U.S. AST is moving forward with AT&T, an important investor in the company and its core wireless partner domestically. Their spectrum sharing lease agreement is preliminary and must be approved by the FCC through a waiver process. It is complicated. The terms of its commercial agreement with AT&T are not public and dependent on spectrum leasing approval by the FCC. So, there is still much to get done (legally, technologically, financially, and regulatorily) before their five Block 1 Blue Bird satellites launch in 1Q24. But this launch would allow them to begin limited commercial service and the process of de-risking the endeavor. As we learn more over the next year our appetite could grow. Stay tuned.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight the recent change in market cap range of potential investments.