Growth Prospects for Midstream Energy Companies

Portfolio Managers Toby Loftin and Ben Cook discuss growth prospects and the outlook for distribution and dividend growth for midstream companies. They also outline how the Fund’s holdings are poised to benefit from rising global energy demand.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager

Could you explain the drivers behind midstream companies’ recent optimism?

Midstream companies are benefiting from the rapid growth in production of crude oil, natural gas, and natural gas liquids in the U.S. Over the first eleven months of 2018, production of crude oil and natural gas rose 17% and 11%, respectively. This production growth is leading to higher volume handled in gathering and processing facilities, pipelines, and storage assets. Volume growth generally provides midstream companies with the opportunity to generate more revenue and profits, and we believe it is the most important reason midstream company management teams have been sounding more positive about growth prospects over the last few quarters.

How are the Fund’s holdings poised to benefit from rising energy demand outside of the U.S.?

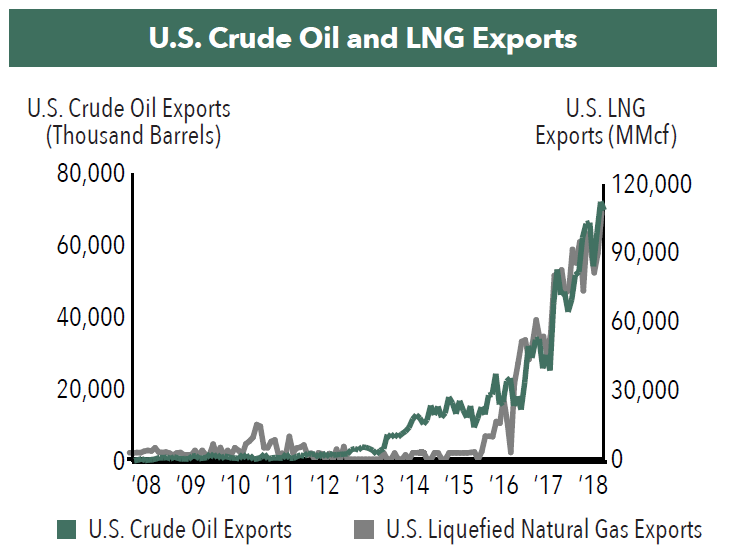

Midstream companies in the Fund whose operations are directly linked to exports of crude oil and natural gas include Enterprise Products Partners, LP a significant exporter of crude oil, Cheniere Energy Partners, LP, a current exporter of liquefied natural gas (LNG), and Tellurian, Inc., an LNG project developer. We believe each of these companies has excellent growth prospects. Exports of crude oil, have been rising, and were up over 70% in the first eleven months of 2018, benefiting companies such as Enterprise Products Partners. LNG exports have risen over five-fold since 2016 and we believe that LNG exports could rise by almost 80% next year as a result of new capacity coming on stream from Cheniere, among others. Meanwhile, global demand for LNG, especially from Europe and China, is expanding rapidly. Strong global demand is also leading to higher U.S. exports of refined petroleum products, benefiting the companies in the Fund that possess refining & logistics assets, including MPLX, LP and Shell Midstream Partners, LP.

What is your outlook for distribution and dividend growth for midstream companies?

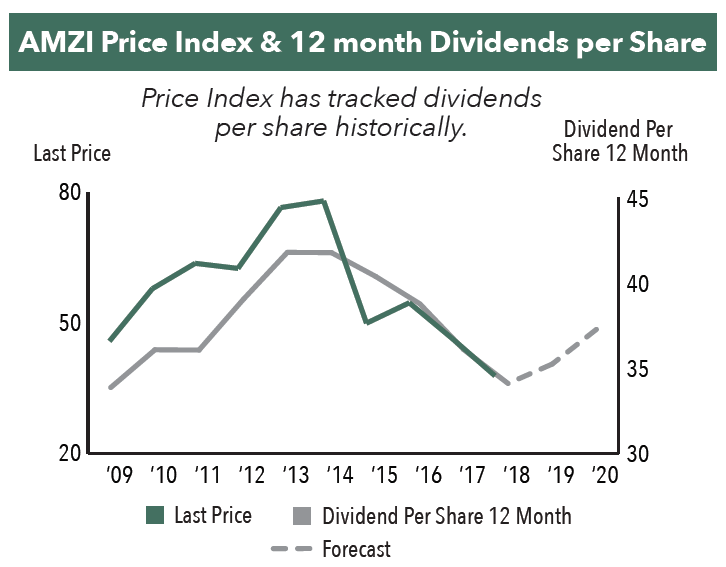

We are optimistic that distributions and dividends growth will be positive for midstream companies over the next few years, following our forecast of growth in revenues and earnings. For the companies in the Alerian MLP Infrastructure Index (AMZI), which includes midstream Master Limited Partnership (MLP) companies, average distributions are forecast to rise by 4.5% annually over the next two years.

- In this article:

- Energy

- Midstream Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.