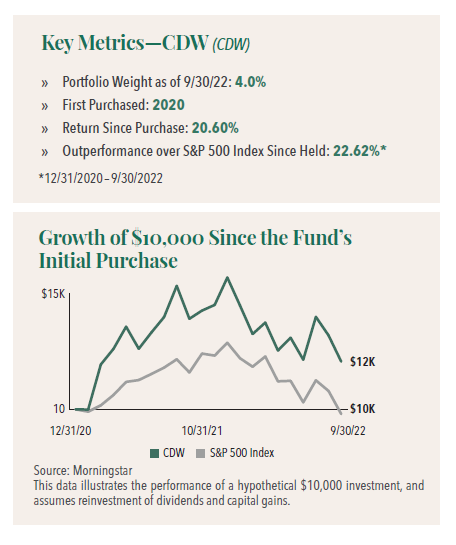

Focus Fund Company Spotlight: CDW

CDW Corporation, a Fortune 500 company, is a value-added reseller (VAR) of information technology hardware, software, and services. We believe its scale advantages, breadth of offerings and consultative sales culture combined with a growing market and market share gains should propel attractive growth for many years to come.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

A Market-Leading Provider of Integrated Technology Solutions

CDW is a value-added reseller (VAR) offering over 100,000 integrated information technology (IT) products and services from more than 1,000 brands.

As a provider of integrated technology solutions, CDW’s products and software cover the entire IT lifecycle including desktop computers, networking equipment, peripherals, and cloud-based software to help navigate an increasingly complex IT market and maximize the return on their customers’ technology investments.

The company is customer-centric, working with over 250,000 business, government, education and healthcare customers in the U.S., U.K. and Canada.1 It has a diverse customer base and many of its clients have less than 5,000 employees so they can really benefit from CDW’s specialized expertise. The composition of CDW’s 2021 net sales of over $20 billion includes $8.2 billion from corporate customers (large/medium), $4.1 billion from education customers, $2.2 billion from government customers, $1.9 billion from small businesses and $2.5 billion from the U.K./Canada. CDW believes this diverse group of customers with their divergent needs, technology paths, and timing will create multiple drivers of growth over the next few years and allow the company to consistently grow faster than the US IT market.

CDW has approximately 12,000 employees in the U.S. and 2,600 international employees.1 In contrast to competitors, the company has a strong technical organization with over 5,400 technical workers that include pre-sales specialists and advanced services delivery engineers, allowing CDW to deliver complex solutions to its customers.

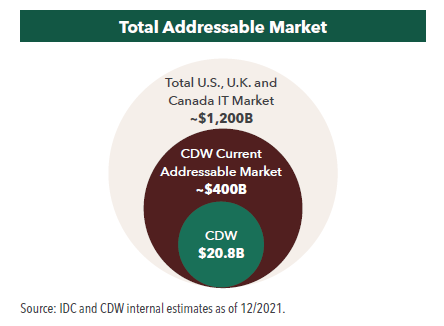

There are thousands of VARs that provide IT solutions, making for a fragmented market. As a result, CDW has just 5% share of an approximately $400 billion addressable market, providing a long runway for continued growth.

Advantages as an IT Provider

We believe CDW has multiple sustainable competitive advantages:

1. Scale. With a market capitalization of $23 billion, CDW is more 7x as valuable as its nearest public competitor and has twice the sales in an industry where scale matters. Its large size affords CDWgreater volume discounts and increased vendor support, as well as better product breadth, availability, and delivery speeds for customers.

2. Strong Customer Relationships. CDW enjoys consultative relationships with much of its customer base. These customers, who are typically generalist IT professionals within an organization, look to CDW for trusted advice selecting the best IT products and system configurations. As a result, CDW fosters strong customer relationships and referrals, and typically wins new business with high-quality service, rather than price, enabling industry leading margins.

3. Sales Culture. Central to CDW’s success is perpetuating its consultative sales culture that it purposefully manages though hiring, training, and commission-based compensation programs. The consultative sales culture is embedded in the firm as over two-thirds of its employees are customer-facing and provide highly complex and interconnected customer experiences. These CDW employees are able to act as trusted advisors to their customers and are able to provide IT solutions across the entire technology stack and lifecycle.

Personal Computer Business Remains an Important Revenue Source

Comprising just 35% of the company’s revenue base today, personal computers (PCs) have been and should continue to be an important part of CDW’s business mix. CDW has historically grown its PC business in excess of the market regardless of the product cycle. For example, despite sharp double-digit declines for the PC market in 2015, CDW still grew revenue mid-single digits on a consolidated basis and high-single digits within laptop computers. However, PC margins have been trending down over the last decade and now have lower margins than many other products and account for less than 20% of gross profits. But the growth in hybrid and work-at-home routines have the potential to drive stronger PC demand into the future as many employees will now need two PCs.

Future Growth: Off-Premises Cloud-Delivered Software

One mega-trend affecting nearly the entire technology space is the transition from on-premises software and servers to off-premises cloud-delivered software and infrastructure-as-a-service, by such heavyweights as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

This transition could have a meaningful, net positive development for CDW. While revenue from some hardware categories will face headwinds, these are more than offset by the company’s increased opportunity in cloud solutions. For a value-added reseller, hardware is a one-time sale with generally a low gross margin.

Cloud solutions, on the other hand, typically feature recurring revenue with very high gross margins (nearly 100% in some cases). While this mix shift to the cloud could present an optical headwind to reported revenue dollar growth, it should provide a favorable tailwind to reported gross profit dollar growth. As CDW gradually transitions to more recurring revenue with higher margins, we believe it becomes a more attractive business than it already is, with the corresponding potential for a rerating of its PE multiple by the market.

Strategic Acquisitions

CDW has been expanding its services and solutions capabilities to further enhance its ability to solve customers’ increasingly interconnected and complex technology challenges through strategic acquisitions. Two 2021 acquisitions include the following:

• Sirius Computer Solutions, a leading provider of IT services, consulting and secure technology-based solutions, was acquired in December 2021. With a strong cultural fit, Sirius accelerated CDW’s capabilities in key areas including hybrid cloud infrastructure, security, and digital and data innovation across an employee base of 2,600+ coworkers.

• Focal Point Data Risk, a leading provider of cybersecurity services, expands CDW’s ability to support the full technology lifecycle through enhanced cybersecurity services.

Our Independent Research and Key Insights

CDW continues to meet our key investment criteria:

Large Growth Opportunity

The cloud represents a substantial business opportunity for CDW. The company has made significant cloud-based investments and acquisitions in the cloud, and has been growing its cloud business at a 15-20% annual rate.

Excellent Management

• Management is highly focused on organic growth and profitability.

• Performance-based incentives align company interests with shareholder interests.

• CDW’s management team and culture appear to be highly regarded throughout the industry.

Discount Valuation

• As of September 2022, CDW traded at 13x our next 12 months adjusted EBITDA estimate and 17x our next 12 months adjusted earnings estimate.

• Its valuation today represents a 8-10% discount to the S&P 500 Index, and an even larger discount to most other high quality growth oriented businesses we study.

Summary

CDW is a well-run, high-quality business with a large growth opportunity. With a growing IT market, scale advantages, and a successful sales culture, we believe CDW can grow its gross profit dollars at a high single digit rate, and grow earnings per share at a mid-teens rate or higher for at least the next five years.

As of September 2022, the stock traded at about 17x forward twelve months adjusted earnings, a discount to the S&P 500. Given its better-than-average market growth, strong returns on invested capital and below-average market valuation, we believe CDW can be a long-term compounder for investors.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.