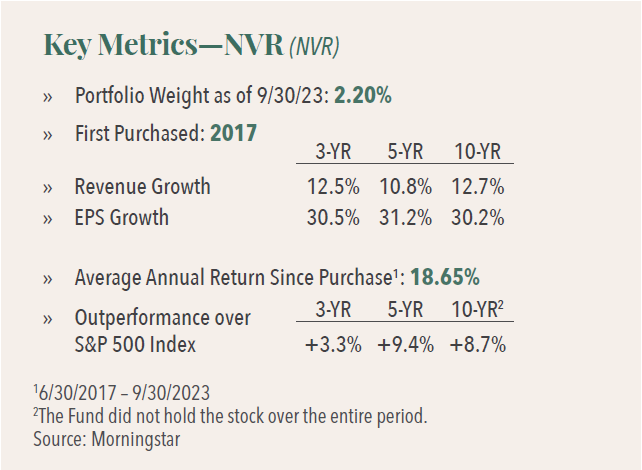

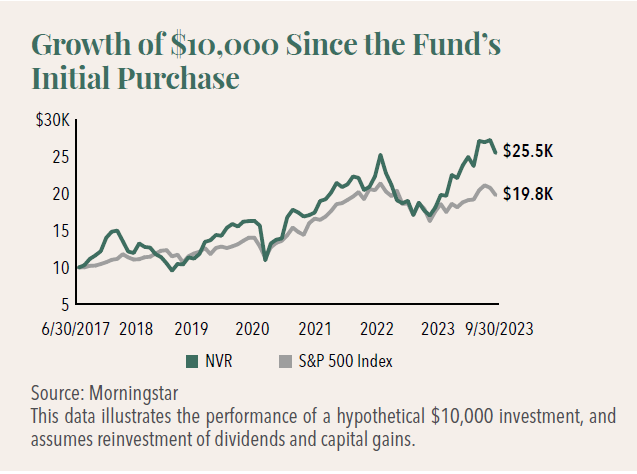

Focus Fund Company Spotlight: NVR - Building A Better Home Construction Business

NVR is one of America’s leading home builders. With its uniquely “asset-light” balance sheet and focus on operational efficiency, the company has created a hard-to-replicate business model.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

Preeminent Home Builder

Founded in 1980, NVR has grown to become a top-10 home builder in the U.S. The company specializes in the construction and sale of single-family detached homes, with a footprint in 35 metropolitan areas and 15 states, primarily along the East Coast.

The company has grown from its core Washington D.C. market, where it has an estimated 20% market share, into the adjacent markets of Baltimore and Richmond, where it now commands a similar or even higher market share. In newer locations, such as Pittsburgh and Charlotte, NVR has an estimated 5-10% market share, but they are steadily gaining as the company leverages its existing infrastructure and industry relationships.

NVR’s strategy of establishing itself as the dominant builder in each geography allows the company to leverage its regional production facilities, leverage local management, foster strong relationships with subcontractors, and obtain access to quality land deals.

Strengths of NVR’s Business Model

A core tenet of the company’s business model is its approach to lot acquisition and land development. Unlike other home builders, who typically purchase and develop land, NVR doesn’t own land, rather it negotiates with developers for the exclusive option on finished lots. By offering an upfront cash deposit and agreeing to purchase the finished lots at a premium price, the company is a preferred partner for developers who can use NVR’s credit rating to procure favorable financing from lenders.

By avoiding the capital intensive and multi-year process of land development, NVR has been able to generate returns-on-equity (ROE) of 20 to 40% over the long term, 2x to 3x better than most of its large homebuilder competitors. Additionally, this strategy acts as a risk mitigation tool, allowing the company to reassess, renegotiate, or withdraw from commitments during housing market downturns.

By focusing exclusively on home construction, NVR has achieved a remarkable level of efficiency. The company’s relatively standardized floor plans have helped reduce design complexity and achieve a best- in-class “cycle time,”—the time to construct a finished home—nearly one-third better than competitors Additionally, by utilizing offsite manufacturing and assembly for its components, NVR can reduce waste and enhance construction quality.

NVR’s unique business model also acts as a barrier to competitors looking to emulate its success. NVR’s size and experience outpace small and mid-sized builders who cannot match its land procurement, construction efficiencies, or marketing ability to compete on an equal footing. Meanwhile, large competitors are culturally and structurally wedded to land development due to their multi-decade experience in that arena, large development teams, and billions invested in land ownership.

Market Catalysts for Future Success

Inadequate Housing Supply

The Great Financial Crisis (GFC) and housing downturn casts a long shadow. U.S. housing construction has returned slowly from the nadir in 2010 and 2011, and has still not recovered normalized levels of the last 60 years. We believe new single family home construction—the type that NVR specializes in—needs to increase by 25% from recent levels to get back to long-term normal. In addition, because starts were so far below normal for so long, we estimate the country has under-produced by about 5 million housing units over the last 15 years, implying starts may need to exceed the long-term average for an extended period of time to get back to equilibrium.

Growing Demographic Demand

The Millennial Generation—those born between 1981 and 1996—have been slower than prior generations to marry, have children, and become homeowners. Millennials were entering adulthood around the time of the GFC, so had a front row seat to the housing collapse and its ensuing pain. Many swore they would live downtown and rent forever. Now, this generation is finally entering the housing market en masse as their families grow and memories of the GFC fade.

Increasing Preference for Suburban and Rural Areas

The COVID-19 pandemic has halted population growth in urban areas. The rise of “urbanesque” developments, suburban developments centered around pre-planned town centers that include restaurants, bars, shops, and other amenities, offer previously suburban-skeptical millennials both a vibrant and active neighborhood as well as more affordable larger homes with bigger yards. Additionally, the increasing ability to work remotely because of the pandemic allows homebuyers to place less emphasis on proximity to their workplace, helping expand their search into underdeveloped suburban and rural areas. These trends all benefit NVR as a suburban homebuilder.

Our Independent Research and Key Insights

NVR continues to meet our key investment criteria:

High Quality Business

• NVR’s unique business model outsources capital intensive, low return activity of land ownership and development, enabling higher returns on equity.

• The company’s focus on home construction has allowed it to eliminate inefficiencies and achieve a best-in-class “cycle time.”

• NVR’s focus on building market share in each of its markets has allowed it to leverage its management expertise and marketing expense, secure attractive lending terms with land owners and developers, and access quality land.

Large Growth Opportunity

• Years of below-average building rates suggest more than 25% industry unit growth is needed to return to normalized levels.

• With only a 2% market share of the U.S home construction industry overall, we believe NVR can more than triple its current size by expanding geographically.

Excellent Management

• Executive Chairman Paul Saville has been with the company since 1981, fostering a culture and discipline supportive of the company’s unique strategy.

• CEO Eugene Bredow took over in 2022, but has been with the company since 2005 and is well positioned to carry the business forward.

• With management owning over $700 million of NVR stock, we believe our interests are well-aligned.

Discount Valuation

• NVR has demonstrated excellent capital allocation and has delivered shareholder value via opportunistic share repurchases.

• We believe that the company’s earnings per share can achieve a mid-teens annualized growth rate over a full market cycle.

• The company is trading at 13x our forward earnings estimate, below the market at 19x.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.