Portfolio Rebalance August 2019

In the following commentary, the Portfolio Managers of the Hennessy Cornerstone Growth Fund discuss the Fund’s quantitative investment strategy and how it drives the Fund’s sector and industry positioning.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Hennessy Cornerstone Growth Fund’s investment strategy?

The Fund utilizes a quantitative approach to build a portfolio of attractively valued, growth stocks whose stock prices are exhibiting strong relative strength. In essence, the strategy seeks to combine elements of both value and momentum investing. From the universe of stocks in the S&P Capital IQ Database, the Fund selects the 50 stocks with the highest one-year stock price appreciation that also meet the following criteria:

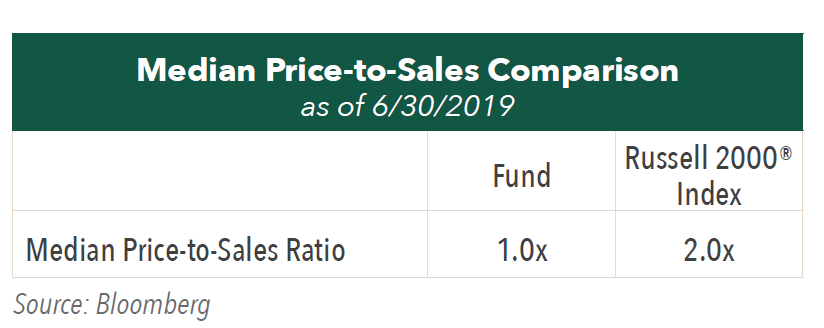

- Price-to-sales ratio below 1.5

- Annual earnings that are higher than the previous year

- Positive stock price appreciation over the past three- and six-month periods

Why does the Fund use these screening criteria?

The Fund uses a sales-based value criterion because sales are more difficult to manipulate than earnings. The price-to-sales ratio works well under almost all conditions, including when a company’s profitability may be temporarily depressed, or when earnings may be artificially inflated.

Higher year-over-year earnings help identify growth stocks, i.e. companies that are operating successfully in growth markets, gaining market share, or increasing their profitability.

Positive price appreciation over three- and six-month periods generally reflect market recognition of improving underlying fundamentals in the near term.

Why does the Fund rank by and select stocks with high one-year price appreciation?

From among the companies that have passed the screening criteria, the Fund selects the 50 with the highest one-year price appreciation. We believe this ranking by relative share price strength can be a good predictor of future price appreciation or outperformance.

How does the Fund seek to provide a return to investors?

We believe the Fund’s investments present the potential for capital appreciation as a result of earnings growth and potentially higher valuations.

How often does the Fund rebalance its portfolio?

The universe of socks is re-screened and the portfolio is rebalanced annually, generally in the winter. Holdings are weighted equally by dollar amount with 2% of the Fund’s assets invested in each. In addition to the regular annual rebalance, the Fund’s portfolio may be reconstituted more frequently, generally on a quarterly basis, re-screening the universe of stocks and replacing the lowest-performing stocks in the portfolio with up to five new stocks as dictated by the Fund’s investment strategy.

How does the Fund’s portfolio differ from its benchmark?

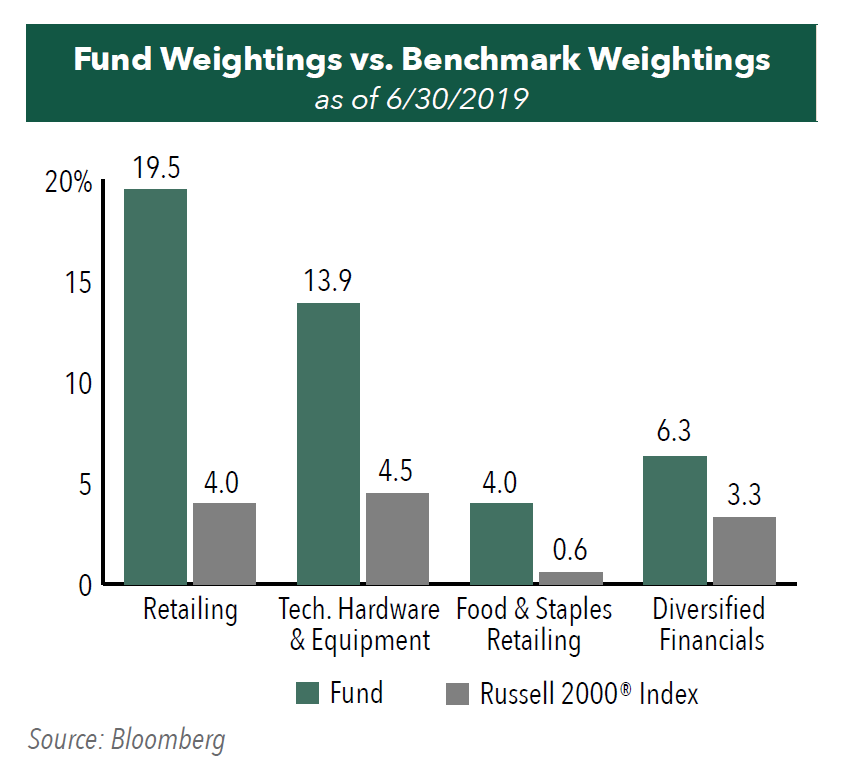

Compared to its benchmark, the Russell 2000® Index, the Fund has a substantial overweight position in consumer stocks, with almost 30% of the Fund invested in the Consumer Discretionary and Consumer Staples sectors. Automotive dealers, food and general retailers account for many of the Fund’s holdings in the consumer area. Consumer spending has been growing rapidly over the last year, averaging 4.2% growth in the 12 months ended May 31, 2019, powered by robust job growth and higher wages. This growth in consumption has been driving growth in earnings and positive stock price performance for many retail stocks over the last year. These are two important investment criteria considered in the stock selection process for the Fund.

The Fund is also overweight the Information Technology sector compared to its benchmark, with a number of investments in technology hardware, solar and technology services. The Technology sector has been benefiting from robust economic growth and growing corporate investment spending on technology products to lower costs and improve competitive positioning. As a result, technology companies have been reporting solid growth in earnings, and have seen their stock prices perform well.

While the Fund is underweight the overall Financials sector, the Fund is overweight the Diversified Financials Industry Group with holdings in the brokerage and asset management industries.

- In this article:

- Domestic Equity

- Cornerstone Growth Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.