Portfolio Update April 2019

Cornerstone Large Growth Fund - The Fund's Portfolio Managers discuss the Fund’s quantitative investment process and how it drives the Fund’s sector and industry positioning.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Hennessy Cornerstone Large Growth Fund’s investment strategy?

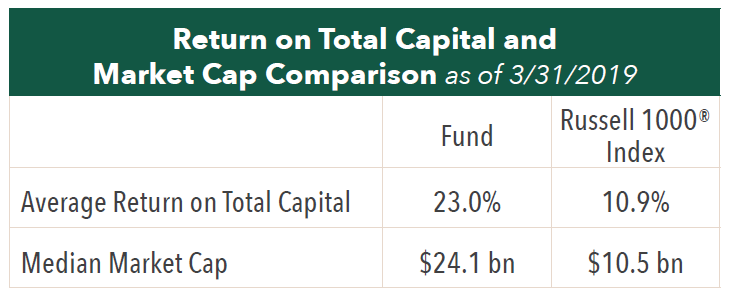

The Fund utilizes a quantitative approach to build a portfolio of attractively valued, highly profitable larger-cap companies. In essence, the strategy seeks high quality, high return companies that may be being overlooked by investors.

From the universe of stocks in the S&P Capital IQ Database, the Fund selects the 50 stocks with the highest one-year return on total capital that also meet the following criteria:

- Market capitalization that exceeds the Database average

- Price-to-cash flow ratio less than the Database median

- Positive total capital

Why does the Fund use these screening criteria?

Larger market capitalization companies tend to be well-established leaders in their industries with long, successful track records and solid profitability.

A low price-to-cash flow ratio can be a good indicator of attractive stock valuation. Positive cash flow tends to be associated with companies with profitable business models.

The use of positive total capital as a screening criterion helps the Fund avoid financially weaker companies.

Why does the Fund rank by and select stocks with high one-year return on total capital?

From among the companies that have passed the screening criteria, the Fund selects the 50 with the highest one-year return on total capital. We believe return on capital is an excellent measure of a company’s profitability and is often associated with able management, high barriers to entry, and other favorable factors. As a result, we believe this measure can help uncover stocks with the potential to outperform the market.

How does the Fund seek to provide a return to investors?

We believe the Fund’s investments present the potential for capital appreciation when and if market sentiment changes and their valuations rise. Strong profitability also has the potential to lead to earnings growth, which could also drive capital appreciation.

How often does the Fund rebalance its portfolio?

The universe of stocks is re-screened and the portfolio is rebalanced annually, generally in the winter. Holdings are weighted equally by dollar amount with 2% of the Fund’s assets invested in each.

How does the Fund’s portfolio differ from its benchmark?

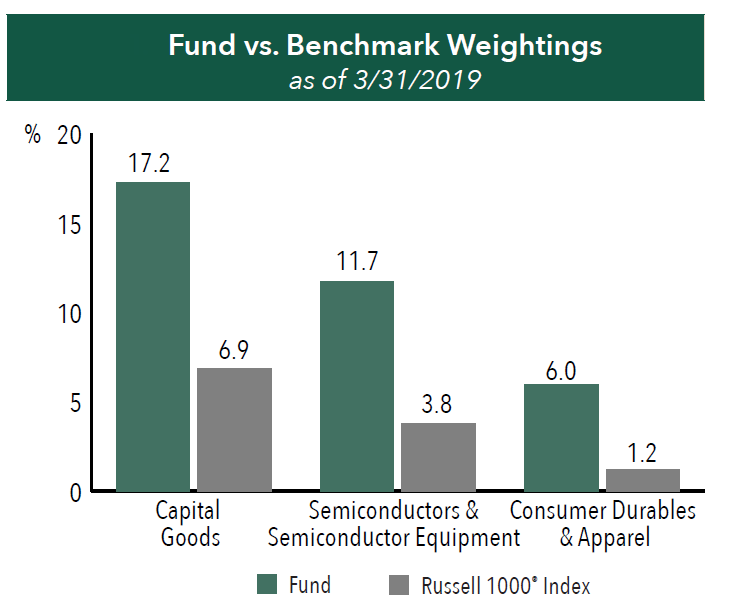

There are three primary industry groups where the Fund currently maintains an overweight position versus its benchmark, the Russell 1000® Index: Capital Goods, Semiconductors & Semiconductor Equipment, and Consumer Durables & Apparel.

Semiconductors & Semiconductor Equipment companies have been benefiting from strong economic growth and increasing use of semiconductors to connect everyday products, such as cars and appliances, to the Internet. As a result, many semiconductor companies have seen profitability and returns on capital rise. However, the Fund’s holdings in these industry groups are still trading on attractive valuations in terms of price-to-cash flow.

Capital Goods and Consumer Durables & Apparel stocks have lagged the general market due to concern that rising interest rates may lead to slower economic growth. We believe many now look undervalued. Despite this underperformance, the Fund’s holdings in this industry group have maintained strong levels of profitability and have continued to generate high returns on total capital and steady earnings growth.

- In this article:

- Domestic Equity

- Cornerstone Large Growth Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.