Cornerstone Mid Cap 30 Portfolio Drivers: Housing, Retail, and Consumer Spending

Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy and discuss the Fund’s most recent rebalance and changes in the portfolio composition. They also highlight the fundamental drivers of select sectors within the portfolio.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Fund’s investment strategy?

The Cornerstone Mid Cap 30 Fund utilizes a quantitative formula to select 30 domestic, mid-cap stocks, those with between $1 and $10 billion in market capitalization, that exhibit both value and momentum characteristics. The formula selects stocks with higher year-over-year earnings, positive stock price appreciation, and lower price-to-sales ratios. The universe of mid-cap stocks is screened using these criteria, and the portfolio is rebalanced annually, generally in the fall.

Would you please discuss sector weightings and the themes supporting those sectors?

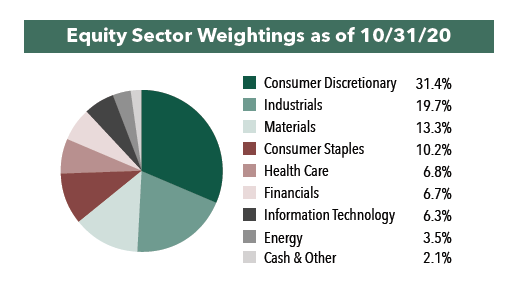

Following the most recent annual rebalance in the fall of 2020, the Fund’s portfolio is diversified across eight of the 11 GICS sectors. The two largest sectors are Consumer Discretionary at 31% of the portfolio, a decrease of about 9% compared to the prior portfolio, and Industrials at 20%, an increase of about 8%. The largest sector increase was within Consumer Staples, increasing from zero holdings in last year’s portfolio to three out of our 30 positions this year, representing a sector weighting of 10%. The largest drop in concentration was within the Information Technology sector, down from about 21% last year to 6% this year. We view this year’s portfolio as more diversified than last year, although the Fund overall remains a highly concentrated, focused portfolio of 30 mid-cap equities.

Compared to the Russell Midcap® Index, the Fund continues to have a substantial overweight position in consumer-related stocks, both Consumer Discretionary and Consumer Staples, as well as larger weightings in Industrials and Materials. As the economic and employment recovery from the pandemic progresses in the coming year, we believe that increases in consumption, coupled with potential infrastructure spending increases, may in turn drive higher growth in earnings and positive stock price performance for many of the Fund’s holdings.

Is there a common investment theme in the current portfolio?

Albeit less than last year, a common driver of many holdings of the Fund, regardless of sector, is the strength of housing and housing-related stocks. Many of our portfolio companies generally benefit from a heathy real estate market, low interest rates, and spending on household goods. Specifically, two out of the 30 holdings are homebuilders, and three are related to home furnishings. We believe that the housing market has shown incredible resilience in 2020 and that a continuation of that trend in 2021 should be a tailwind for a number of the Fund’s current holdings.

An additional theme in the current portfolio is related to retail, including auto sales and service, specialty retail, discount chains, and grocery and convenience stores. The Fund’s formula is designed in part to uncover companies that may be rebounding (positive momentum) but that are still trading at attractive valuations (price/sales ratio). With the potential for continued economic recovery in 2021, coupled with an effective COVID-19 vaccine and potential for a greater portion of in person shopping, we would expect these types of retailers to benefit.

What is the median market capitalization of the Fund’s holdings following the most recent rebalance?

The Fund selects its holdings from a universe of midcap stocks with market capitalizations ranging from $1 billion to $10 billion. Following the most recent rebalance, the Fund’s holdings had a median market cap of $7.1 billion at the end of October 2020. We believe mid-caps offer untapped potential and that investors may be surprised to learn that mid-cap stocks have outperformed both small- and large-cap stocks over the past twenty year period with less risk than small-cap stocks.

Would you please discuss the relative valuation of the Fund’s holdings compared with the benchmark?

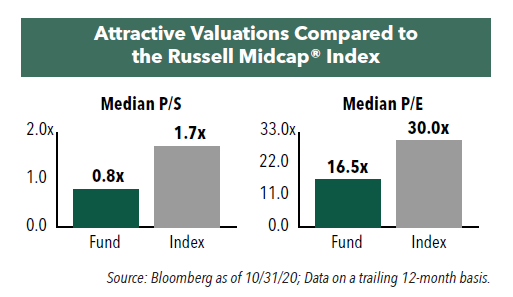

Attractive valuation is an important factor in the Fund’s stock selection process. The Fund uses price-to-sales as its primary valuation metric because it is a simple metric, can be universally applied, and is difficult for companies to manipulate. The Fund selects stocks with a price-to-sales ratio below 1.5x. The median price-to-sales ratio of the portfolio was just 0.8x at October 31, 2020 compared to 1.7x for its benchmark index, the Russell® Midcap Index.

The Fund’s holdings are also trading at a discount in terms of price-to-earnings. The Fund’s median price-to-earnings ratio was 16.5x at the end of October 2020 versus 30.0x for its benchmark index.

- In this article:

- Domestic Equity

- Cornerstone Mid Cap 30 Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.