Uncovering Value Through High Dividend Yields

In the following commentary, the Portfolio Managers of the Hennessy Cornerstone Value Fund discuss the Fund’s formula-based investment strategy and how it drives the Fund’s sector and industry positioning.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Hennessy Cornerstone Value Fund’s investment strategy?

The Fund utilizes a formula-based approach to build a portfolio of potentially undervalued, profitable, large-cap companies. From the universe of stocks in the S&P Capital IQ Database (excluding Utilities), the Fund selects 50 stocks with the highest dividend yield which also meet the following criteria:

» Above-average market capitalization

» Above-average number of shares outstanding

» Trailing 12-month sales 50% greater than average

» Above-average cash flow

Why does the Fund use these screening criteria?

These criteria help the Fund find companies that are large, profitable and able to pay a healthy dividend.

- Large market capitalizations tend to be associated with companies that are well-established leaders in their industries, with long successful track records and solid profitability.

- A large revenue base tends to be associated with companies that have high market shares or that have diversified successfully.

- Above average cash flow identifies companies with strongly profitable business models, possibly generating excess cash flow, which may be returned to shareholders in the form of a dividend.

Why does the formula select stocks with the highest average dividend yield?

From among the companies that have passed the screening criteria, the Fund then selects the 50 with the highest average dividend yield. As high average dividend yield can be a good indicator of a low stock valuation, this ranking criteria helps uncover potentially undervalued companies.

How does the Fund seek to provide a return to investors?

We believe the combination of profitability and value offers investors an opportunity to earn a return in two ways. In our view, the Fund’s investments offer the potential for capital appreciation if and when market sentiment changes and their valuations rise. Investors in the Fund are also “paid to wait,” potentially rewarded with a steady income stream from the dividends.

How often does the Fund rebalance its portfolio?

The universe of stocks is re-screened and the portfolio is rebalanced annually, generally in the winter. Holdings are weighted equally by dollar amount with 2% of the Fund’s assets invested in each.

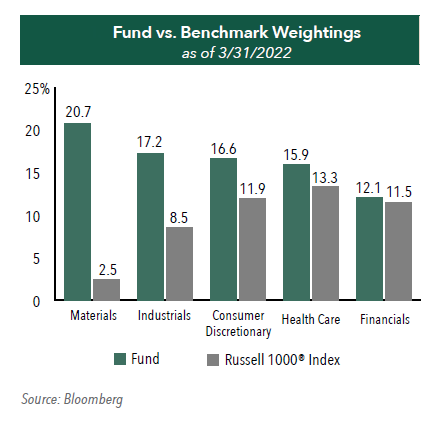

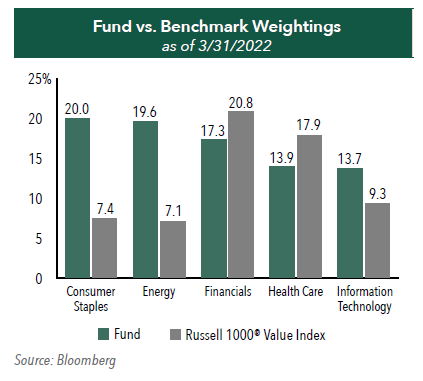

How does the current portfolio differ from its benchmark?

The Fund maintains overweight positions versus its benchmark, the Russell 1000® Value Index, in the Consumer Staples and Energy sectors and has significant, yet slightly underweight, positions in Financials and Health Care.

In the case of Consumer Staples, the Fund has holdings in soft drinks, packaged foods, tobacco, drug retails and household products. These stocks tend to pay consistent and strong dividends over time, and given the focus of this Fund on higher yielding stocks, we typically see high representation from this sector.

The Fund’s Energy exposure should continue to benefit from higher commodity prices coupled with any potential improvement in the domestic and global economies. With holdings in the large, integrated oil & gas conglomerates, as well as exploration, production, and refining, the Fund could benefit from continued significantly higher cash flows, higher profitability, and benefits to shareholders through dividends, share repurchases, and pay down of higher costing debt.

Lastly, the Fund has significant positions in Financials and Health Care, which can be less volatile and more defensive in nature, both important attributes for a value focused fund. Many of the Fund’s financial companies could also benefit from a rising rate environment as the Federal Reserve has already begun a potentially prolonged period of interest rate hikes.

- In this article:

- Domestic Equity

- Cornerstone Value Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.