Fundamentals Remain Strong

The Portfolio Managers discuss several Fund holdings that offer an attractive risk/return profile, share their views on consumer-related holdings, and provide insights into the portfolio’s valuation and earnings growth relative to its benchmark.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

After a turbulent first quarter, would you please discuss a Fund holding that offers an attractive risk/return profile?

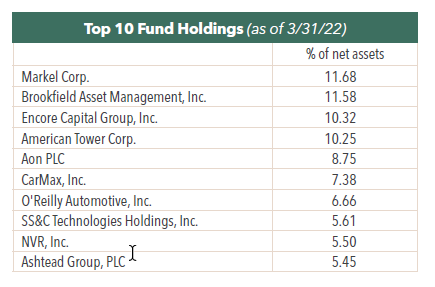

The Fund is a concentrated portfolio with weightings based on the strength of fit with our key investment criteria: high-quality business, large growth opportunity, excellent management, low “tail risk,” and discount valuation. Large weightings are reserved for companies in which we have the highest level of conviction in their long-term business outlook and in which the shares offer high return potential. Therefore, our largest positions are holdings that can be considered to have a particularly attractive risk/reward profile.

For example, Encore Capital Group is a top 10 holding in the Fund. Encore is a global specialty finance company that purchases defaulted consumer receivables, primarily credit card paper, at a deep discount to face value and takes collection efforts to drive its return on investment. Industry returns are largely determined by what a company pays for and collects from receivables, how long it takes to collect, and the cost to collect.

We believe Encore is a best-in-class operator with sustainable competitive advantages that allow for higher collections and a lower collection cost structure than its peers. Its continuous innovation and robust analytics on debtor behavior further strengthen these advantages. The company has built a proprietary database that provides insights into debtors’ willingness to pay. We believe these advantages allow Encore to bid more aggressively for portfolios than its peers while improving its collection rate. Its two largest markets, the U.S. and the U.K., have operating scale advantages, and compliance requirements have led to limited competition.

In 2021, the company improved its financial position, repurchasing 23% of its shares and lowering its leverage. Yet its shares trade at only 6x our estimate of the next 12-month’s earnings per share. Over the next five years, we anticipate Encore could generate mid-teens annualized earnings per share growth driven by an improving supply of defaulted consumer receivables in the U.S. and U.K. markets, an increasingly successful digital collection program and opportunistic share repurchases.

Continuing with other top 10 positions, would you please comment on insurance holdings Markel Corp. and Aon PLC?

Markel, a U.S. based global property and casualty insurance company, and Aon, a global broker of insurance products, reported favorable results in the first quarter and have a positive forward outlook. These companies are experiencing pricing momentum in the insurance market due to a confluence of events: a strengthening economy, rising real estate prices, and natural catastrophes. These all lead to higher insured assets which should benefit revenue and earnings growth for both companies.

Many consumer-related stocks declined in the first quarter of 2022. Would you please share your thoughts on the Fund’s various consumer-related companies?

So far in 2022, inflation, rising interest rates, supply chain challenges, and the invasion of Ukraine have taken a toll on consumer confidence. And as expected, there has been some shift away from spending on goods and toward services. American Woodmark, CarMax, NVR, and RH have seen some deceleration in their collective growth rates from last year, but are still making good forward progress and our mid- and long-term thesis on each company remains intact.

What are your thoughts on consumer spending in the housing segment?

Over the past decade or so, there has been a significant amount of wealth creation. For example, as one datapoint, the total amount of home equity in the U.S. is currently about $26 trillion. In 2009, it was approximately $6 trillion. Yet, the U.S. remains below historical levels of remodeling spend. We believe homeowners will continue reinvesting in improvements to their existing homes, which provides a positive backdrop for portfolio holdings, American Woodmark and RH.

Please comment on the Fund’s valuation and earnings growth versus the benchmark.

As of March 31, 2022, using preliminary estimates, the Fund traded at 15.9x 2022 forward earnings, compared to 18.4x at the end of the fourth quarter 2021. Our earnings growth estimates have declined modestly since the beginning of the year, but we are still expecting results to be up double digits for the year. With the benchmark Russell 3000® Index trading at 19.6x, the Fund is trading at a 19% discount to the overall market, which is the near the largest spread we have seen in the last decade.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.