Compelling Growth Runways for Portfolio Companies

The Hennessy Focus Fund Managers discuss portfolio earnings relative to the overall market, repercussions from the trade dispute, insight on the Fund’s financial holdings, and views regarding proposed mergers involving two portfolio companies.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

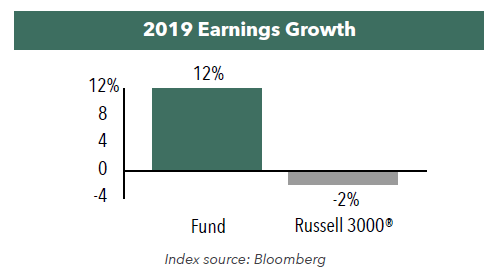

Would you please discuss the Focus Fund’s earnings growth relative to its benchmark?

Over the long term, we believe that stock prices follow earnings per share (EPS) growth, and that the Fund’s portfolio companies will post attractive growth rates comfortably exceeding the growth rates of the broader market index. 2019 was a step in the right direction; we calculate that the Fund’s portfolio companies had a 12% EPS growth, with broad-based progress for most holdings. In contrast, the Russell 3000® Index as a whole had a difficult earnings year, experiencing a 2% decline in EPS. This decline was largely due to a slowdown in global economic activity and the impact of tariffs.

How has the portfolio been affected by the trade dispute between the U.S. and China?

While market volatility caused by the trade war affected the Fund overall, most individual holdings were not impacted. However, two portfolio holdings had minor repercussions from the trade disputes.

O’Reilly Automotive, a U.S. auto parts retailer, was initially impacted by a 10% tariff on Chinese-made auto parts, and further affected by that tariff increasing to 25%. However, the tariff did not materially weigh on business operations or earnings, as O’Reilly was able to pass these additional costs to consumers.

Another company that felt minor repercussions was American Woodmark, a kitchen and bath cabinet manufacturer. The company’s imports of hardware parts from China were subject to a new tariff. Operating in a competitive market, American Woodmark was limited in its ability to increase its prices, and, in some cases, had to internally bear the higher costs. However, the earnings impact was negligible due to imported hardware being a small part of an assembled cabinet value.

Longer term, further trade developments could be positive for American Woodmark. The American Kitchen Cabinet Alliance of 50 cabinet manufacturers filed a case against several Chinese cabinet makers, targeting China’s unfair subsidies. The preliminary ruling by the U.S. Commerce Department indicates countervailing duties may be imposed on some or all of these Chinese manufacturers totaling between 16%-50%. Given the growth of Chinese kitchen and bath imports over the last several years, these duties could mitigate the subsidy and restore the competitive balance in the U.S. market.

With the Fund’s largest sector weighting in the Financials sector, please elaborate on the types of companies the Fund holds.

While some investors may think the Financials sector is comprised of just depositories (i.e., banks, thrifts, savings and loans), the majority of the Fund’s Financials holdings are actually not traditional depository institutions. We hold companies with specialized financial businesses that operate in different markets and have different asset-liability structures. Our holdings include a discount brokerage company, a global alternative asset manager, a property and casualty insurance broker, and a specialty insurance underwriter. We believe these portfolio companies have compelling growth runways, attractive returns on capital and equity, and strong competitive advantages.

What are your thoughts on Charles Schwab’s proposed purchase of TD Ameritrade?

We like the transaction, and believe that it makes both strategic and financial sense. Charles Schwab, because of its scale and aggressive technology adoption, is a low-cost leader in the financial services industry. It uses its low-cost position to provide great service at a great price to its customers, which drives steady market share gains over time. The merger with TD Ameritrade would increase Schwab’s assets under custody from $3.4 trillion to approximately $5 trillion, further enhancing its low-cost position. From a financial standpoint, we believe this transaction is about 20-25% accretive to EPS over the next 3-4 years, and will help accelerate earnings growth for the next decade.

Although we believe the merger is likely to be approved, there is some regulatory risk since the combined market share will approach 50% of the independent Registered Investment Advisor market. However, across the entire wealth management marketplace, the combined Schwab and TD Ameritrade would represent a much more modest 8-10% of the total universe, so regulatory approval will likely hinge on market definition.

What synergies might result from the proposed merger between portfolio holding Hexcel and Woodward?

We anticipate the marriage of Hexcel’s advanced composites technology and Woodward’s control solutions will allow the combined company to offer innovative technologies that optimize aerodynamics, improve energy efficiency, and lower emissions. For example, on the next generation of aircraft, we expect smaller, more fuel-efficient engines to be integrated into a thin wing design. Smaller engines present heat management challenges that the combined company will be uniquely positioned to combat with Hexcel’s composites and Woodward’s engine components. The merger also creates opportunities to enhance noise suppression, and integrate sensor and control solutions to improve performance.

We are pleased that Hexcel’s current CEO Nick Stanage will continue to provide strong leadership and thoughtful capital allocation as the head of the combined company. Post-merger, we believe the company could generate mid-to-high single digit revenue growth and compound at EPS at a low-teens rate. In addition, we believe the combined company could generate annual cost synergies of more than $125 million by the second full year post closing.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight the recent change in market cap range of potential investments.