A Differentiated Portfolio Focused on Margin of Safety and Upside Potential

The Portfolio Managers summarize the significant events that drove markets over 2025 and how the Fund remains focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager

Key Takeaways

» In 2025, Japanese equities reached all-timehighs; corporate governance reform was the mostimportant driver.

» In its portfolio construction, the Fund prioritized businesses with natural hedges and globalexposure, reducing sensitivity to currencyfluctuations.

» By investing in firms with global footprints and diversified revenue streams, the Fund seeks tomitigate risks associated with currency volatility.

» Corporate governance reforms are expectedto continue regardless of political changes andremains a key structural driver for Japaneseequities in 2026.

» The investment thesis for SoftBank Group centerson its exposure to AI, aggressive share buybacks,and a significant increase in its net asset value per share.

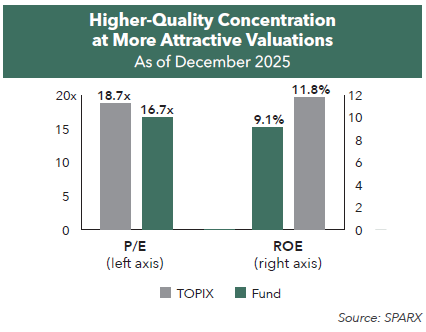

» As of the end of 2025, the Fund’s portfolio holds aconcentration in higher-quality companies at moreattractive valuations than the broader market.

What drove the Japanese market in 2025?

2025 was a landmark year for Japanese equities, with the market reaching all-time highs. The most important driver was the ongoing wave of corporate governance reform. The Tokyo Stock Exchange’s initiative for companies trading below book value created a sense of urgency in boardrooms, pushing both underperformers and blue-chip firms to improve capital efficiency. This reform is now self-sustaining, with the upcoming revision of the Corporate Governance Code expected to broaden its impact even further.

AI-related stocks, select retail names, and gaming companies with minimal exposure to global trade risks attracted significant investor interest and now trade at what we believe to be premium valuations. Domestically oriented sectors—financials, real estate, construction—also performed strongly, benefiting from the normalization of interest rates and a shift in consumer behavior as inflation and wage growth became more established. Shareholder activism and the expansion of the Nippon Individual Savings Account (NISA) program brought renewed retail investor interest, supporting market breadth. Despite global uncertainties, the market’s resilience was notable, with the Tokyo Stock Index (TOPIX) posting a three year return of nearly 18%.

How have yen levels—especially periods of weakness—affected globally exposed companies?

Yen weakness in 2025 had a nuanced impact. Export-oriented companies, particularly automakers and parts suppliers, faced stagnation due to concerns over tariffs and global trade tensions. However, many of the Fund’s core holdings—such as ORIX, Seven & i Holdings, Hitachi, and Sony Group—were largely insulated from direct tariff and foreign exchange (FX) impacts. These companies benefit from diversified global operations, local production, and strong pricing power.

The Fund’s portfolio construction prioritized businesses with natural hedges and global exposure, reducing sensitivity to currency fluctuations. While FX can impact returns for dollar-based investors, the underlying competitiveness and resilience of these companies appeared to remain intact.

How do you anticipate the new Prime Minister influencing corporate governance or economic priorities in Japan in 2026?

The new Prime Minister Sanae Takaichi has introduced proactive fiscal policies and maintains a dovish stance on monetary policy, which have been welcomed by the equity market. The administration is focused on strengthening domestic capabilities in AI, semiconductors, and defense, while supporting economic growth through fiscal stimulus. There are concerns about potential inflationary side effects and fiscal discipline, but these are seen as manageable in the current environment. Most importantly, the steady progress in corporate governance reform is expected to continue regardless of political changes, with upcoming revisions to the corporate governance code likely to further encourage capital efficiency, even among high-quality companies trading above book value. This ongoing reform remains a key structural driver for Japanese equities in 2026. By investing in firms with global footprints and diversified revenue streams, the Fund seeks to mitigate risks associated with currency volatility. Companies that produce goods locally in key markets (such as the U.S.) reduce their exposure to currency risk and tariff impacts.

In addition, the Fund recognizes that the interest rate differential between Japan and the U.S. can influence short-term currency movements. The current divergent rate cycles between the U.S. and Japan can cause short-term noise. These potential fluctuations are factored into the Fund’s overall risk management framework, which includes maintaining a diversified portfolio to manage exposure across sectors and currencies.

Would you please discuss your interest in investing in companies benefiting from improving global tech demand and investments related to AI and automation?

The Fund maintains selective exposure to semiconductor, robotics, and precision-engineering sectors, focusing on companies where Japan retains a sustainable competitive advantage. Investments in Tokyo Electron, Shin-Etsu Chemical, Renesas Electronics, and Socionext contributed positively, but exposure was reduced as competition from China intensified. Tokyo Electron remains a core holding due to its technological edge and strong partnerships with global manufacturers like TSMC and Samsung. The Fund also invests in companies benefiting from AI-driven demand and automation, while remaining mindful of the challenges posed by rapid advances in China’s industrial policy.

Notably, SoftBank Group is the only Japanese company with direct exposure to ARM and OpenAI, making it a unique play on global AI trends.

Would you provide an update on the Fund’s homebuilder holdings in light of the potential interest rate cuts in 2026?

The Fund initiated positions in Sekisui House, Sumitomo Forestry, and Daiwa House in 2025, focusing on their expansion in the U.S. single-family housing market. These companies are leveraging Japanese manufacturing excellence and cost-efficient techniques to gain market share in a fragmented U.S. market. A recovery in the U.S. housing market is anticipated, though the timing may be pushed out to next year and beyond. Potential interest rate cuts in 2026 could improve affordability and support order trends. The Fund is maintaining a margin of safety and monitoring industry developments closely. In Japan, these industry leaders are expected to benefit from ongoing consolidation in the mature housing sector.

Would you please summarize your investment thesis in SoftBank?

The investment thesis for SoftBank Group centers on its exposure to AI (notably through OpenAI), aggressive share buybacks, and a significant increase in its net asset value (NAV) per share. SoftBank’s investment value in OpenAI and ARM has been a primary driver of its stock price. The company’s reduction in outstanding shares has effectively increased intrinsic value for remaining shareholders. From June 2020 to September 2025, NAV per share doubled, driven by a 30% reduction in outstanding shares. The Fund increased its position in SoftBank in 2025, viewing its unique positioning in AI and ongoing buybacks as key drivers of long-term value. We continue to see SoftBank as a strategically advantaged platform with optionality across AI hardware, software, and enterprise applications.

What changes were made to the portfolio in the fourth quarter of 2025?

In the fourth quarter, the Fund maintained core positions in Seven & i Holdings, ORIX, the three major insurance groups, semiconductor-related names, and homebuilders. Adjustments included reducing exposure to certain semiconductor stocks and adding more shares to select insurance holdings.

The portfolio remains differentiated, with a focus on margin of safety and upside potential. We employ a “basket buying” strategy in sectors like insurance, homebuilders, and semiconductors, with ongoing rebalancing to optimize risk and return. The Fund’s approach is to build a concentrated yet diversified portfolio, with several themes running through it, but always grounded in bottom-up stock picking.

How do valuations in Japan compare to the U.S. and Europe? How do they compare to historical Japanese valuations?

As of December 2025, the Tokyo Stock Index (TOPIX) was trading at 18.7x forward earnings and 1.7x book value, with a return-on-equity (ROE) of about 9.1%. This is a significant improvement from ten years ago but still below international standards. By comparison, the Fund’s portfolio trades at a forward P/E of 16.7x and ROE of 11.8%, indicating a concentration in higher-quality companies at more attractive valuations than the broader market.

Japanese equities remain attractively valued compared to U.S. and European markets, trading at lower price-to-earnings and price-to-book multiples. Historically, Japan remains a laggard compared to the U.S. and Europe, suggesting room for further appreciation as reforms continue.

What is your outlook for Japanese equities in 2026?

The outlook for Japanese equities in 2026 is constructive, supported by several structural and cyclical tailwinds. Continued corporate governance reform—expected to persist regardless of political changes—normalization of interest rates, positive shifts in consumer behavior, booming inbound tourism, and Japan’s geopolitical neutrality are all supportive.

Risks include negative real wage growth and potential fiscal discipline challenges, but these are being addressed through policy measures and corporate action. We believe the Fund’s portfolio could continue to deliver attractive returns relative to the broader market, as Japan’s structural story continues to unfold. Share buybacks and dividends remain key sources of returns alongside earnings growth, and Japanese equities should continue to trade at attractive valuations compared to U.S. and European markets.

We remain focused on quality, capital discipline, and valuation, with a clear preference for stock picking over index exposure.

Earnings growth is not representative of the Fund’s future performance. Diversification does not assure a profit, nor does it protect against a loss.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps’ Earnings Resilience and Improving Returns on Capital

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers cover small-cap outperformance drivers, pro-growth fiscal policy, governance reform, yen volatility, portfolio repositioning, profitability and capital efficiency trends, valuation gaps, and their 2026 outlook.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.

-

Investment Idea

Investment IdeaWhy Active Matters When Investing in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaWhen investing in Japanese businesses, we believe it is imperative to select a manager who is immersed in the culture and can perform in-depth, company-specific research to build a concentrated portfolio of Japanese companies that can outperform a benchmark and weather volatility.