Q2-2020: An Updated Assessment of Portfolio Holdings

The Hennessy Focus Fund Portfolio Managers at Broad Run Investment Management, LLC, the Fund’s sub-advisor share insights on the portfolio.

Portfolio Update

Last quarter we provided you an assessment of our portfolio holdings and how we expected them to be impacted by the economic downturn due to COVID-19. Now that we are three months further into the pandemic, we want to share our updated thinking.

In general, the economic downturn has been harsh, but nowhere near the extreme contraction we were modeling in our worst-case stress test scenarios. April and May were unquestionably challenging months for a number of our businesses, but demand trends got progressively better for most, and the recovery accelerated in June. Indeed, companies such as CarMax, Ashtead Group, and NVR, which we thought could have an extended period of significantly reduced demand, appear to have sales nearly fully recovered by the end of the second quarter.

For other companies, such as American Woodmark and Hexcel, it is clear that full recovery will take longer due to their exposure to in-home cabinet installations and air travel, respectively. We continue to believe that American Woodmark is positioned for a near full recovery once a vaccine or highly effective therapeutic is widely available, probably sometime in 2021. However, Hexcel likely has a much longer road to recovery with most industry observers expecting air travel and aircraft production to reach 2019 levels in the 2023 to 2025 timeframe. We continue to like the Hexcel investment from this level since we model a low-teens internal rate of return (IRR) even if full recovery takes until 2026.

While we are encouraged by the recent demand trends at our businesses, we expect the recovery to be lumpy with occasional setbacks due to macroeconomic factors and regional health related shutdowns. Many jobs that were lost will not return, and so we expect broader economic pain to persist well into 2021. Nonetheless, we like our portfolio of what we believe are well run, competitively advantaged, reasonably valued businesses. Many of these businesses have now pivoted to offense, looking to take advantage of their relative strength in this period of economic dislocation.

Portfolio Changes

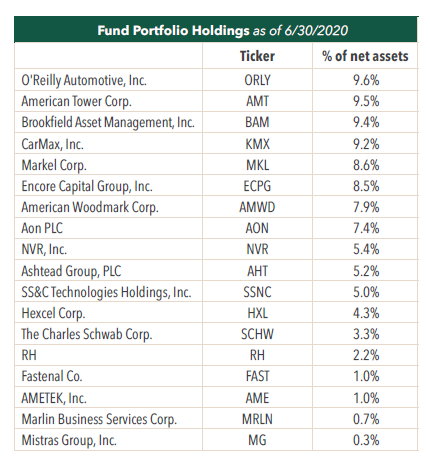

During the quarter we added a new position in Fastenal Company at about 1% of assets. Fastenal is a distributor of industrial MRO (Maintenance, Repair, and Operations) products including fasteners, safety products, hardware, cutting tools and much more.

Similar to O’Reilly Automotive, Fastenal’s strategy entails having a distribution system that strives to provide the best parts availability and fastest delivery in its industry. For example, Fastenal has a proprietary transportation network and about 2,000 U.S. stores (7x more than its nearest competitor), enabling it to deliver parts to customers on a same-day or next morning basis compared to next-day or second day for most other MRO distributors. This can make the difference between keeping a manufacturing line up and running or having it shut down for several shifts while waiting for a critical part to arrive. In addition, by having a local store presence and a significant local sales team, Fastenal builds relationships with customers enabling them to be more responsive than a traditional MRO vendor operating remotely from a location across town or a catalogue/web site operator with a warehouse hundreds of miles away.

We have long admired Fastenal; in our view, it has a great culture, clear competitive differentiation, and best in class financials. It has compounded value at a 15%-plus rate over the last 30 years. Despite this very impressive record, its organic revenue growth rate decelerated materially this last decade, despite having just 4% U.S. market share. Indeed, large competitors W.W. Grainger and MSC Industrial Direct also appear to have hit a ceiling on growth, stuck at single digit market shares rather than the 20, 30, or 40% shares we typically see in a more mature industry structure. The large distributors are still growing and benefiting as customers consolidate to fewer vendors for efficiency, but specialization, technical expertise, and relationships still matter, so the industry has remained stubbornly fragmented.

What has piqued our interest in Fastenal is their latest major growth initiative called the “onsite” solution—essentially a dedicated Fastenal store located in a customer’s production facility. This is a natural extension of service for Fastenal since it already has a very successful vending machine program that carries individualized MRO inventory at the customer’s location. However, what is

compelling about this solution is that it expands the Fastenal relationship beyond just an MRO part supplier to a strategic supply chain partner. As part of the onsite design process, Fastenal works closely with the customer to analyze and engineer their MRO procurement process to make it more efficient. This is a win-win for both Fastenal and the customer. Inventory is reduced, redundant

touch points are eliminated, and paperwork is streamlined. The customer saves money and Fastenal becomes embedded in the customer’s workflow making for a much stickier relationship with higher switching costs.

According to our research, a new onsite installation results in two- to ten-fold increase in sales from that customer location as Fastenal gains wallet share from other MRO vendors. Further, Fastenal’s historical advantages in distribution and local service leverage nicely here to make them virtually unrivaled in their ability to execute on this opportunity. In short, we believe that Fastenal has “cracked the code” to its next wave of growth; one that can get them into double digit market share and sustain value creation for more than a decade. We believe that onsite stores combined with continued rollout of Fastenal’s MRO vending machines will enable it to sustain high single to low double-digit revenue growth and low to mid-teens total returns for an extended period of time. For this, we paid about 28x our estimate of 2021 earnings. This is a higher multiple than we usually pay, but this may be offset by 2021 earnings estimates being suppressed due to the expected lingering effects of the pandemic, and our strong conviction in the long-term market share opportunity.

To fund the Fastenal purchase we sold roughly half of our stake in Ametek, leaving the position size at about 1% of assets. We have held Ametek for about four years, and the business has done well during that period. However, additional conversations with former employees provided new insights into management’s operating philosophy that reduced our conviction in the company’s ability to sustain that success going forward. As a result, we thought it the best source of capital to fund our Fastenal purchase.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight the recent change in market cap range of potential investments.