Infrastructure Spending Drives Earnings Growth

For more than a decade, U.S. natural gas utility and pipeline companies have significantly increased investment in their infrastructure networks. We believe higher investment is a positive catalyst driving earnings growth for many natural gas distribution companies operating under rate of return (ROR) regulation.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Key Takeaways

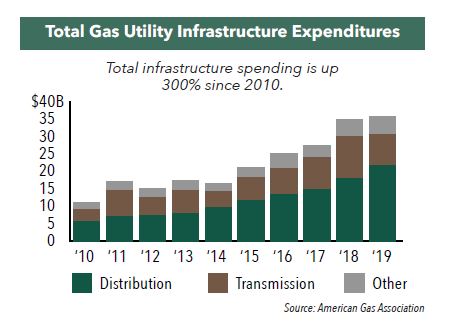

- Infrastructure spending among natural gas utilities is up 300% over the past decade

- Primary factors driving spending include safety and repairs, cybersecurity, production growth, and an increase in LNG exports

- Increased spending is driving earnings growth of natural gas distribution companies

The Infrastructure Network

The U.S. natural gas industry maintains a vast infrastructure network consisting of high pressure transmission pipelines, local distribution pipelines, storage facilities, processing plants, and liquefied natural gas (LNG) terminals. Natural gas is delivered to customers through a 2.6-million-mile underground pipeline system, including 2.3 million miles of local utility distribution pipelines and 300,000 miles of transmission pipelines that stretch across the country.

Utility Regulation – A Return on Investment

Natural gas distribution companies operate under a rate of return (ROR) regulatory framework, which allows them to pass onto their customers, in the form of price increases, the cost of their investments, plus a rate of return typically between 8% and 11%. Effectively, the more a natural gas distribution company invests, the more it can earn.

Over the past decade, natural gas distribution companies have been investing significantly more than in previous decades, principally in their infrastructure network, laying the groundwork for increasing earnings growth down the road. In fact, from 2010 to 2019, total infrastructure spending by natural gas utility companies has risen 300%. Spending on transmission pipelines (large diameter pipes that transport natural gas across the U.S.) has more than doubled while investment in local distribution pipelines (main and service lines that connect customers to their natural gas supply) has more than quadrupled from $4.8 billion to $21.6 billion.1

Projects proceeded as planned in 2020, with approximately $36 billion invested through gas utility construction expenditures, higher than in 2019, and investment looks to be strong in the years ahead.

Spending has been driven by three major factors:

1. Pipeline safety and repairs. Nearly half of the U.S.’s transmission and local distribution networks were installed in the 1950s and 1960s.2 In renovating and replacing their existing and aging infrastructure, natural gas companies can take advantage of newer technologies and materials to minimize transmission costs and reduce leaks that may have developed from deteriorating infrastructure.

Increased investment on pipeline replacement and modernization began in earnest in 2011, following a series of serious pipeline incidents. Today, America’s natural gas utilities invest $91 million, on average, every day to enhance the safety of natural gas distribution and transmission systems.3 New federal regulations prompted the local distribution companies to start major repair and rehabilitation programs, and now the majority of states have joined with the federal government to prioritize pipeline safety.

Infrastructure security has become a growing priority in recent years. Natural gas distribution companies have developed stronger security standards, guidelines, and tools, both at the industry level and in conjunction with federal agencies such as the Department of Homeland Security, to improve their ability to repel cybersecurity threats.

2. Significant growth in natural gas production. Growth in natural gas production has pushed pipeline companies to increase the capacity of existing transmission pipelines by adding compressor stations along the line to boost pressure and by “looping” or adding another line along the same right of way.

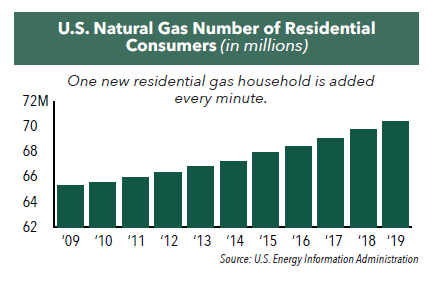

Interstate transmission pipeline mileage has also been increasing and local gas distribution companies have been increasing the size and capacity of their distribution networks, extending the reach of service lines to add new households as customers. Over the past ten years, approximately 184,000 miles of distribution and transmission pipelines have been added in the U.S. and over 5 million residential users have been added, an increase of almost 8%.4 Today new natural gas customers are being added at the rate of about one per minute.5

3. Growth in exports.

LNG - Since opening its first LNG export terminal in 2016, the U.S. has quickly grown to become the third largest exporter of natural gas globally behind Qatar and Australia.6 Currently the U.S. has six active LNG export terminals in service, with an additional 20 under construction or approved by the Department of Energy.7

Demand for LNG is growing worldwide. As the fastest growing market for LNG, China’s demand for natural gas in energy and industrial applications continues to provide a compelling opportunity for natural gas distribution and utility companies to invest in transmission, processing, storage, and export terminals for LNG. The LNG market has also seen increasing demand from Europe as countries seek to reduce their reliance on Russian imports.

Pipelines - Increasing demand from Mexico’s industrial and electric power sectors has spurred a growth in natural gas infrastructure and pipelines in Texas and the Southwest U.S.8 Natural gas exports to Mexico continue to provide a compelling opportunity for additional transmission and distribution infrastructure along the U.S.-Mexican border.

Spending on transmission pipelines (large diameter pipes that transport natural gas across the U.S.) has more than doubled while investment in local distribution pipelines (main and service lines that connect customers to their natural gas supply) has more than tripled from $4.8 billion to $14.9 billion.1

Spending has been driven by three major factors:

1. Pipeline safety and repairs. Increased investment on pipeline replacement and modernization began in earnest in 2011, following a series of serious pipeline incidents. New federal regulations prompted the local distribution companies to start major repair and rehabilitation programs and now 40 states have joined with the federal government to prioritize pipeline safety. For some companies, system integrity and replacement projects now account for over 70% of their total capital spending.

2. Significant growth in natural gas production. Growth in natural gas production over the past 10 years has pushed pipeline companies to increase the capacity of existing transmission pipelines by adding compressor stations along the line to boostpressure and by “looping” or adding another line along the same right of way.

Interstate transmission pipeline mileage has also been increasing, and miles of new pipeline were awaiting approval by the Federal Energy Regulatory Commission at the end of 2017. Local gas distribution companies have also been increasing the size and capacity of their distribution networks, extending the reach of service lines to add new households as customers. Over the last ten years, 95,000 miles of main distribution pipeline has been added in the U.S., an increase of 8%, and about 1.6 million residential users have been added, an increase of almost 3%. Today new residential gas customers are being added at the rate of about one per minute.1

Investment Drives Earnings Growth

The significant increase in capital spending by gas distribution companies is driving earnings growth today. Many gas distribution companies have been citing capital spending on infrastructure projects as a contributing factor driving reported earnings growth.

In fact, over the past few years, the growth in earnings per share (EPS) of Utilities has been about 1.5× their long-term average.

An Opportunity to Benefit

The Hennessy Gas Utility Fund (GASFX/HGASX) maintains a portfolio of distribution-focused natural gas companies. The Fund provides exposure to companies that should benefit from the growing demand for natural gas.

- In this article:

- Energy

- Gas Utility Fund

1. American Gas Association

2.EIA

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.