Guide to Natural Gas Mutual Funds

Learn why you should include natural gas mutual funds in your portfolio. Get our current outlook on the sector and advice on how to choose the right funds.

Gain exposure to a growing industry while mitigating risk

For most investors, the best way to gain exposure to the growing demand for natural gas is through mutual funds. Buying shares in a fund mitigates the risk associated with picking individual stocks and doesn’t require the sophistication required to invest in natural gas futures, options on futures or exchange-traded funds and notes.

This guide is designed to help you understand why you should consider including natural gas mutual funds in your portfolio, how to choose the right natural gas mutual funds, and key trends in the market.

Why Include Natural Gas Mutual Funds in Your Portfolio

A strong case for investing in natural gas can be made based on several factors:

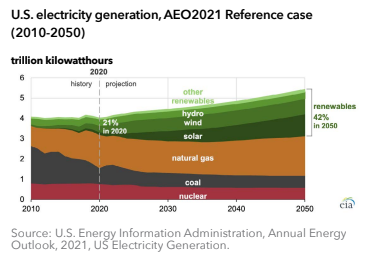

- Growing demand for clean fossil fuels: United States electric power plants continue to switch from coal to natural gas, making natural gas the leading source of energy for the nation.

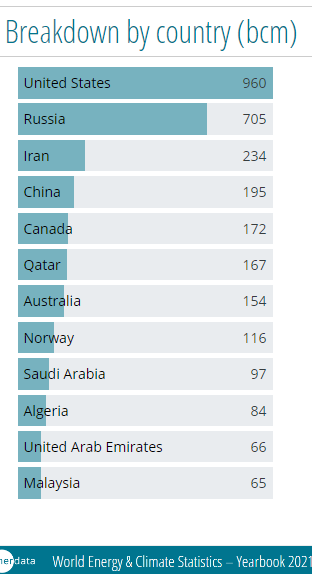

- Vast domestic supply: The US is the largest producer of natural gas in the world and has enough natural gas to last 90-100 years assuming the same rate of production

.

- Low cost of energy: Natural gas has a lower fuel cost than other fossil fuels and a lower cost to produce a British thermal unit (Btu) of energy.

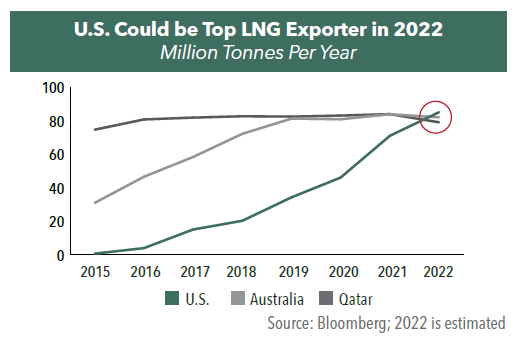

- Increase in US exports: The US is a leading exporter of natural gas and is expected to be the largest global exporter of liquefied natural gas by 2023.

- Relative stability during volatile markets: While oil prices plummeted during the Covid-19 pandemic of 2020, natural gas prices held fairly steady. This is because utilities favor natural gas and strong residential demand for energy offset the lower demand from manufacturing and transportation.

For a deeper look at these and other trends, see our guide to Investing in Natural Gas

How to Choose Natural Gas Mutual Funds

Natural gas funds are made up of a portfolio of stocks of natural gas companies. They can cover a wide range of market caps and focus on particular areas of the industry such as:

- Natural gas drilling companies

- Diversified multi- and electric utility companies

- Regulated, local natural gas distribution companies

- Midstream pipeline and LNG exporting companies

Many companies operating in natural gas drilling also drill for crude oil and are therefore affected by negative trends in oil. Investors looking for the opportunity to benefit from the growing demand for natural gas while limiting exposure to negative trends in oil should seek out funds that focus on natural gas distribution.

Current Outlook for Natural Gas Mutual Funds

The Portfolio Managers of the Hennessy Gas Utility Fund discuss America’s role as a global supplier of natural gas, the Fund’s alternative energy exposure, earnings growth expectations, and how Utilities perform in a rising rate environment.

- U.S. - Top LNG Exporter for the First Time in 2021

Natural gas utilities’ average EPS growth is expected to remain strong at 6-8% per year due to the growing importance of natural gas and its usage, an accommodative regulatory environment, and a continued large undertaking in pipeline replacement and modernization.

Read our latest commentary: Natural Gas Remains a Fuel of Choice.

Selecting Natural Gas Mutual Funds

We encourage investors to look at all available natural gas mutual funds to find the best funds that match their portfolio objectives. Hennessy offers the Hennessy Gas Utility Fund, a natural gas mutual fund.

Here are a few highlights of the Hennessy Gas Utility Fund:

- Focus on Distribution: The fund invests in the distribution side of the natural gas industry. This provides exposure to the growing demand for natural gas while limiting exposure to negative trends affecting other energy companies.

- Index-based Investment Methodology: The fund holds shares of publicly traded members of the American Gas Association (AGA) in approximately the same proportion as their weighting in the AGA Stock Index.

- Steady Dividend Payouts: Due to their relatively stable revenue streams, we expect dividend payouts to remain steady for the vast majority of our portfolio companies. Further, companies in the fund have grown their dividend at about a 5% annual rate over the last five years.

- Participation in Expansion of Renewable Energy: Many of the companies in the fund offer a diverse portfolio of energy solutions, providing not only natural gas but also renewable energy sources including solar, wind, and hydropower.

Frequently Asked Questions – Natural Gas Mutual Funds

These are the questions we often hear about investing in natural gas funds:

What is an energy fund?

Simply put, an energy fund is a mutual fund that invests primarily in energy companies. These funds will often focus on a particular sector such as natural gas or crude oil and focus on areas of that sector such as drilling, electric utilities or distribution.

How can investors seek to benefit from the growing demand for natural gas?

Investors looking for the opportunity to benefit from the growing demand for natural gas while limiting exposure to negative trends in oil should seek out funds that focus on natural gas distribution.