Natural Gas: An Efficient, Reliable, Affordable, and Abundant Energy Source

The Portfolio Managers of the Hennessy Gas Utility Fund discuss how rate cuts could affect natural gas utilities, the types of companies in the AGA Stock Index, natural gas demand, renewables, utilities’ earnings growth and dividends, and current valuations.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

How could the Federal Reserve’s interest rate cuts affect natural gas utilities?

Utilities finance growth through both debt and equity and generally target a capital structure of about 50% debt and 50% equity, although the range may vary depending on market conditions. In a declining interest rate environment, a utility’s overall cost of capital would generally decrease and be a benefit to earnings. However, compared to some industries, both increasing and decreasing interest rates may have a more muted effect on a utility company’s profitability due to the long-term nature of its debt as well as the regulated nature of its earnings.

The price of natural gas has been trading around $2 recently. How do lower gas prices affect the companies in the Hennessy Gas Utility Fund?

The price of natural gas is not a primary driver of the Hennessy Gas Utility Fund’s performance, whereas volume is. The Fund invests in utilities and companies that deliver natural gas to customers. Therefore, the more the meter spins, the greater their profits. However, lower prices may increase growth in volume over time, as new customers might choose natural gas due to its stable and competitive pricing.

Would you please describe the types of companies that comprise the AGA Stock Index?

The Hennessy Gas Utility Fund replicates the AGA Stock Index. The AGA Stock Index is comprised of all member companies of the American Gas Association (AGA) which are publicly traded on a U.S. stock exchange.

All AGA member companies are involved in the distribution of natural gas, primarily in the U.S. and Canada. The classification of companies in the AGA Stock Index has evolved over time. Currently, about one-third of the Index are Energy companies involved in the transport of natural gas via pipeline or LNG tanker as well as to a limited extent the exploration and production of natural gas. Multi and electric utilities make up about half of the Index, and pure play natural gas utilities comprise about 15% of the Index composition.

Over the years, merger and acquisition transactions have reduced the number of holdings in the Fund. The latest example is Tellurian, a small position in the Fund, that is being purchased by Woodside Energy, an Australian oil and gas company.

As a historical comparison, at the beginning of 2015 the Fund held 62 positions. As of June 30, 2024, there were 49 holdings, as 18 companies have been acquired, and five companies have been added to the Fund.

How could natural gas demand change as the world transitions to renewables?

When considering the primary fuel mix on a global basis, we believe natural gas and renewable energy such as wind and solar should continue to grow in tandem. Even though the growth in renewables has been rapid in recent years, they are subject to issues associated with reliability concerns, i.e., the wind doesn’t always blow and the sun doesn’t always shine. With these limitations on power generation, a reliable source of energy will continue to be needed.

Would you please discuss how the boom in artificial intelligence (AI) use is affecting natural gas demand?

Advances in AI computing power are creating opportunities for both productivity enhancement and cost efficiency around the world. As a result, there is a huge demand for AI computing which in turn is driving the build out of data centers that house this infrastructure.

AI requires significantly more power relative to conventional central processing units (CPUs) and should continue to drive meaningful growth in electric power demand. Given that approximately 43% of electricity is generated by natural gas, this rapid and continuous increase in power demand should benefit natural gas distribution companies in addition to the power sector.

What should utility investors expect in terms of earnings growth and dividends?

Utilities’ earnings over the past several years have been consistent with long-term averages, offering 3% to 5% earnings growth per share. Looking ahead, EPS growth for Utilities is expected to be approximately 1% to 2% higher, which is significant for this sector. This growth does not factor in the advent of artificial intelligence and the increased adoption of electric vehicles that will lead to increased demand for a reliable energy source offered by natural gas.

Utilities have been able to grow their dividends slightly faster than their earnings growth. To date in 2024, 47 out of the 49 companies in the Hennessy Gas Utility Fund have paid a dividend, 42 companies have increased their dividends in the past year, and the average rate of increase was over 5%.1

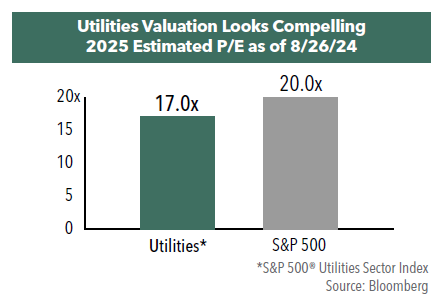

Would you please discuss the valuations of Utilities compared to the S&P 500® Index?

Utilities currently are trading at a slight discount relative to the overall market. Relative to the S&P 500, the Utilities sector trades at about 84% of the S&P 500 on a forward price-to-earnings (P/E) basis as of 8/26/24, lower than the historical average of 94% over the past 10 years.

On an absolute basis, Utilities are trading at around 18.6x earnings for 2024 and 17.0x earnings for 2025, while the S&P 500 is trading at 23.2x earnings for 2024 and 20.3x earnings for 2025, based on forward looking consensus estimates from Bloomberg.

Overall, the outlook for natural gas utilities is positive. The fundamentals of the companies remain strong, and the long-term demand for natural gas remains steady, especially with the increasing demand from AI and the need for reliable energy sources.

- In this article:

- Energy

- Gas Utility Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundThe Role of Natural Gas to Meet AI Energy Demand

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.