The Role of Natural Gas to Meet AI Energy Demand

In the following commentary, Portfolio Manager Ben Cook and Josh Wein highlight the Fund’s 2025 outperformance, discuss the impact the events in Venezuela may have on the energy sector, and outline key 2026 Energy sector opportunities.

-

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

Key Takeaways

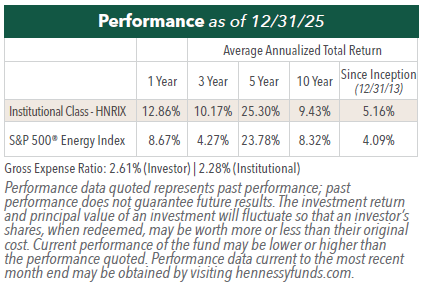

» In 2025, the actively managed Hennessy Energy Transition Fund outperformed the S&P 500 Energy Index.

» The Energy sector appears undervalued relative to the overall equity market.

» Energy companies should continue to emphasize capital discipline, focusing on shareholder return.

» While U.S. crude oil production may plateau in 2026, U.S. natural gas production will likely grow due to AI-related power generation demand and rising LNG export capacity.

» We believe the Energy and Midstream sectors should benefit from healthy demand and reduced funding expenses in a lower rate environment.

» We are finding the most opportunity in natural gas-oriented midstream equities.

How has the Fund’s actively managed approach helped 2025 performance vs. the S&P 500® Energy stocks?

The Hennessy Energy Transition Fund has the flexibility to opportunistically invest in the subsectors of the energy value chain. Historically, we have shifted the Fund’s subsector weightings over time as market conditions change to help maximize total portfolio return while minimizing portfolio risk.

As a result, the Fund outperformed the broader S&P 500 Energy Index in 2025 driven primarily by its relative overweight positioning in U.S. natural gas producers as well as oilfield service companies.

How do Energy sector valuations compare to the S&P 500 Index?

We believe Energy companies appear attractively valued relative the overall market. As of December 31, 2025, the 2025 Enterprise Value (EV) to the 1-year forward EBITDA estimate for the S&P 500 Energy Index was 7.4x, significantly lower than the S&P 500® Index on that same basis, which traded at 17.8x EV/ EBITDA as of the end of the year.

What impact could the recent events in Venezuela have on the U.S. energy sector?

With the Trump administration’s removal of Venezuelan President Nicolas Maduro, the U.S. may have an opportunity to influence the development of the country’s natural resources.

While still in the early stages, Trump has signaled the importance of the U.S. energy sector playing a key role in rebuilding the Venezuelan energy industry. Chevron, an incumbent operator, as well as U.S. majors like ExxonMobil and ConocoPhillips, which left Venezuela in 2007, now have a path to recover billions in seized assets or negotiate new joint ventures. The Trump administration has signaled preferential access to upstream assets and production-sharing deals for large U.S. oil companies willing to be early entrants in rebuilding the sector.

Other beneficiaries potentially include U.S. Gulf Coast refiners which are specifically configured to process Venezuela’s heavy, high-sulfur crude, such as Valero, and Phillips 66. Decades of neglect suggests the sector could require hundreds of billions of dollars in investment to return to historic production levels, which could benefit U.S. service companies, drilling contractors, and engineering firms.

How might U.S. energy companies allocate capital between core oil & gas operations and lower-carbon initiatives in 2026?

As in 2025, we expect U.S. energy companies to demonstrate capital discipline in the coming year. Capital allocation priorities will likely continue to emphasize shareholder return over upstream volume growth.

Core oil and gas operations will continue to focus on capital efficiency through the achievement of both productivity enhancements as well as cost savings.

In the power generation sector, lower carbon initiatives are likely to continue to focus on solar and battery storage technology as well as decarbonization activities where lower emission fuels and carbon capture technology are integrated with existing core portfolios.

With U.S. rig counts falling and upstream activity softening in late 2025, what is the outlook for domestic production growth?

After growing by approximately 300 thousand barrels per day (bbls/d) in 2025, we anticipate U.S. crude oil production may plateau in 2026 as upstream sector activity continues to moderate in a relatively range bound crude oil price environment.

U.S. natural gas production, by contrast, will likely grow by approximately 3% in 2026 as producers respond to firm natural gas pricing associated with increased artificial intelligence (AI) related power generation demand as well as rising liquefied natural gas (LNG) export capacity.

Would you please summarize consolidation activity in the Energy sector in 2025 and what you anticipate over 2026?

Corporate transaction activity within the Energy sector appeared to reflect mid-capitalization companies’ desire to gain scale through merger and acquisition activity (M&A), with focus on achieving inventory depth, operational synergies and cash flow resilience. External factors were generally favorable as range bound commodity prices, supportive U.S. energy policy, and the continued need to aggregate prime shale basin positioning drove consolidation.

Energy sector M&A activity should persist in 2026 as smaller energy companies continue to pursue transactions that afford scale and the opportunity to operate more efficiently. We expect to see the benefits of AI-related efficiencies propel the digital transformation of the oil patch, allowing for greater innovation, productivity and improved cost savings. As part of that process, we believe U.S. energy companies will continue to monetize non-core assets and make targeted investments.

How could demand for natural gas, driven by AI and data centers, impact the midstream sector?

The rapid pace of AI infrastructure buildout is driving significant growth in electric power demand, prompting both utilities and hyperscaler companies to add significant power generating capacity, much of which is utilizing natural gas as a fuel source.

Perhaps the best example of a midstream beneficiary of this buildout trend is Williams Companies (WMB) which has announced three separate ‘behind the meter’ power generation projects colocated at the sites of newly constructed data centers. In addition, Williams continues to pursue transmission expansion projects along its Transco pipeline asset to support flows to a number of different market centers requiring natural gas for power generation by Utilities.

Other midstream companies such as Energy Transfer, Enbridge, and TC Energy have also announced plans to expand natural gas transportation capacity to meet AI data center needs. We see the capital investment opportunity associated with natural gas infrastructure expansion as a key source of sector cash generation and ultimately enhanced shareholder return, a clear positive for equity investors.

Where are you finding the most opportunity along the Energy value chain?

Natural gas-oriented midstream equities represent the most attractive way to gain exposure to the favorable growth trends we are seeing in the U.S. natural gas market. This multi-year expansion trend should provide growth potential for much of the natural gas value chain. Increasing “demandpull” from LNG export expansion, AI data centers, electrification, and industrial onshoring in the U.S. should drive volume needs over the next several years. For midstream investors, growth opportunities represent the important driver of cash flow growth and shareholder returns.

How could inflation and interest rates affect energy and midstream investments as we head into 2026?

After rising at a 3% rate in 2025, we expect the U.S. inflation rate will gradually slow to a pace ranging between 2.5% and 3% in 2026. Pricing pressure should ease in the coming year as result of two key market dynamics:

1. A diminishing impact of tariff policies

2. Cost efficiencies gained from AI-driven productivity

With pricing pressure under control, the Federal Reserve will likely pursue a more accommodative monetary stance, which should allow for further interest rate cuts. The stimulative impact of reduced rates should, in turn, support healthy economic conditions as reduced borrowing costs invigorate investment and spending thereby boosting the broader economy, including the energy sector.

We believe the Energy sector should benefit from healthy energy commodity demand, which is supportive of commodity pricing. In addition, the sector should benefit from reduced funding expenses in a lower rate environment, which affords capital cost savings on infrastructure investment.

- In this article:

- Energy

- Energy Transition Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Midstream FundPotential Natural Gas Tailwinds for Midstream Companies

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe following commentary highlights how recent events in Venezuela affect midstream investors, how midstream companies could benefit from interest rate cuts, rising natural gas and LNG demand, and AI-driven efficiencies, while maintaining disciplined capital allocation, strong shareholder returns, and attractive valuations.

-

Portfolio Perspective

Portfolio Perspective

Gas Utility FundNatural Gas Utilities as a Potential Growth Story

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryWith AI-driven power demand, rising capital investments, LNG growth, and pipeline infrastructure expansion, natural gas utilities are being repositioned as potential growth stories with attractive valuations and dividends.

-

Investment Idea

Investment IdeaDefining the Energy "Value Chain"

Ben Cook, CFAPortfolio ManagerRead the Investment Idea

Ben Cook, CFAPortfolio ManagerRead the Investment IdeaEnergy is a large and complex sector. The sector’s broad sub-industries can be divided into a “value chain,” each segment of which has different characteristics and offers different investment opportunities.