A Look at 25 Years of a Focused Approach

The Portfolio Managers discuss how the Focus Fund has rewarded investors over the past 25 years. They also share their thoughts on how certain portfolio holdings have benefited from the inflationary environment, supply chain issues, and strong housing demand.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

The Focus Fund celebrated its 25th anniversary in January 2022 - Please discuss managing the Fund over a changing economic and investment landscape as well as the advantages to long-term investors.

It’s been an eventful quarter of a century. The U.S. economy has experienced two asset bubbles, the September 11th attacks, and the most impactful global pandemic in 100 years. As long-term investors, we expect the market will face unanticipated times of turbulence, so we defensively build the portfolio with a select number of durable companies with business models and balance sheets to survive and thrive through various economic environments. We seek to purchase these companies at attractive prices to reduce the impact of negative short-term company-specific and macro developments. We also avoid companies with growing competitive threats, excess financial leverage, and unsustainable levels of demand.

As a result, the approximately 20 companies in the Fund’s portfolio at year’s end tend to have the following characteristics: a strong competitive position, a favorable industry structure, and a sustainable competitive edge that enables the company to maintain pricing power and earn outsized returns.

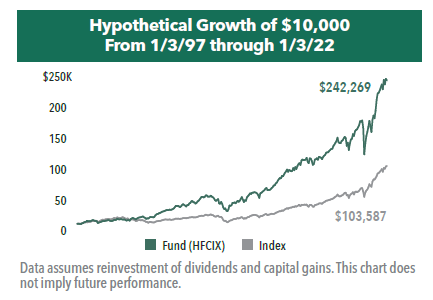

This time-tested approach has rewarded long-term investors. Since its inception 25 years ago, a $10,000 investment in the Fund has grown to more than twice the value of the Russell 3000® Index. We believe our differentiated playbook will continue to give us an important advantage over the next 25+ years.

Click here for full, standardized Fund performance.

Have any portfolio holdings benefitted from the ongoing inflationary environment and global supply chain issues?

A few holdings have been big beneficiaries of the current environment. They include CarMax, a used car retailer, and O’Reilly Automotive, an auto parts distributor and retailer. With semiconductor chip shortages reducing the production rate of new cars, used cars have served as a relief valve for demand in the auto industry. As of November 2021, used car prices were up 50% year-over-year. This has benefitted most used car retailers, but CarMax is even better positioned because of its well-established practice of buying used vehicles from the general population. With used cars in such high demand, and short supply, CarMax is in an enviable position with among the best availability of used inventory in the country.

Likewise, O’Reilly’s industry has been challenged by supply shortages. However, as one of the largest auto parts retailers, the company is able to procure inventory while many competitors cannot. This has translated into meaningful market share gains. As a result of the dramatic increase in used car prices, consumers have been more willing to spend on repairs in order to keep their existing vehicles on the road.

What portfolio holdings have been negatively impacted by the current inflationary and supply constrained environment and how are they addressing these challenges?

Broadly speaking, portfolio companies that produce goods have been challenged by the supply chain disruptions, while those providing services have not.

The most negatively impacted holding has been, American Woodmark, a kitchen cabinet manufacturer. It has experienced significant cost increases in wood inputs such as hardwood lumber, OSB, and particle board, as well as challenges sourcing some key components from overseas. In addition, the company has seen wage inflation in its factory workforce. While we believe the company has pricing power to offset these increased costs, there is a three- to six-month lag in passing along these higher prices to customers. As a result, the company is experiencing a fairly significant—albeit temporary—near-term profitability squeeze.

Other portfolio companies have seen supply chain disruptions resulting in a slowdown in the pace they can produce and deliver their products. Rather than taking a few weeks to fulfill an order, it is now often taking many months.

A few examples include:

• RH - Lead times in obtaining inventory from overseas have been significantly extended.

• NVR - A shortage of building materials and labor have increased the time it takes to build a home by several months.

• Applied Materials – With the current chip shortage, product deliveries have been delayed despite the strong demand for its semiconductor capital equipment.

Over time, we believe these short-term issues will be resolved. Importantly, they have not had a material negative impact on these businesses nor have they dimmed our long-term investment outlook.

How might the strong demand for housing benefit portfolio holdings NVR and American Woodmark?

Demand for new home construction and remodeling products and services remain strong. When taking a longer-term view, new home construction in the U.S. has just recently recovered to a normal level of 1.6 million housing starts nearly 13 years after the financial crisis and related housing bust. Due to years of below average new home construction, we estimate the U.S. is about 5 million housing units short of what is needed to satisfy the current population. Therefore, we believe the industry could run above the long-term average new home production level for an extended period until this gap is filled. This environment provides a good backdrop for home builders including portfolio holding NVR.

In addition, consumer dollars spent on home improvement remain below their 50-year average. We believe home improvement spending will increase and approach the long-term average as we experience increased housing turnover and renewed enthusiasm for home improvement projects that accompanies rising home prices. With a robust home improvement backdrop, we believe American Woodmark should see an extended period of favorable demand for its products.

- In this article:

- Domestic Equity

- Focus Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundSeeking Companies with Strong Growth at Attractive Valuations

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers rely on their strategy of owning durable, well-run businesses capable of turning adversity into opportunity and adapting to macroeconomic surprises. The following Hennessy Focus Fund Commentary recaps the 2025 market and highlights areas of opportunity ahead.

-

Portfolio Perspective

Portfolio Perspective

Focus FundFrom Rate Cuts to AI: Positioning the Portfolio for Potential Opportunity

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryThe Portfolio Managers discuss holdings that could potentially benefit from lower rates, tariffs, and artificial intelligence (AI). The team also provides an update on AST SpaceMobile and discusses potential opportunities in select Technology and Health Care companies.

-

Company Spotlight

Company Spotlight

Focus FundO’Reilly Automotive—Revved for Growth

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Spotlight

Brian Macauley, CFACo-Portfolio ManagerRead the SpotlightO’Reilly Automotive is a leader in the automotive aftermarket parts industry in the U.S. The company’s scale, unique distribution infrastructure, and customer service-oriented culture should allow it to take market share in a fragmented U.S. market for years to come.